Overview of macroeconomic reports

A light economic calendar for Friday, to be precise, just one economic release for the day. The US will release the University of Michigan Consumer Sentiment Index. This is a relatively secondary report that can provoke a market reaction only if the latest numbers significantly deviate from the forecast. But what kind of reaction should we expect now, if both pairs relentlessly rise? If the value is positive, the dollar will rise by 20 points and then it will fall again. If it's negative, why does it even matter if the dollar is already falling into the abyss anyway?

Overview of fundamental events

There is absolutely nothing to highlight from the fundamental events. However, this week, several Federal Reserve and European Central Bank officials spoke, which had no effect on the balance of power between currencies. Even Bank of England Governor Andrew Bailey spoke, who mentioned high wage growth rates. It is unlikely that the market started to buy euros and pounds en masse at the same time because it simultaneously believed that the ECB and the BoE would continue to raise rates for a long time and strongly. We are seeing illogical movement in terms of fundamental and macroeconomic analysis.

Bottom line

On Friday, the US will release one secondary report and that's it. One would like to assume that we might see a corrective phase, but since both pairs remain firm, we can't rule out that the dollar will also plummet for the day.

Main rules of the trading system:

- The strength of the signal is calculated by the time it took to form the signal (bounce/drop or overcoming the level). The less time it took, the stronger the signal.

- If two or more trades were opened near a certain level due to false signals, all subsequent signals from this level should be ignored.

- In a flat market, any currency pair can generate a lot of false signals or not generate them at all. But in any case, as soon as the first signs of a flat market are detected, it is better to stop trading.

- Trades are opened in the time interval between the beginning of the European session and the middle of the American one when all trades must be closed manually.

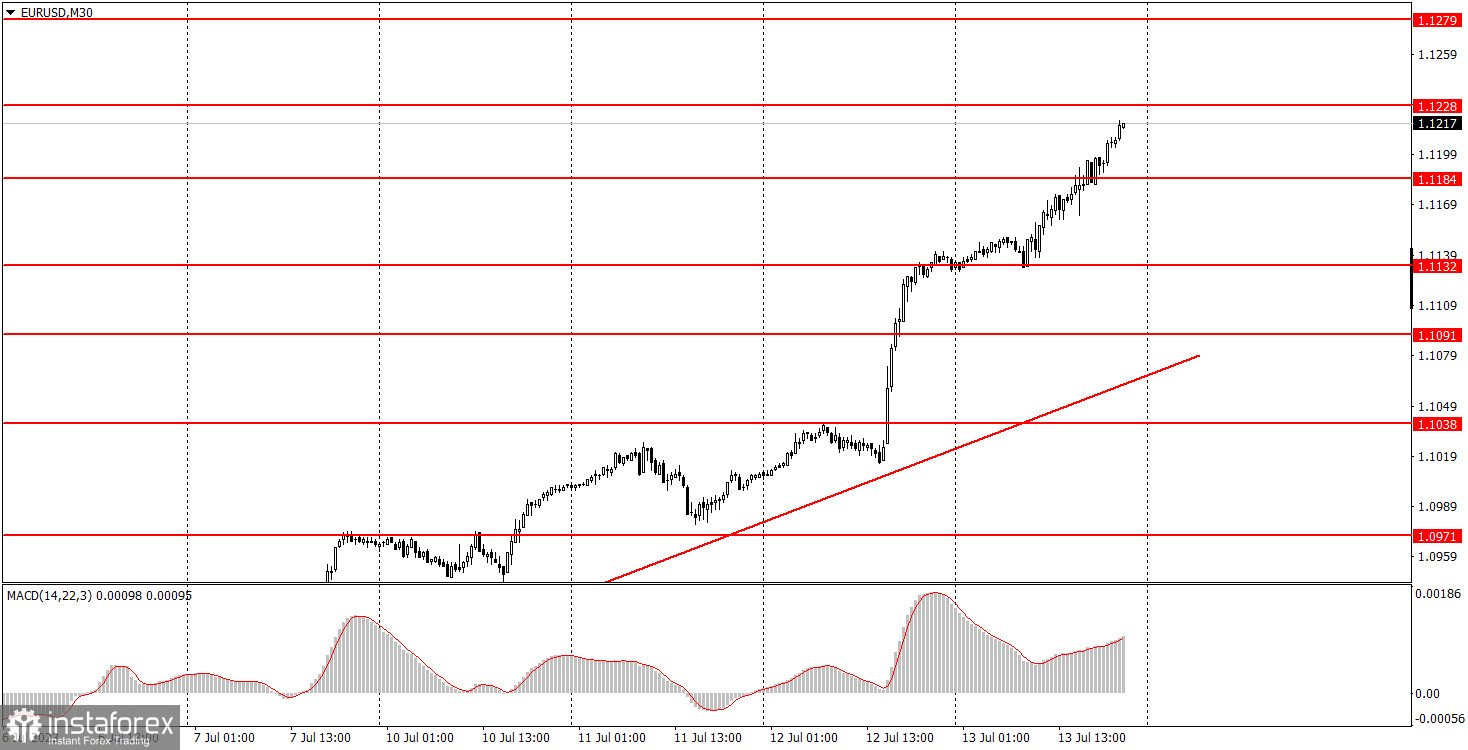

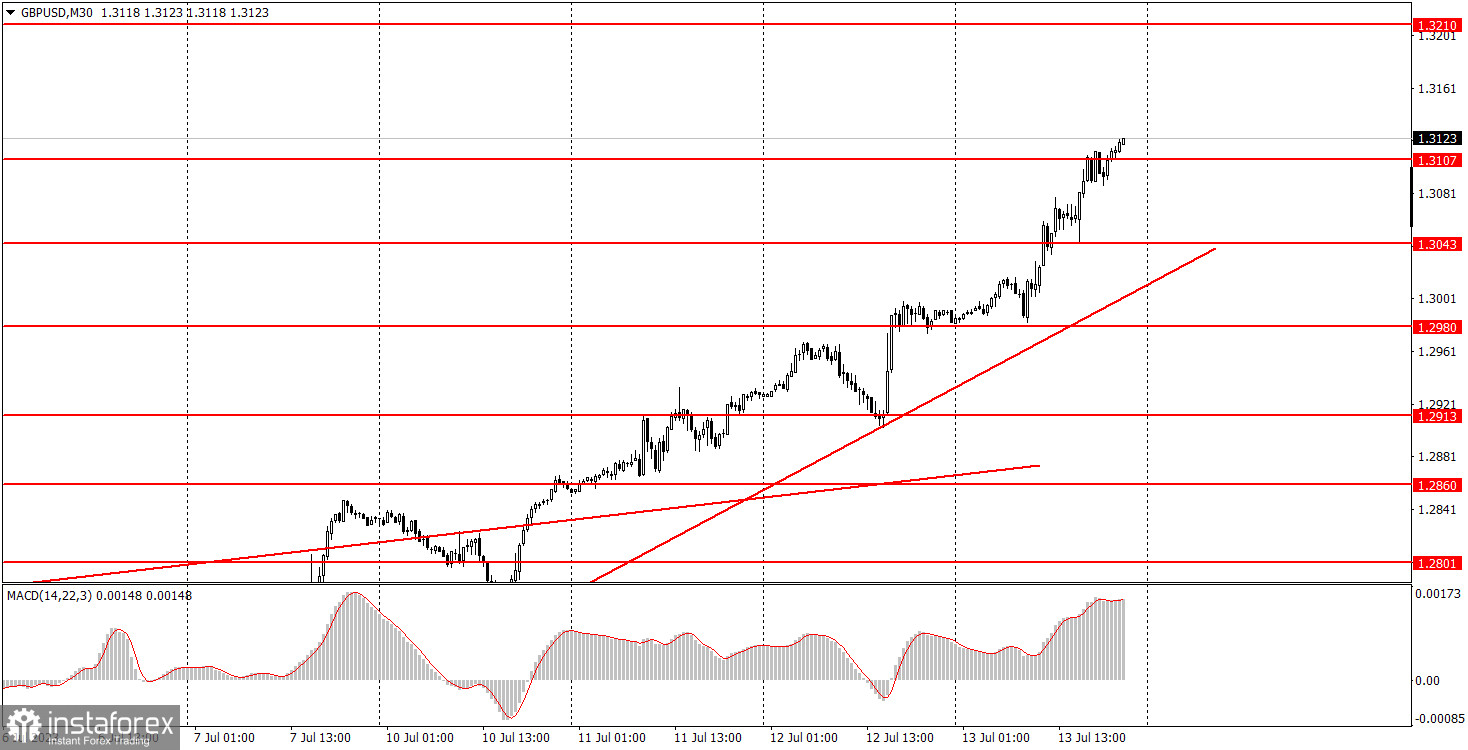

- On the 30-minute timeframe, you can trade based on MACD signals only on the condition of good volatility and provided that a trend is confirmed by the trend line or a trend channel.

- If two levels are located too close to each other (from 5 to 15 points), they should be considered as an area of support or resistance.

Comments on charts

Support and resistance levels are levels that serve as targets when opening long or short positions. Take Profit orders can be placed around them.

Red lines are channels or trend lines that display the current trend and show which direction is preferable for trading now.

The MACD (14,22,3) indicator, both histogram and signal line, is an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always found in the news calendar) can significantly influence the movement of a currency pair. Therefore, during their release, it is recommended to trade with utmost caution or to exit the market to avoid a sharp price reversal against the previous movement.

Beginners trading in the forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is the key to success in trading over a long period of time.