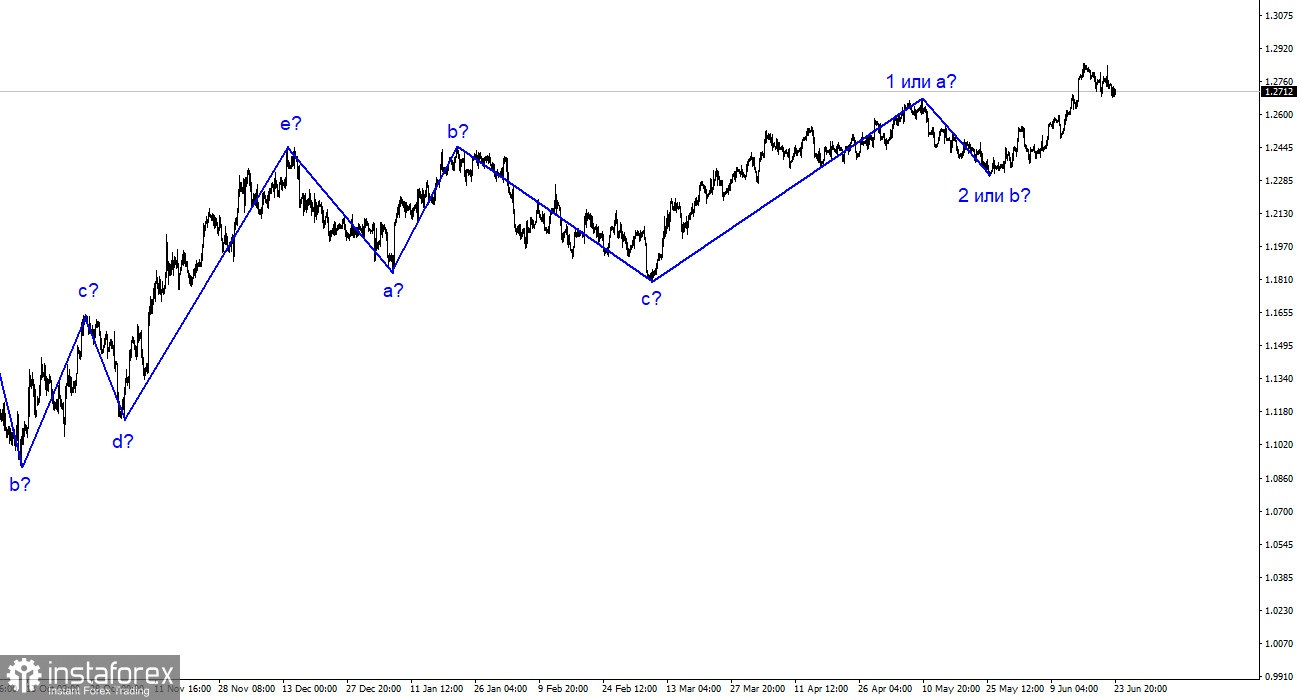

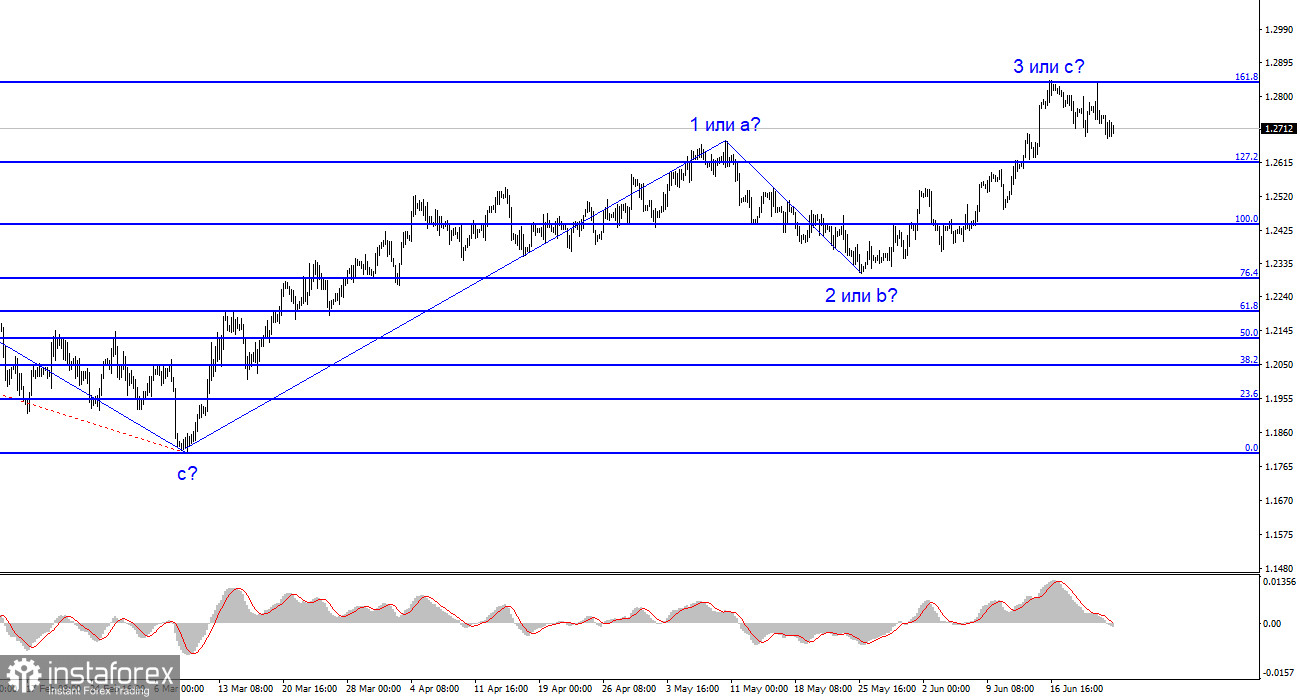

The wave analysis of the pound/dollar pair has undergone a simpler and more understandable transformation. Instead of a complex corrective trend segment, there is a possibility of an impulsive upward movement or a simpler corrective wave. The formation of an ascending wave 3 or c is ongoing, providing the British currency with a potential opportunity to rise to around the 30th figure. However, the justification for this rise should be assessed considering the current news background. There are no solid reasons for the British currency to continue rising to the 30th or 35th figure, which is only possible if it is an impulsive segment of the trend. It is also possible that the presumed wave 3 or c has already been completed. While wave analysis can become more complex, I prefer to rely on its simpler manifestations as they are easier to work with.

It is noteworthy that the wave analysis of the EUR/USD pair differs significantly from the GBP/USD analysis, which is uncommon. A downward wave structure is expected to form for the euro currency, but the wave analysis could transform into a similar pattern as the pound. Currently, the pound appears to be in an upward trend, but the Fibonacci level of 161.8% and two unsuccessful attempts to break through it suggest a readiness for a decline.

The demand for the pound continues to decrease gradually. On Friday, the pound/dollar exchange rate decreased by 30 basis points, although the magnitude of the movements was not significant. While there were higher fluctuations the day before, the pound did not show significant changes in its exchange rate by the end of Friday. The British pound experienced a slight scare after a potentially significant rise. It is worth recalling that the Bank of England unexpectedly raised interest rates by 50 basis points, marking the thirteenth consecutive policy tightening. However, the consumer price index is decreasing slowly, prompting the central bank to take emergency measures.

The emergency measures, although "hawkish" in nature and expected to increase demand for the pound, were interpreted differently by the market. Currently, the presumed wave 3 or c appears to be fully completed, but its confirmation still depends on the Fibonacci level of 161.8%.

While business activity indices in the UK showed a negative trend, the decrease was smaller than the European ones, resulting in only minor losses for the pound. However, the manufacturing sector has been a cause for concern for almost a year, with the Bank of England's hawkish policy devastatingly impacting the British economy. Based on the mentioned factors, the ECB and the Bank of England will face a dilemma soon: whether to raise interest rates further and witness a plunge in economic indicators or to halt and be content with a partial decrease in inflation. This decision will influence the dynamics of the euro and the pound. For now, a decline is expected for both currencies.

In summary, the wave pattern of the pound/dollar pair has changed, indicating the formation of an ascending wave that could be completed soon. Consider buying the pair only if there is a successful break of the 1.2842 level. Selling is also recommended due to two unsuccessful attempts to break this level, with the stop loss set above it. The MACD indicator has also provided a "down" signal.

The pattern resembles the euro/dollar pair on a larger wave scale, but there are still some differences. The descending corrective trend segment has ended, and the formation of a new ascending segment is continuing, which could be completed as early as tomorrow or develop into a full-fledged five-wave structure. Even if it forms a three-wave structure, the length of the third wave could vary, being either extended or shortened.