Long-term perspective.

The GBP/USD currency pair decreased by 90 points this week. The British currency fell almost daily, but it showed a 90-point drop. This is very little, even for a week with a weak fundamental and macroeconomic background. And this week, the Bank of England held its meeting. And not just any meeting, but a meeting with a resonant and unexpected decision. The British regulator raised the interest rate by 0.5% in response to a disappointing inflation report released days earlier. Inflation not only did not decrease but also grew despite 12 interest rate hikes if we talk about the core indicator. The core indicator currently holds special significance for all central banks as it best reflects the state of consumer prices (excluding changes in energy and food prices, which are the most volatile).

Thus, the pound had a perfect opportunity to show strong growth this week, yet it didn't. However, in the previous weeks, it was rising excellently without any significant reasons. Therefore, the pound is not just rising illogically but moving illogically. Of course, the market had already priced in the BOE's decision, but it couldn't have done so as the inflation report was released just a day before the meeting's results were announced. In general, the movements are illogical. The pound is overbought, reluctant to fall, and its further movements can be unpredictable.

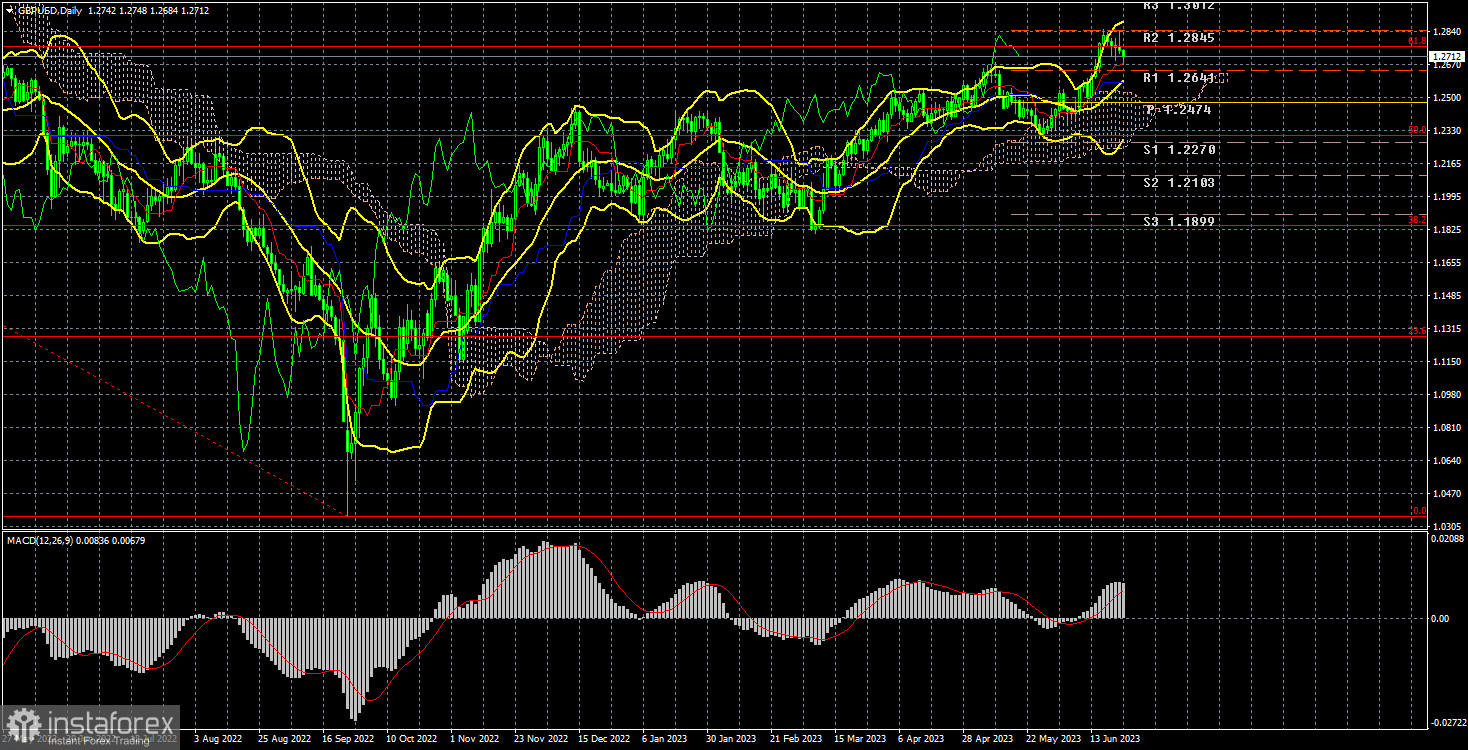

The pair is situated above all the lines of the Ichimoku indicator, indicating an upward trend. However, we still don't see any reasons for the British currency to continue rising after it has already risen by 2500 points.

COT analysis.

According to the latest report on the British pound, the "Non-commercial" group opened 25.1 thousand buy contracts and closed 14.6 thousand sell contracts. Thus, the net position of non-commercial traders increased by only 39.7 thousand contracts in just one week and continues to grow overall. The net position and the British pound have steadily increased over the past 9-10 months. We are now approaching a point where the net position has grown too much to expect further growth. A prolonged and protracted decline of the pound should begin. COT reports allow for slightly strengthening the British currency, but believing in it becomes increasingly difficult daily. It is very difficult to determine on what basis the market may continue to buy. However, there are currently no technical sell signals.

The British currency has already risen by 2500 points, which is a significant amount, and without a strong downward correction, further growth would be illogical. The "Non-commercial" group currently has 101.5 thousand contracts for buying and 54.9 thousand for selling. Such a gap suggests the end of the upward trend. We remain skeptical about the long-term growth of the British currency and expect it to decline.

Analysis of fundamental events.

There were significant macroeconomic events in the UK this week. We have already discussed the Bank of England's meeting and the inflation report. In addition, there were releases of business activity indices in the service and manufacturing sectors, which were weaker than forecasts and May's values. However, unlike in Europe, they fell relatively high, although the manufacturing sector raises serious concerns. Nevertheless, the indices in the United States also declined, resulting in a market standoff.

In the United States, there were few macroeconomic publications, but representatives of the Federal Reserve (Fed) made speeches, some of which were fairly aggressive. It is worth noting that the market expected the key interest rate to remain at 5.25% as the final value for a long time. However, the rate now appears to increase twice this year. The Bank of England also raises the interest rate, hence the deadlock. However, for some reason, only the pound is growing. Therefore, the fundamentals continue to have a strange impact on market sentiment and the movement of the second most significant currency pair.

Trading plan for the week of June 26-30:

- The GBP/USD pair attempted to start a correction a few weeks ago but quickly reversed. The price is currently situated above all the lines of the Ichimoku indicator, which formally allows for considering long positions. However, the growth may be chaotic, weak, inertial, and illogical. Despite the ongoing upward trend, trading it can be quite inconvenient.

- As for selling positions, there currently needs to be technical grounds for them. The pair is positioned above all the lines of the Ichimoku indicator. Therefore, one should wait for consolidation below the Kijun-sen line. There is a significant risk that the pair, in its inertial growth, will be near this line and regularly surpass it, creating false signals. Hence, the pound should decline and not rise. However, it may continue doing so soon. Selling on an upward trend is dangerous, just as buying is.

Explanation of illustrations:

Support and resistance levels, Fibonacci levels - these are the targets when opening buy or sell positions. Take Profit levels can be placed near them.

Ichimoku indicator (default settings), Bollinger Bands (default settings), MACD (5, 34, 5).

Indicator 1 on COT charts - the net position size for each category of traders.

Indicator 2 on COT charts - the net position size for the "Non-commercial" group.