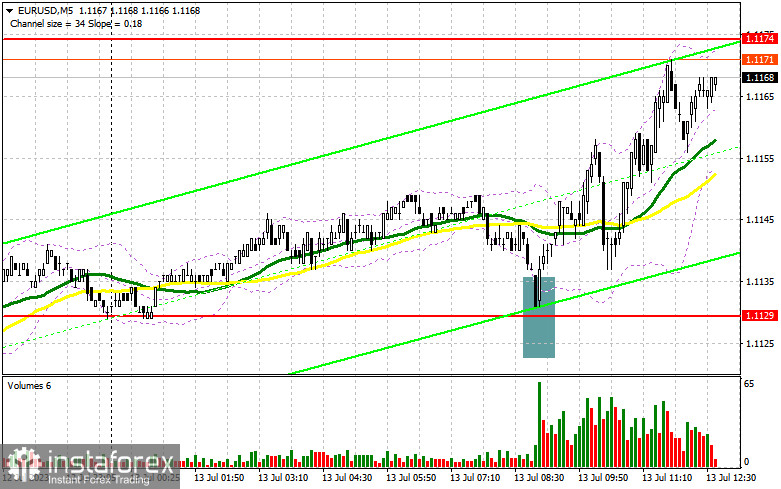

In my morning forecast, I paid attention to the level of 1.1129 and recommended making decisions about the market entry from it. Let's look at the 5-minute chart and figure out what happened there. A false breakout at this level signaled a purchase, which resulted in an increase of more than 45 points at the time of writing this article. The technical picture still needs to be revised for the second half of the day.

For opening long positions on EUR/USD, you need the following:

There are no reasons to sell the European currency - only purchases, especially after yesterday's inflation reports. Today, pressure on the US dollar may increase after the release of reports on the number of initial jobless claims and the producer price index in the US. An increase in claims compared to last week will weaken the dollar's position and lead to a new euro surge upwards. However, be cautious with purchases at current highs.

I prefer to wait for a correction in the area of 1.1129 and will only act there. Forming a false breakout at this level, similar to what I analyzed above, will signal a purchase, confirming the presence of major players capable of pushing the euro upwards to new annual highs. The target, in this case, would be the resistance of 1.1174. Breaking through and testing this range from top to bottom will strengthen demand for the euro, giving a chance for a surge to 1.1227. The farthest target remains the area of 1.1271, which will testify to the euro establishing a new upward trend. I will fix the profit there. In the case of a decline in EUR/USD and the absence of buyers at 1.1129 during the American session, bears may act more actively, hoping to form a downward correction. Therefore, only forming a false breakout in the area of the next support of 1.1097 will signal the purchase of the euro. I will open long positions immediately on a rebound from the minimum of 1.1058, with a target for an upward correction of 30-35 points within the day.

For opening short positions on EUR/USD, you need:

Sellers will be waiting for American statistics and relying specifically on them, as there is nothing else they can count on. Most likely, they will focus on defending the nearest resistance of 1.1174, which will be tested shortly. I would prefer to act from this level only after a false breakout, which would signal a sell with the prospect of reducing EUR/USD to support at 1.1129. I expect larger buyers to show up there. Consolidation below this range, as well as a reverse test from bottom to top against the backdrop of strong labor market statistics, is a direct route to 1.1097, where the moving averages are located, playing on the side of the bulls. This will testify to a rather large correction of the euro, which may return the appetite to buyers. The farthest target will be the area of 1.1058, where I will fix the profit.

In the event of an upward movement of EUR/USD during the American session and the absence of bears at 1.1174, which is quite possible in the current bull market, bulls will continue to push the euro upward. In this case, I will postpone short positions until the next resistance of 1.1227. There you can also sell, but only after unsuccessful consolidation. I will open short positions immediately on a rebound from the maximum of 1.1271 with the aim of a downward correction of 30-35 points.

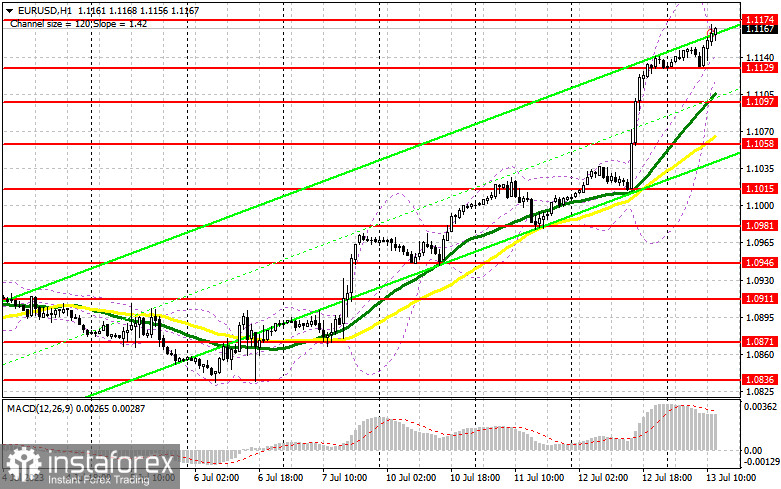

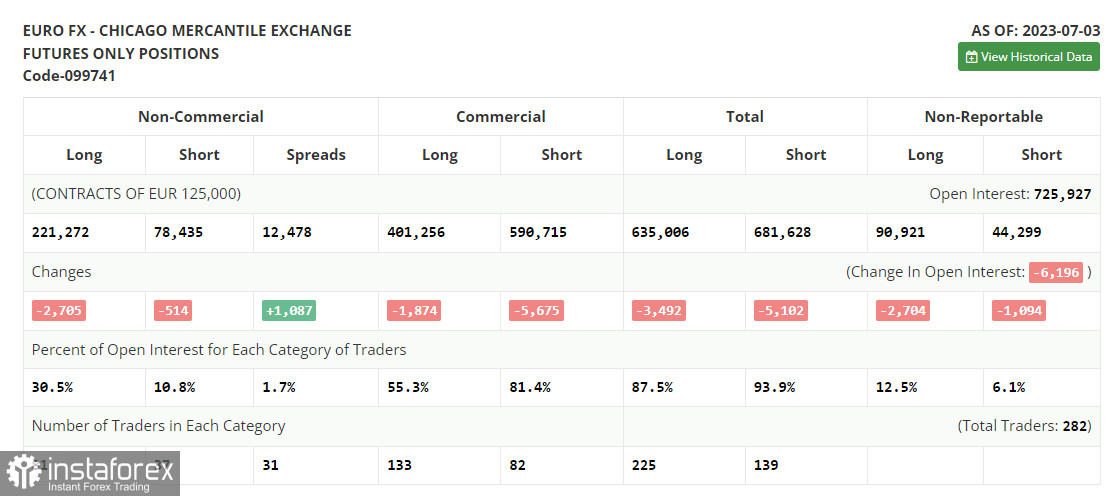

In the COT report (Commitment of Traders) for July 3, there was a reduction in long and short positions, which left the balance of power in the market virtually unchanged. The data released on the US labor market indicate the first signs of cooling, which plays on the side of buyers of risky assets, expecting further aggressive monetary policy from the central banks of their countries, which cannot be said about the Federal Reserve. Many believe that the expected Fed rate hikes are already factored into the quotes, and any data indicating a decrease in price pressure could lead to a larger dollar sell-off. The optimal medium-term strategy in the current conditions remains buying the euro on a decline. The COT report indicates that non-commercial long positions fell by 2,705 to 221,272, while non-commercial short positions fell by 514 to 78,435. As a result of the week, the overall non-commercial net position decreased slightly and amounted to 142,837 against 145,028. The weekly closing price fell and amounted to 1.0953 against 1.1006.

Indicator signals:

Moving averages

Trading above the 30- and 50-day moving averages, which indicates further growth of the pair.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of growth, the upper border of the indicator in the region of 1.1040 will act as resistance.

Indicator descriptions:

• Moving average (smooths volatility and noise, determining the current trend). Period 50. It is marked in yellow on the chart.

• Moving average (smooths volatility and noise, determining the current trend). Period 30. It is marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence – convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.