The consumer price index has already decreased to 4%, while the interest rate has risen to 5.25%. As mentioned earlier, in this scenario, the pause could have been longer than a month and a half (until the July meeting, when it will be raised by 25 basis points again). However, the Federal Reserve is eager to restore inflation to the target level swiftly and is not concerned about economic growth.

Currently, there is no reason to worry. The U.S. economy continues to grow each quarter, albeit slower. Unemployment remains low, and positive payroll figures are observed almost every month. Nonetheless, Mary Daly, the President of the San Francisco Federal Reserve, expressed on Friday that two interest rate hikes in 2023 seem like a very reasonable decision.

She mentioned her support for the pause in June, and the regulatory body successfully balanced the risks associated with insufficient or excessive interest rate increases. Additionally, she noted that inflation forecasts are trending downward, but the Federal Reserve does not want to halt its actions midway. "We want to remain determined yet cautious to avoid overcooling the economy," said the head of the Philadelphia Federal Reserve Bank.

This information indicates that the Federal Reserve maintains a hawkish stance and possesses the economic capacity to continue raising rates, unlike the Bank of England or the European Central Bank. This information should bolster demand for the U.S. currency, which is currently undergoing a challenging period. Even if the current wave analysis remains unchanged, both pairs have a high probability of a downward wave pattern. Economic performance is deteriorating globally, but it started declining from higher levels in the United States. It is time for the U.S. dollar to strengthen.

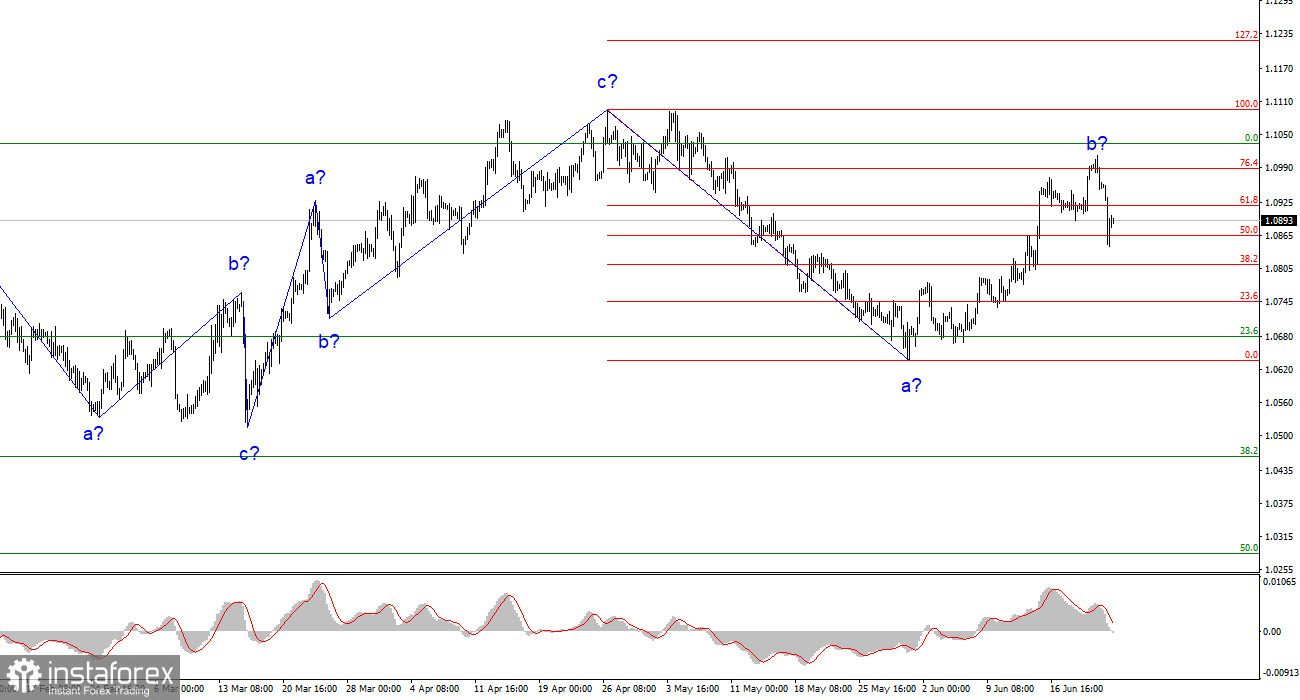

Based on the analysis, a new downward trend segment is being formed. There is still significant potential for the pair to decline. I still consider targets around 1.0500-1.0600 quite realistic and recommend selling the pair with these targets in mind. There is a high likelihood of completing wave b, and the MACD indicator has already generated two "down" signals. According to an alternative wave pattern, the current wave will be more prolonged, but the formation of a downward trend segment will follow it. Therefore, I do not advise buying.

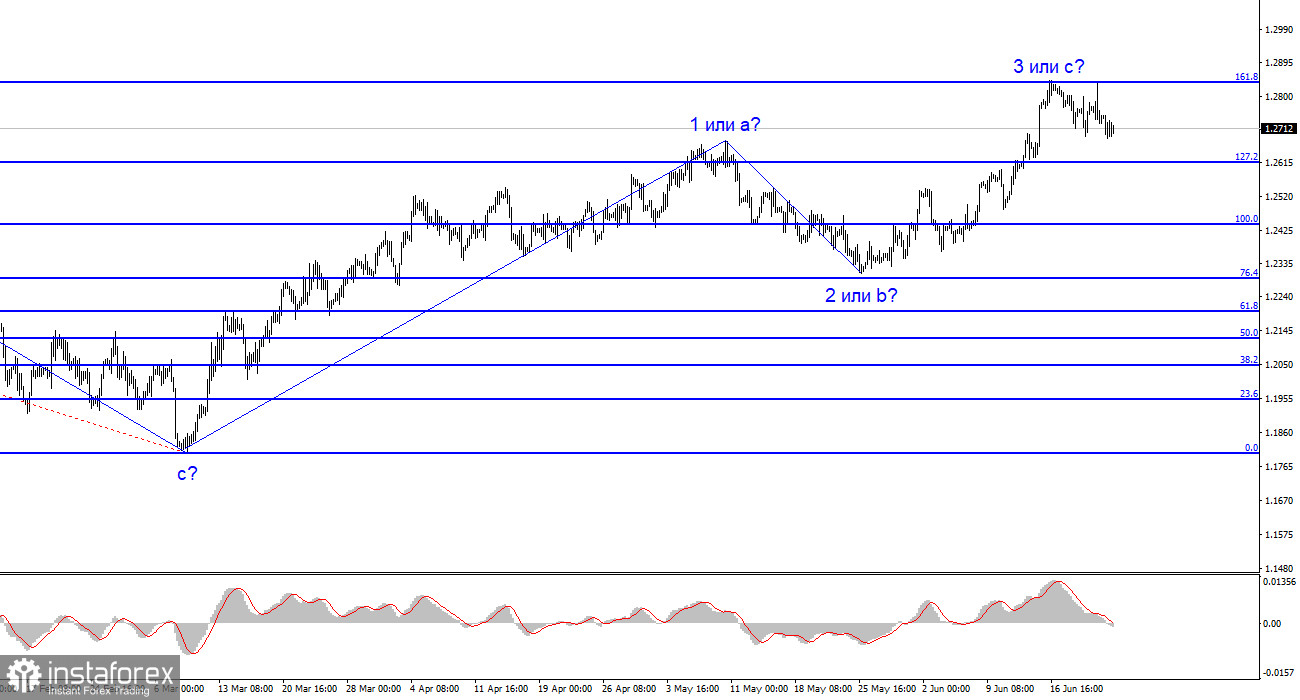

The wave pattern of the pound/dollar pair has changed and now suggests the formation of an upward wave, which could conclude at any moment. Consider buying the pair only if a successful breakthrough is above the 1.2842 level. Selling is also recommended, as there have been two unsuccessful attempts to break this level, and the stop-loss should be set above it. The MACD indicator has also given a "down" signal.