On Tuesday, the EUR/USD currency pair struggled to establish itself above the moving average line, failing to surpass the Murray level of "3/8"-1.0925, resuming its downward trend in the latter half of the day. However, to label this movement as a "decline" would be an overstatement, as the day's total volatility was merely 40 points. As such, the past week better embodies the idea of a "flat" market rather than a trending one. Currently, the currency market is experiencing a tranquil period. The fundamental and macroeconomic landscapes are intact, but the market appears saturated by them. Time and again, macroeconomic reports are in line with market expectations. Statements by representatives of the Fed and ECB do not offer traders any new or crucial information.

The euro continues to maintain a relatively high position but has been static in recent weeks. The subject of interest rates is becoming less pertinent to traders. It's worth noting that when a monetary tightening or easing cycle initiates, the market endeavors to anticipate it. If this happens concurrently in two or more countries, as is usually the case, the market also strives to consider all changes preemptively. For instance, last year, the Fed began raising rates ahead of the ECB, resulting in an initial surge in the dollar's value (taking geopolitics into account). Subsequently, as inflation in the US began to ease, the euro began to appreciate. It has been on an upward trend for the past ten months, although it has been largely consolidating in the 1.05–1.11 range for the last 5–6 months.

Consequently, we do not foresee any significant triggers for a sudden upswing in the value of the euro or the dollar. The pair will likely continue to consolidate within the outlined range, and it might take considerable time before this process reaches completion. The market has already accounted for 90% of all forthcoming interest rate hikes by the Fed and ECB.

Currently, neither the euro nor the dollar holds a distinct advantage. Many experts have been forecasting a downturn, recession, and deceleration for the US economy, particularly for the labor market. These predictions have been circulating since last year, yet official statistics suggest no signs of a looming recession. Over the past three quarters, the US economy has grown by at least 2%, significantly more than the growth observed in the European Union or Britain. The labor market continues to demonstrate robust performance month after month, even with the Fed's rate escalating to 5.25%. Unemployment has seen minimal growth, while Nonfarm Payrolls consistently reveal at least 200 thousand new job additions each month. As such, the Fed can continue its monetary tightening policy as required, especially now that inflation has fallen to 4%.

This factor might play against the dollar in the medium term. Since inflation is already approaching the target level, the Federal Reserve will begin to soften monetary policy in 2024. It is unknown when the ECB, dealing with higher inflation, will begin to soften. Nevertheless, inflation in the Eurozone continues to decrease steadily. It initially rose more than in the US. Hence, it needs more time to return to 2%. However, the ECB began raising the rate after the Fed. Thus, everything is in its place. The European regulator may start reducing the rate a few months later than the Fed.

The monetary policy of the Fed and the ECB currently does not imply a strong strengthening of the dollar or the euro.

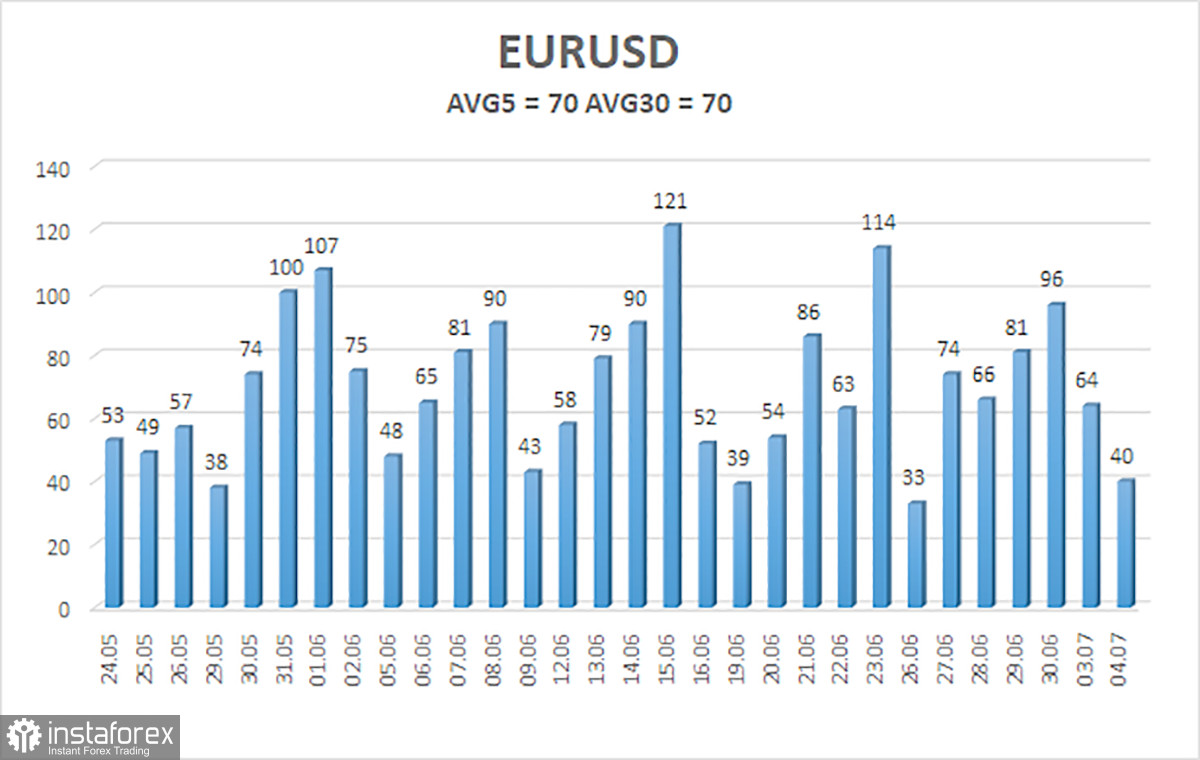

The average volatility of the euro/dollar currency pair for the last five trading days as of July 5 is 70 points and is characterized as "average." Thus, we expect the pair to move between levels 1.0779 and 1.0915 on Wednesday. A reversal of the Heikin Ashi indicator upwards will indicate a new round of upward movement.

Nearby support levels:

S1 – 1.0864

S2 – 1.0803

S3 – 1.0742

Nearby resistance levels:

R1 – 1.0925

R2 – 1.0986

R3 – 1.1047

Trading recommendations:

The EUR/USD pair went flat at the beginning of the week, so it's best to wait for it to finish. Short positions with targets of 1.0828 and 1.0803 should be considered when the price is below the moving average. Long positions will become relevant no earlier than when the price consolidates above the Murray level of "3/8" (1.0925) with targets of 1.0982 and 1.0986.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.