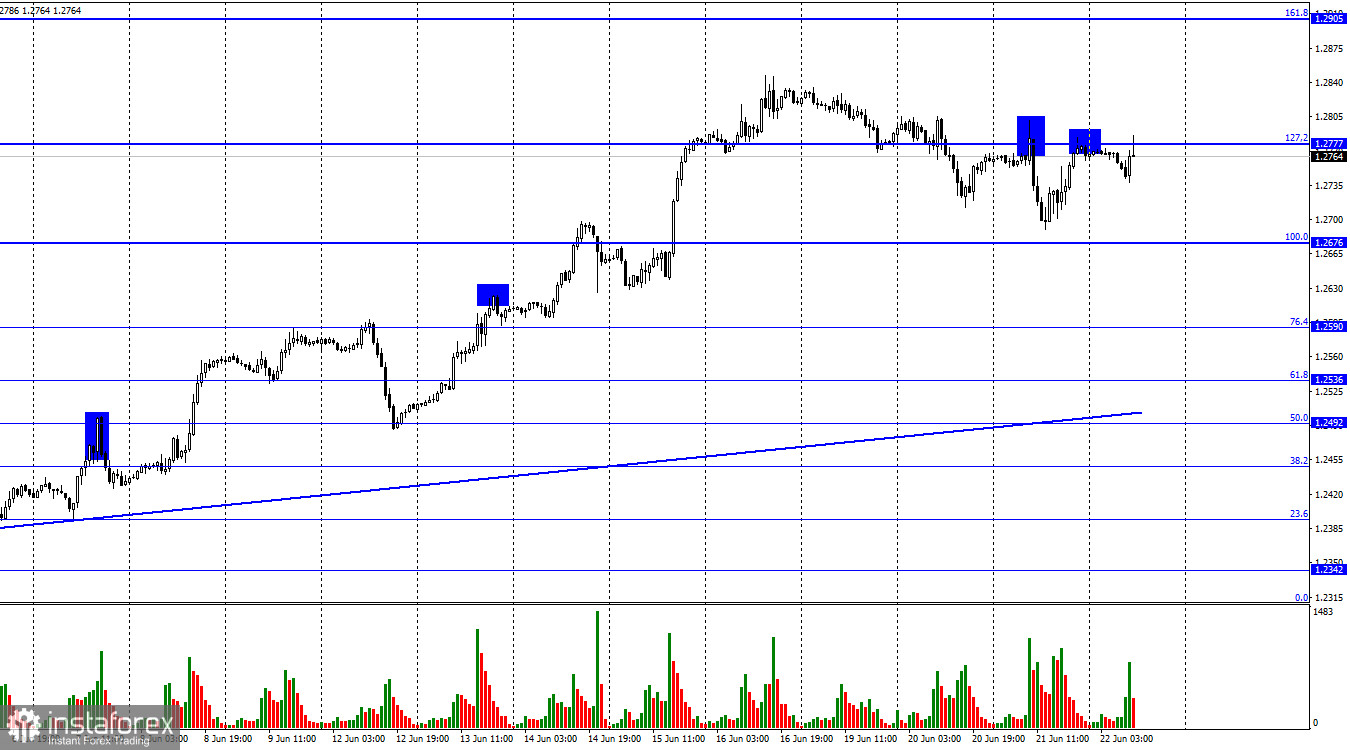

Yesterday, on the hourly chart, the GBP/USD pair experienced a rebound from the corrective level of 127.2% (1.2777), then dropped nearly to 1.2676 and returned to the 1.2777 level. Another rebound from this level will favor the American currency, leading to a decline toward the Fibonacci level of 100.0% (1.2676). If the pair's rate closes above 1.2777, it increases the likelihood of further growth towards the next corrective level of 161.8% (1.2905). Trading volumes have been sufficiently high recently, and trader sentiment remains bullish.

In a few hours today, the Bank of England will announce its decision on the interest rate. According to forecasts, the rate will increase by 0.25% again, with 7 out of 9 MPC committee members voting in favor of the hike. This decision has already been factored into current prices, but bullish traders are currently very strong and can accommodate the same rate hike twice. There is no scheduled speech by Andrew Bailey in the economic events calendar; we must rely on meeting minutes and accompanying letters. Despite yesterday's weak inflation report, the market does not expect a 0.50% rate increase today.

As a result, Powell's second speech may have an even greater impact on the pair's movement, but the issue is that these two events almost coincide. When the Fed President's speech begins, it will be difficult to determine whether or not the market pays attention to it. Therefore, we should anticipate active trading today, but it doesn't necessarily mean the pair will move in one direction. It could be a situation similar to yesterday.

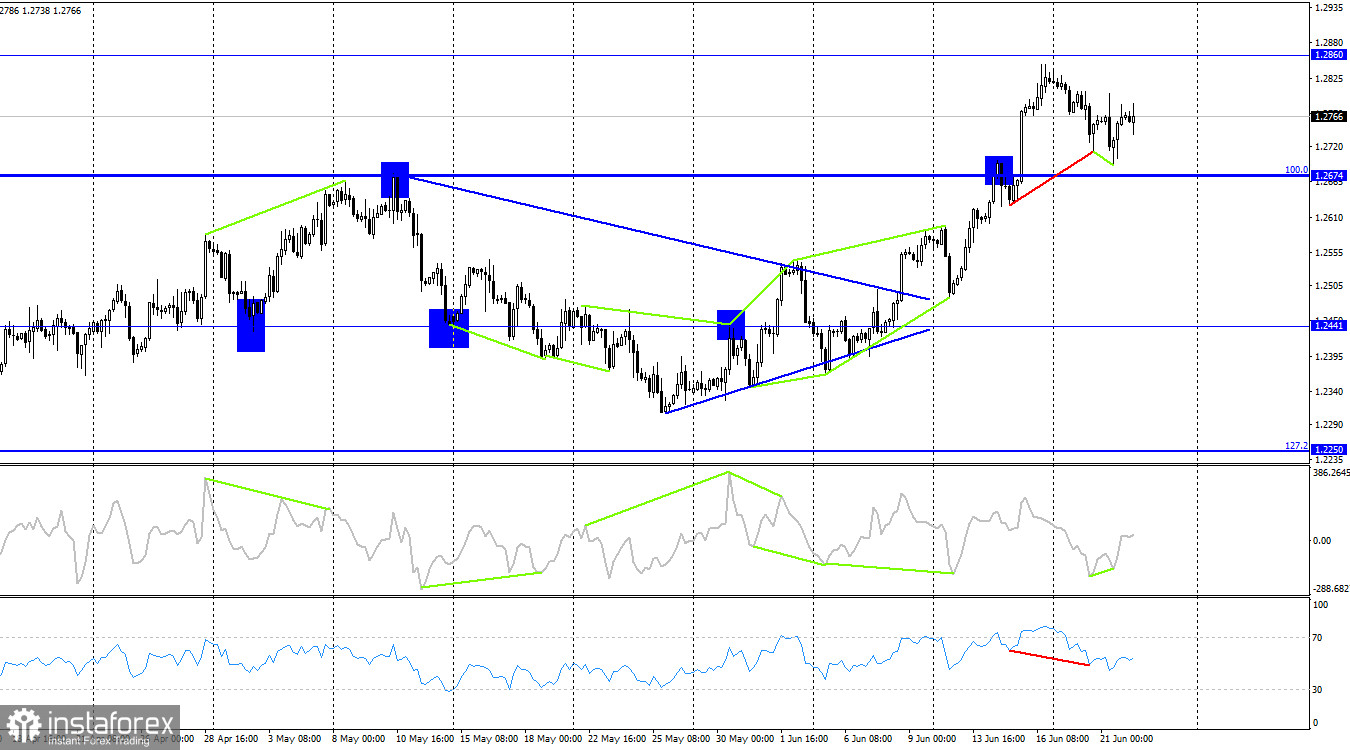

On the 4-hour chart, the pair has reversed in favor of the British pound and resumed upward toward the 1.2860 level after two bullish divergences were formed in the RSI and CCI indicators. There are no new emerging divergences observed in any indicators today. If the pair's rate rebounds from the 1.2860 level, it would indicate a reversal in favor of the US dollar, resulting in a decline toward the Fibonacci level of 100.0% (1.2674).

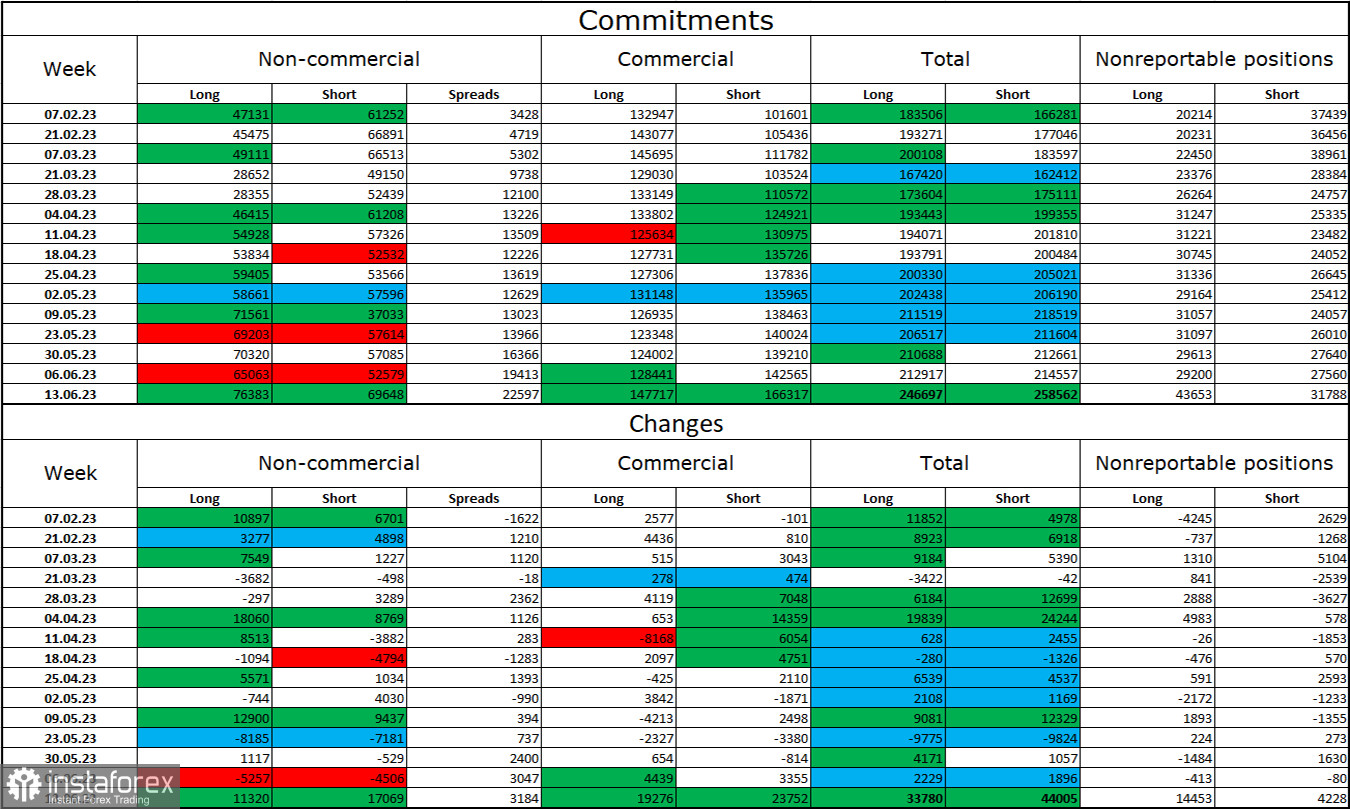

Commitments of Traders (COT) report:

The sentiment of "Non-commercial" traders has become slightly less bullish over the past reporting week. The number of long contracts held by speculators increased by 11,320 units, while the number of short contracts increased by 17,069. The overall sentiment of major players remains predominantly bullish, but the number of Long and Short contracts is now nearly equal - 76,000 and 69,000, respectively. The British pound has good prospects for further growth, and the current informational background supports it more than the dollar. However, I do not expect a significant rise in the pound sterling in the coming months. The Bank of England's meeting outcome this week will clarify the pound's prospects.

News calendar for the US and the UK:

United Kingdom - Bank of England Interest Rate Decision (11:00 UTC).

United Kingdom - Monetary Policy Committee Meeting Minutes (11:00 UTC).

United Kingdom - Bank of England Inflation Report (12:00 UTC).

United States - Initial Jobless Claims (12:30 UTC).

United States - Existing Home Sales (14:00 UTC).

United States - Federal Reserve Chairman Powell Testifies (14:00 UTC).

Thursday's economic events calendar contains many important entries. The impact of the informational background on trader sentiment today could be significant.

Forecast for GBP/USD and trader advice:

I recommended selling the pound in case of a rebound on the hourly chart from the level of 1.2777 with a target of 1.2676. Buying the pound is possible if the price closes above 1.2777 on the hourly chart with targets at 1.2860 and 1.2905.