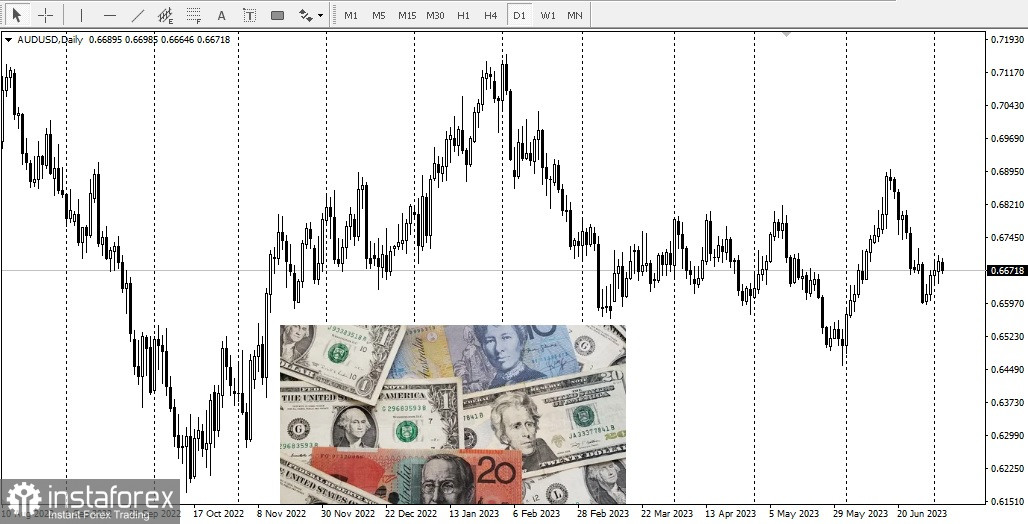

AUD/USD fell under some selling pressure as the Reserve Bank of Australia (RBA) decided to keep interest rates unchanged at 4.10%.

Apparently, the bank's decision disappointed some analysts, who were hoping for another 25 basis point rise in rates. However, the RBA paused its cycle due to the need for further assessment of the economic situation. The bank added that tightening may be needed in the future.

The FOMC minutes will be published today, but it will not contain any interest rate decision, as that will only happen on July 25-26 at the next FOMC meeting. Markets expect to see a 25 basis point rise by then, especially since the bank hinted at a 50 basis point rise during the June meeting. However, Jerome Powell said last week that there will be no rate cuts for now as inflation needs to decrease first. This, in turn, caused US Treasury yields to soar, which became a tailwind for dollar.

The strength of dollar currently prevails, so the line of least resistance lies on the downside.