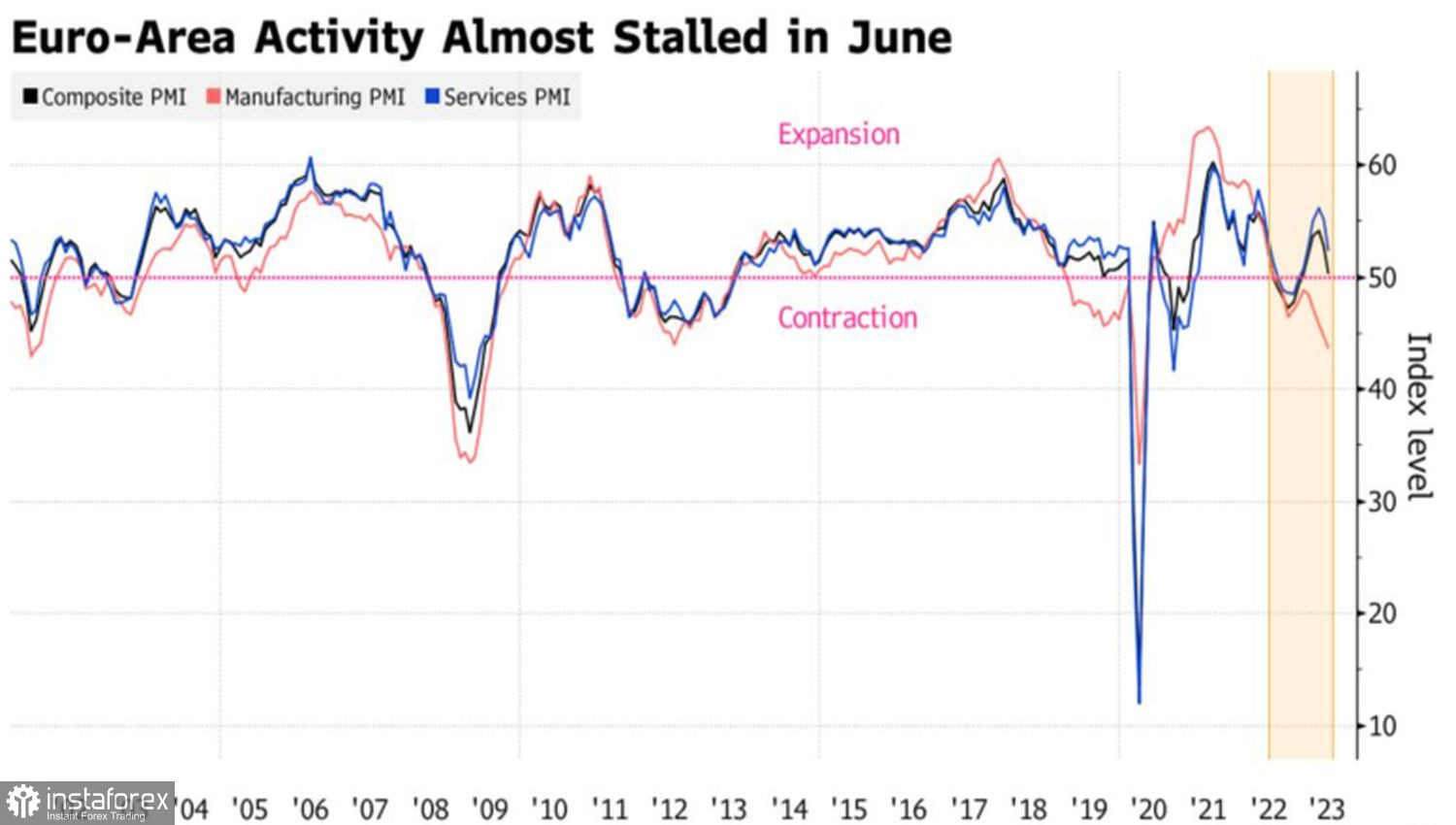

You can't go against the fundamentals. As much as euro supporters would like to see more rate hikes on deposits, the weak economy won't allow it. The Eurozone composite Purchasing Managers' Index (PMI) dropped to a five-month low of 50.3 in June. This indicates that the recession that started in late 2022 and 2023 may extend further. Moreover, the European Central Bank is prepared to aggressively raise rates. Fearing the downturn, EUR/USD bulls were forced to retreat from the battlefield.

In June, France pulled down the economy of the currency bloc. Although the issues in Germany's manufacturing sector also played a negative role. Judging by the dynamics of the PMI, French GDP is expected to contract by 0.5% in the second quarter. Furthermore, the latest data signal problems not only in manufacturing but also in the services sector.

PMIs in the eurozone

Disappointing PMI data weighed on European bond yields, as well as the presumed cap on the ECB deposit rate from 4.07% to 4%. It is unlikely that the ECB will push too hard by tightening monetary policy, as the economy weakens visibly and slides into a recession. Investors realize that they went too far with the EUR/USD rally in response to the announcement of the June Governing Council meeting.

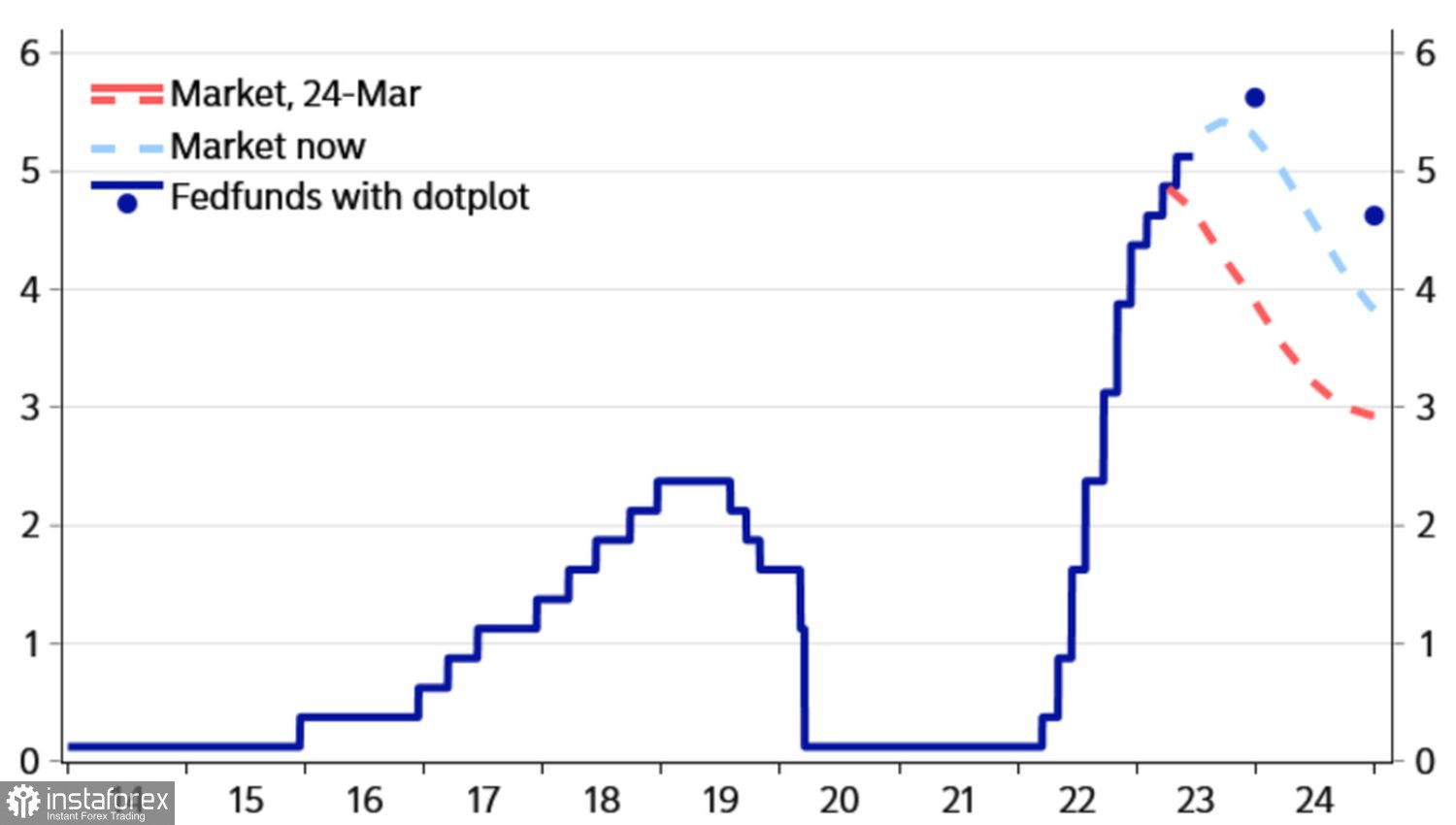

The market overestimated the determination of ECB President Christine Lagarde and her colleagues, and clearly underestimated the Federal Reserve's intention to tame inflation. Derivatives suggest that the peak federal funds rate in this cycle will be 4.3%, which does not align with the FOMC forecast of 4.6%. It appears that the US dollar has room to grow, while the euro has room to fall.

The dynamics of market expectations and FOMC rate forecasts

Key events in the last week of June will be the release of data on German and European consumer prices, as well as the US Personal Consumption Expenditures Index. The Fed prefers this inflation indicator, although markets react less to it due to its lagging nature compared to CPI. According to experts surveyed by Bloomberg, core inflation in the eurozone is expected to accelerate from 5.3% to 5.6%. In theory, this provides a basis for the ECB to raise the deposit rate. However, in practice, the central bank will surely consider its own economy.

Thus, the markets are overestimating the ECB's potential for monetary tightening and they are going against the Fed. Considering the more favorable position of the US economy compared to the European one, this poses a risk for EUR/USD bulls. The first whipping occurred at the end of the five-day period leading up to June 23. I believe it will not be the last.

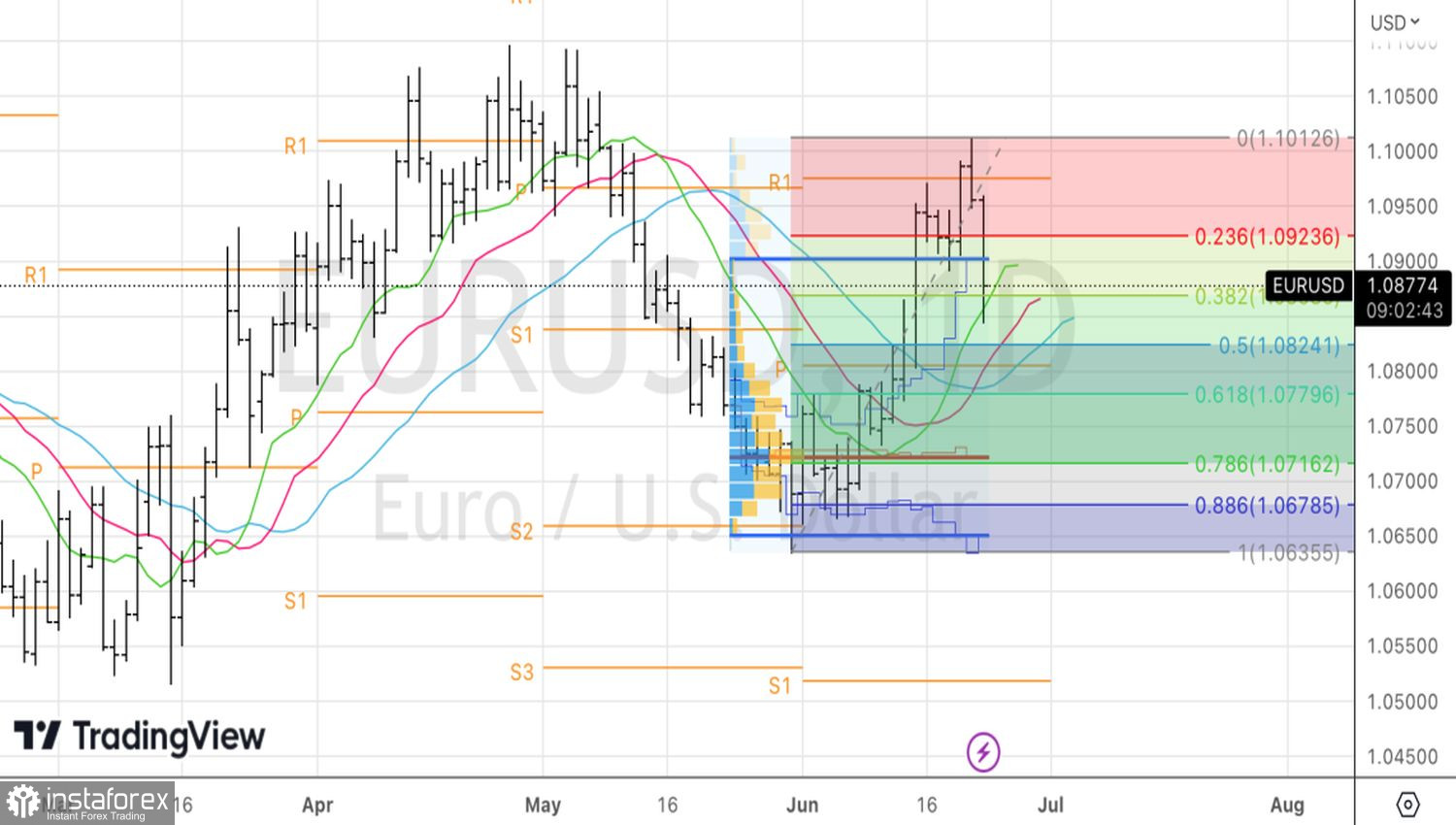

Technically, on the daily chart, EUR/USD formed and executed a reversal pattern called the Anti-Turtles. Despite the rebound from the weekly low, the pair's movement will depend on the bears' ability to stay within the fair value range of 1.072-1.090. If successful, it will continue to fall, and we will be able to build the shorts formed from the level of 1.098.