On Wednesday, markets are trading with low activity as they await the opening of the US markets and new cues after yesterday's celebration of US Independence Day. The main events are expected at the end of the week. On Thursday, the ISM Non-Manufacturing Index will be published, and on Friday, the June labor market report.

Both reports will allow for adjusting expectations regarding the Federal Reserve's interest rate, as they will provide an answer to the question of how strong the threat of a recession is in the context of still-high inflation. If the ISM Non-Manufacturing Index falls below the threshold of 50, following the decline in the Manufacturing Index, the US dollar may experience a new wave of selling.

Regarding the nonfarm payrolls on Friday, the main focus will be on the pace of wage growth. Currently, the growth is low and has only exceeded 0.3% month-on-month once this year (in April it was +0.4%), which restrains real wage growth and inflation expectations.

USD/JPY

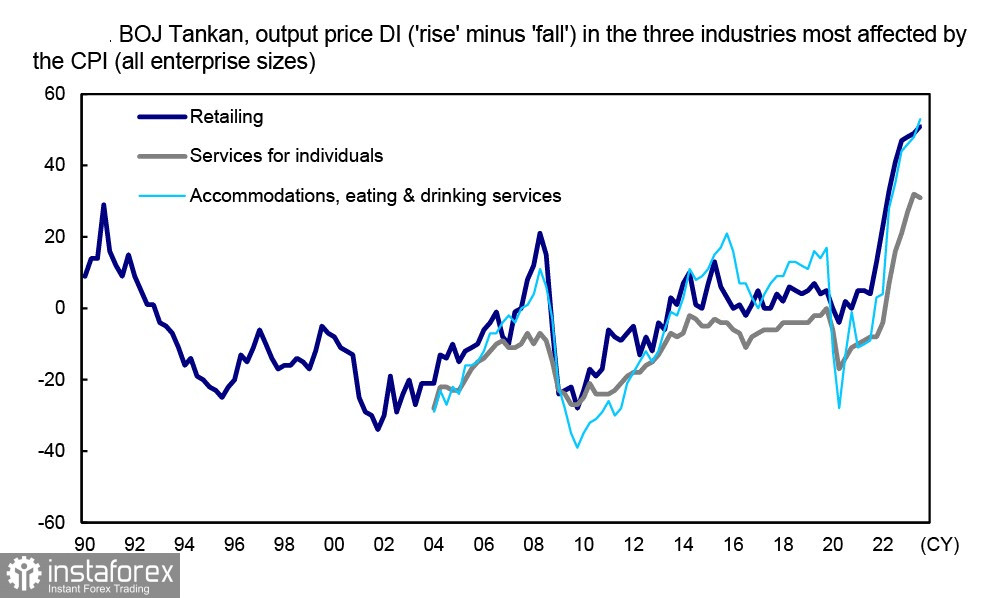

The quarterly Tankan survey showed growth in almost all components in the second quarter, allowing for several important conclusions regarding the correction of credit and monetary policies.

The Bank of Japan's monetary policy since former Governor Kuroda came into power has been primarily focused on achieving price stability. As a result, many market participants currently tend to interpret the Tankan survey results as indicators of inflation rather than the economy itself.

Everything appears to favor further inflation growth. The diffusion index (growth minus decline) has risen in all three sectors, and the September forecast has improved in two. All these indicators are currently at levels unseen since Tankan began including this question in 2014, and they all exceed the Bank of Japan's target of 2%.

Both the diffusion index of production and the inflation forecast would support the Bank of Japan if it decided to review QQE based on the fact that trend inflation is gaining momentum. However, the balance between domestic demand and supply is shifting in favor of supply, and the recent spike in inflation was a result of a clear supply shortage, making it essentially temporary. As the impact of this factor clearly fades, consumers are expected to reduce their activity, and demand will no longer fuel inflation.

The second key question is the pace of wage growth. There is no clear evidence in this regard. In any case, 81 out of 144 surveyed companies refused to provide information on wage growth plans for the next year, making it also impossible to prove the trend of wage growth adjusted for inflation.

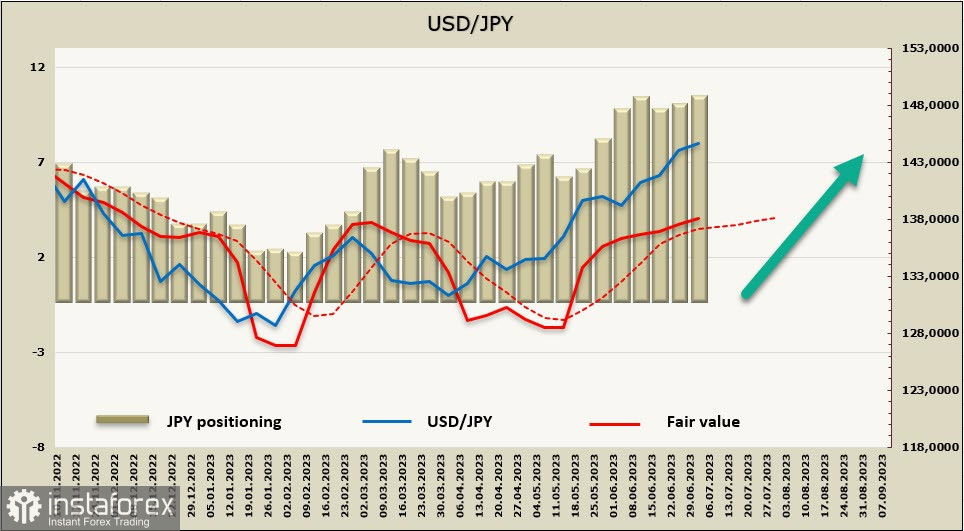

These considerations provide a basis to assume that the Bank of Japan has no need to rush with the withdrawal of QQE. And if that's the case, there are also few grounds for the yen to strengthen in the near term.

The net short position on JPY increased by 281 million over the reporting week to -9.793 billion, and the settlement price remains above the long-term average and is upward-oriented.

The USD/JPY trend is decidedly bullish, with no significant technical resistance until the October 2022 high of 151.96. The rise is held back by the growing weakness of the dollar, but there are no additional grounds for a bearish reversal from this.

USD/CAD

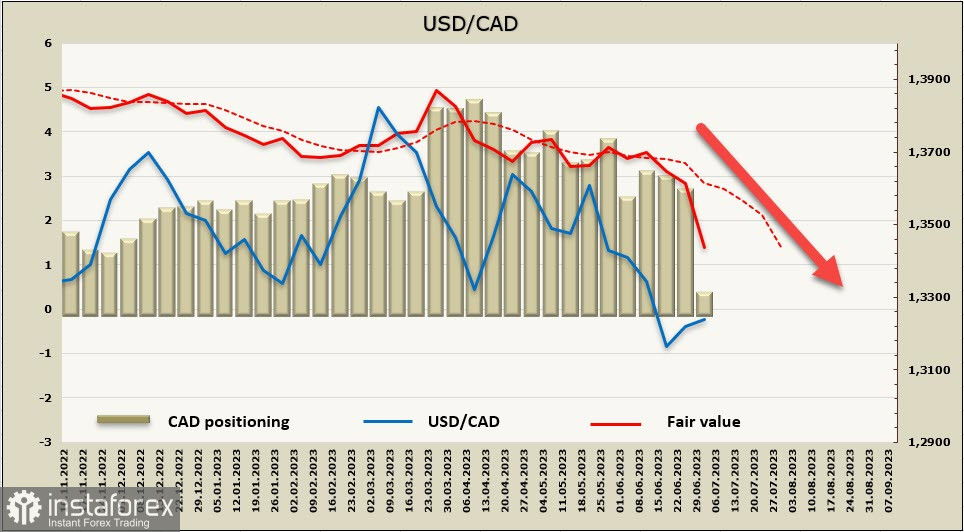

On Friday, the employment report for June will be published, and these will be the last data that can influence the position of the Bank of Canada, which will hold its regular monetary policy meeting next week.

Markets expect another 25 basis point rate hike, and the probability of a second hike is also quite high. The main argument for the hike is the likelihood of a resumption of inflation growth. Since the beginning of the year, 231,000 new jobs have been created, but the labor force has grown slightly more by 280,000, resulting in a slight increase in unemployment.

Regarding the pace of wage growth, several collective agreements are expected to be concluded in the public and private sectors in the near future, which will regulate this issue in terms of indexed payments adjusted for inflation. The emergence of such agreements, especially in the absence of labor productivity growth, will clearly fuel inflation expectations.

Overall, the arguments in favor of the Bank of Canada raising rates next Wednesday are strong, and this factor will contribute to the strengthening of the loonie in the coming week.

According to the latest CFTC report, demand for the Canadian dollar has sharply increased. A net short position on CAD decreased by 2.319 billion over the reporting week to -216 million, almost reaching a neutral level. The settlement price has sharply declined, indicating a bearish trend.

We can expect a further decline in the USD/CAD pair, with the nearest target being the lower boundary of the 1.3040/60 channel. There is a slight possibility of an upward correction towards the resistance zone of 1.3330/50. In case of an increase, it is better to wait for the end of the move and find an opportunity to sell.