Today, you should pay attention to the final data on the indices of business activity in the UK. Preliminary estimates showed a decline in the services PMI from 55.2 points to 53.7 points, and the composite PMI from 54.0 points to 52.8 points. But at least the second indicator will be better than the forecasts. The only important data on Monday was the manufacturing PMI from the UK, which turned out to be slightly better than the preliminary estimate. So even if the business activity index in the service sector coincides with the preliminary estimate, the composite index will still be a little better. In addition, there is a chance that the services PMI will also be slightly better than the preliminary estimate. Thus, there is a high probability of the pound's growth, as investors will be reassessing positions.

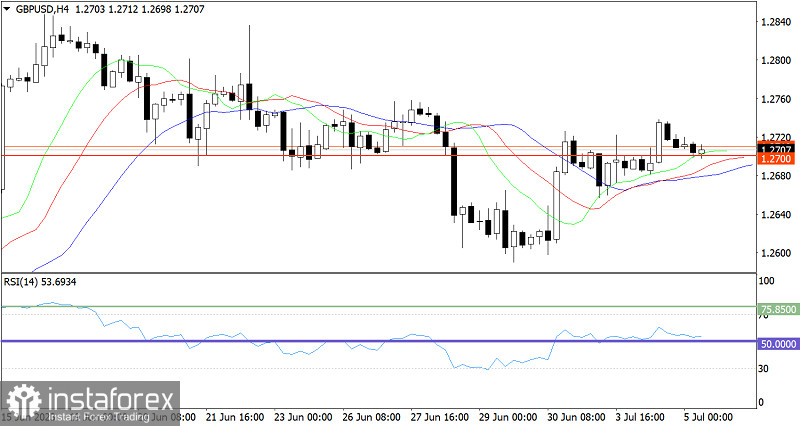

The GBP/USD pair exchange rate ended Tuesday's session slightly higher from its opening levels, but this did not result in anything crucial for the movement. The quote is still near the level of 1.2700, indicating temporary stagnation.

On the four-hour chart, the RSI technical indicator is hovering in the upper area of 50/70, which points to the bullish sentiment.

On the same time frame, the Alligator's MAs are headed upwards, which corresponds to the direction of the cycle.

Outlook

In this situation, we still have the same strategy, in order to raise the volume of long positions, the quote needs to stay above the value of 1.2750. In this case, there may be a step-by-step recovery of the pound sterling relative to the recent corrective move.

As for the bearish scenario, pulling the pair below the 1.0650 mark can restart short positions. This will result in reviving the local low of the corrective cycle.

The complex indicator analysis points to a bearish mood in the short-term period. In the intraday and medium-term periods, indicators are providing an upward signal.