USD/JPY

In our last review of the yen, which was on July 12th, we talked about the descending wedge of the Marlin oscillator on the 4-hour chart being a sign of a reversal of the oscillator and the price moving to the upside. But only the oscillator broke out, and sharply at that, while the price fell, conducting a short consolidation below the level of 138.78 and extending its downward movement this morning.

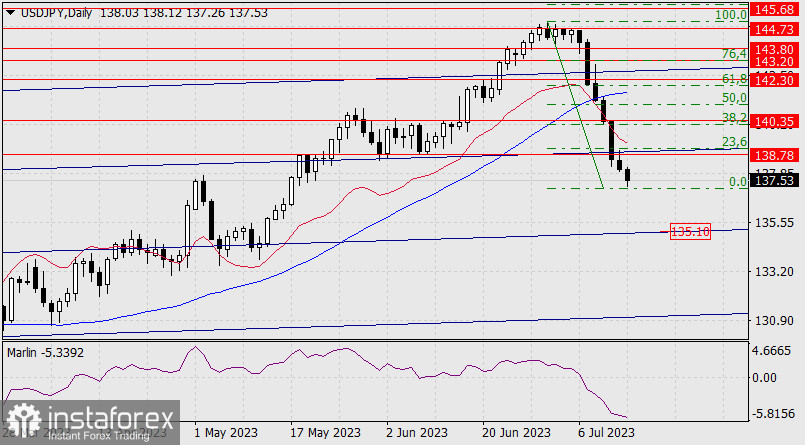

Perhaps this decline will be the final step in forming a convergence, and then a correction may occur. The nearest corrective level is 138.78 - it will correspond to 23.6% according to Fibonacci (see daily chart). Going above it will extend growth to 140.35 (38.2% correction).

Overcoming 140.35 will pave the way for an attack on 142.30 and the MACD line on the daily chart (61.8% Fibonacci correction). However, the correction plan is still weak - on the daily chart, the target is open at 135.10. We are waiting for clarification of the situation.