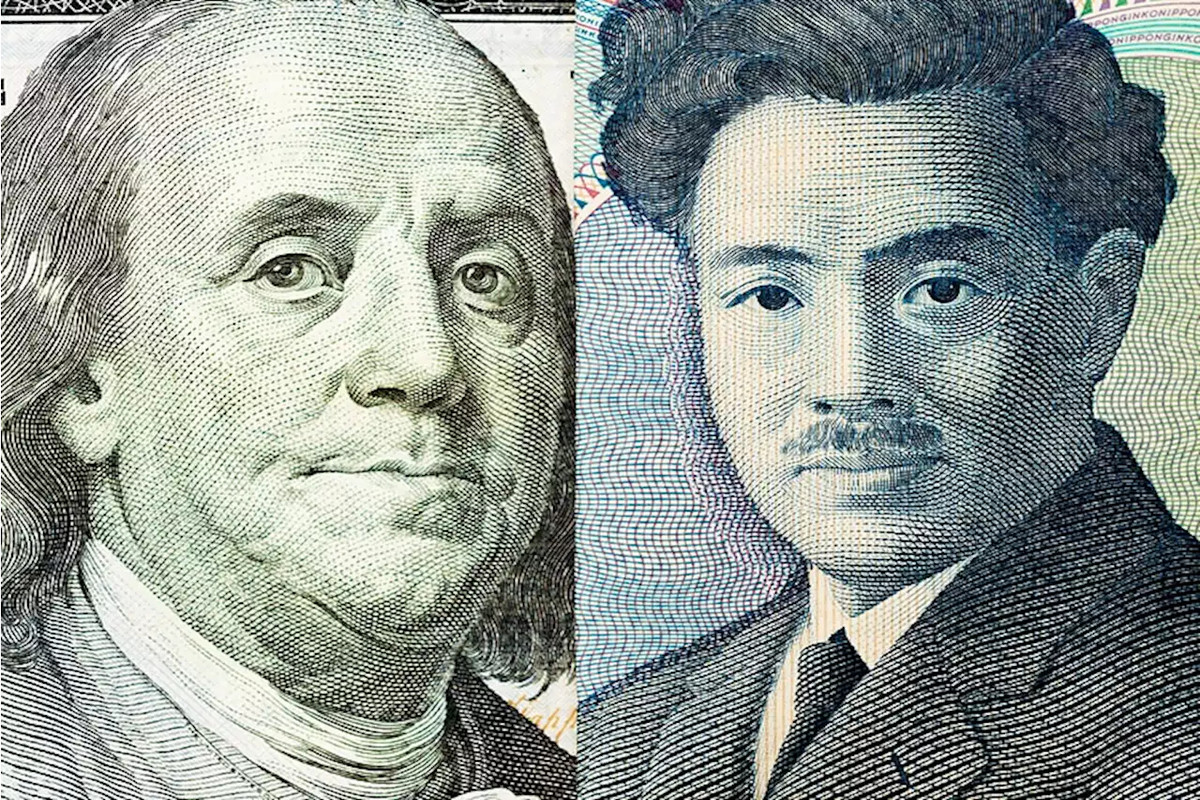

This week, the Japanese currency has taken a defensive position against the US dollar. It managed to rise by almost 0.7% from the 8-month low of 145.07, which was reached last Friday. However, most experts remain pessimistic about the yen's prospects, projecting a continued downtrend against the greenback in both the short and long term.

Intervention fears fade away

Last week, the yen collapsed against the dollar, reaching the level of 145. Speculation had been rife that Japanese authorities would intervene to support their national currency once it breached that level.

Yet, as of now, actual intervention has not materialized. At this stage, Tokyo has decided to use verbal threats, which, of course, have had an effect, but are not as strong as an actual intervention.

During the past week, Japanese officials repeatedly issued verbal warnings to currency speculators who actively bet against the yen due to the Bank of Japan's unwavering dovish stance.

Notably, the Bank of Japan remains the sole major central bank that has refrained from tightening its monetary policy in response to mounting inflationary pressures.

Its monetary course sharply contrasts with the aggressive stance of the US Federal Reserve. The Fed, despite keeping interest rates unchanged in June, maintains its hawkish stance and is ready to continue its tightening cycle within the next few months.

This was reaffirmed by recent comments from the chairman of the Federal Reserve, Jerome Powell. Last week, Powell confirmed two more rate hikes were likely in 2023, and completely ruled out the possibility of rate cuts in the foreseeable future.

Currently, the interest rate differential between the US and Japan stands at 5.35%. Market participants widely anticipate this gap to widen in July, as the Federal Reserve may resume its monetary tightening trajectory with a 25 basis point rate hike.

Futures traders are currently pricing in an 87% probability of such a scenario. It might increase even further this week following the release of several key data releases.

Today's release of June FOMC meeting minutes and the US non-farm payrolls report for the previous month, which is due on Friday, are expected to bolster market expectations for a more hawkish Fed stance.

If the FOMC minutes convey a strong commitment to the anti-inflation campaign in the US, and the non-farm payrolls data show a still strong labor market, providing a compelling case for further rate hikes, the US dollar is poised to rally across the board.

USD/JPY will not be an exception and is likely to resume its recent rally, despite the lingering risk of currency intervention.

Of course, at this stage, the market cannot completely rule out the possibility of intervention. Yesterday, Japan's chief currency diplomat, Masato Kanda, warned speculators that active discussions on the excessive weakening of the yen were being held with his foreign colleagues.

However, doubts are growing among traders about the seriousness of Tokyo's threats, especially considering that the yen's decline this year has not been as extreme as in the past.

Previously, Japanese authorities emphasized that intervention would not be triggered by a specific JPY level, but rather by how fast the currency declines in the foreign exchange market.

"We don't see a very high probability that the Ministry of Finance will intervene at the same level as last year - and if the move is not rapid, below 150 we might not see intervention at all," Shusuke Yamada, an analyst at The Bank of America said.

Analysts at OCBC share a similar view, suggesting that Japanese authorities would only take action if the US dollar spikes by 2-3 yen in a single day, like it did last autumn.

Such a development at this stage is highly unlikely, as unlike in 2022, the Federal Reserve is gradually approaching the end of its months-long hawkish campaign. The US dollar's upwards momentum will eventually run out of steam, preventing USD/JPY from surging beyond its current levels.

Optimistic third quarter outlook

To understand how USD/JPY will perform within the next three months, it is crucial to examine the market expectations surrounding the monetary policies of the US and Japan.

Recently, analysts at Bloomberg presented their quarterly forecast for the monetary policies of the world's largest central banks.

According to Bloomberg's analyst Anna Wong, the Federal Reserve would likely raise its target range for the federal funds rate by an additional 25 basis points if core inflation persists, pushing the upper limet of the Fed funds rate to 5.5%. The projected economic slowdown would discourage US policymakers from adopting a more hawkish policy stance in the future. Wong predicted that the Federal Reserve would choose to keep the rates at their peak level of 5.5% until the end of the year.

Economist Taro Kimura noted that the recent turmoil in the US banking sector has substantially alleviated the pressure on the Bank of Japan to hastily alter its yield curve control policy. He predicted that the BOJ would likely uphold its Yield Curve Control policy until the latter half of 2024 and maintain its ultra-dovish policies in the short term. Taro Kimura added that BOJ was unlikely to raise interest rates by year-end, and that the regulator would continue its bond purchases.

The fundamental backdrop in the third quarter and beyond will clearly continue to favor the US dollar. This could propel USD/JPY to new highs in the 145-147 range.