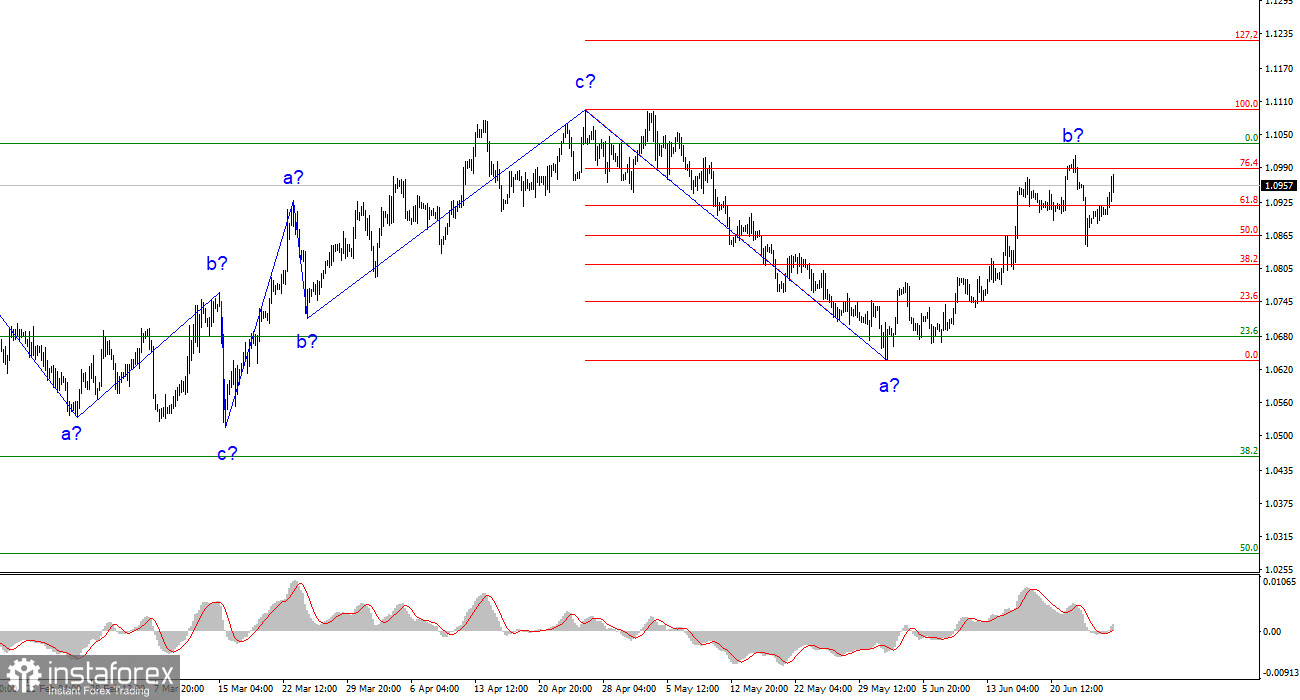

The wave analysis of the 4-hour chart for the EUR/USD pair remains non-standard but understandable. The entire ascending trend segment, which began on March 15, could adopt a more complex structure, but at this time, I expect the formation of a descending trend segment, which is likely to be a three-wave movement as well. Recently, I have regularly mentioned that I anticipate the pair to be around the 5th figure, from where the formation of the ascending three-wave movement began. So far, I'm not giving up on my words. The presumed wave b could have completed its formation this week, as indicated by the subsequent retreat of the quotes from the achieved peaks.

However, in light of recent events, especially the movements in the GBP/USD pair, I have developed an alternative wave count, which suggests that the entire trend segment between March 15 and April 26 is one wave a. If this is indeed the case, then the next wave would be b, and we are currently observing the formation of an ascending wave c. In this scenario, the wave counts of the British pound and the euro coincide, and everything falls into place. If this assumption is correct, the euro will continue to move towards the 11th figure and beyond.

The market does not react to US statistics.

The EUR/USD exchange rate increased by 40 basis points on Tuesday. In the morning, ECB President Christine Lagarde spoke at an economic forum in Sintra, but we will discuss it in more detail in the following reviews. There was nothing new in Lagarde's speech; it again focused on excessive inflation and the need to continue tightening monetary policy. Her speech may have caused a slight increase in demand for the euro currency, which we witnessed today, but it is not the first similar statement and not the first speech with such content.

Even less important reports in the US today were more significant, such as the number of building permits, new home sales, and durable goods orders. All three reports were much better than market expectations, which could have caused a slight increase in demand for the US currency. Unfortunately, this did not happen. Therefore, the current upward wave may take on a more extended form and become the third wave within the ascending trend segment I mentioned earlier. I cannot say that the euro has significantly strengthened its position in the market over the past few months. Rather, the dollar still needs to do something similar. However, the euro currency still feels more confident. The ECB's stance supports buyers, indicating a readiness to continue raising interest rates in both summer and autumn.

General conclusions.

Based on the analysis conducted, the formation of a new downward trend segment continues. The pair once again has significant room for decline. I still consider targets around 1.0500-1.0600 quite realistic, and I advise selling the pair on MACD indicator signals "down" with these targets. There is a sufficiently high probability of completing the formation of wave b. According to the alternative wave count, the ascending wave will be more extended, but after it, the formation of a downward trend segment should begin, so I do not recommend buying.

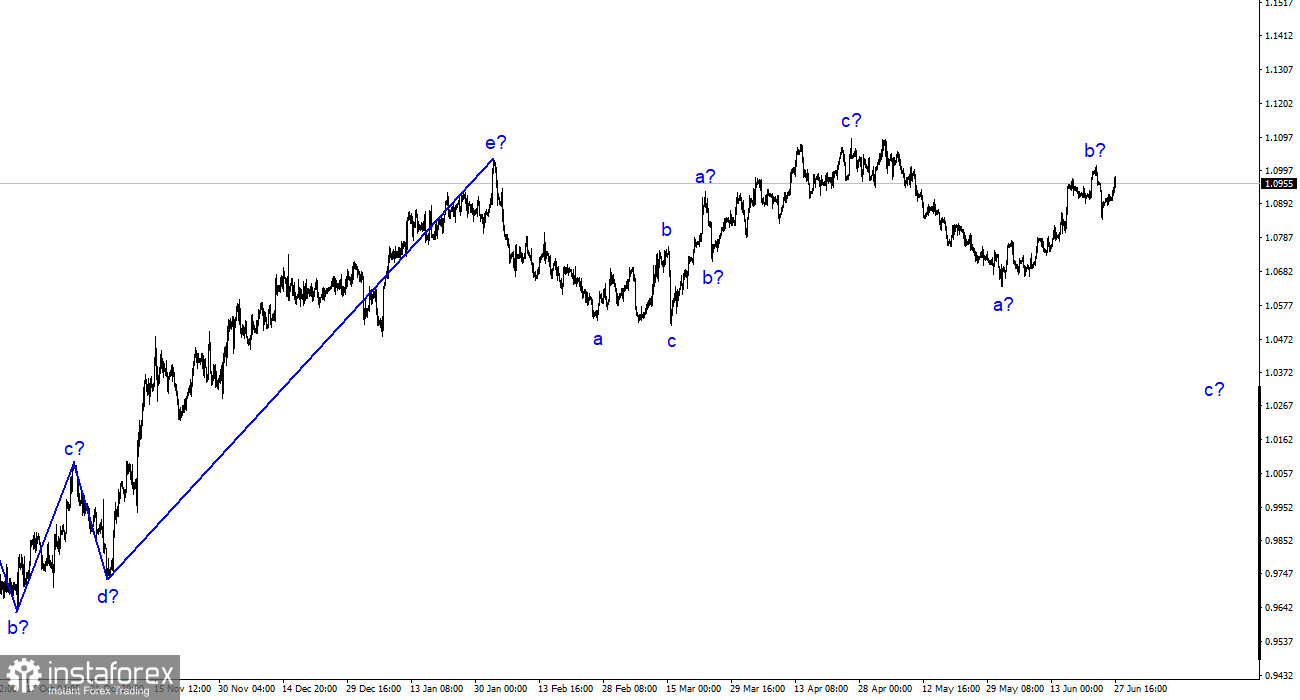

On a larger wave scale, the wave count of the ascending trend segment has taken on an extended form but is likely completed. We have seen five upward waves, most likely the structure of a-b-c-d-e. The pair then formed two three-wave movements, downward and upward. It is likely in the process of constructing another descending three-wave structure.