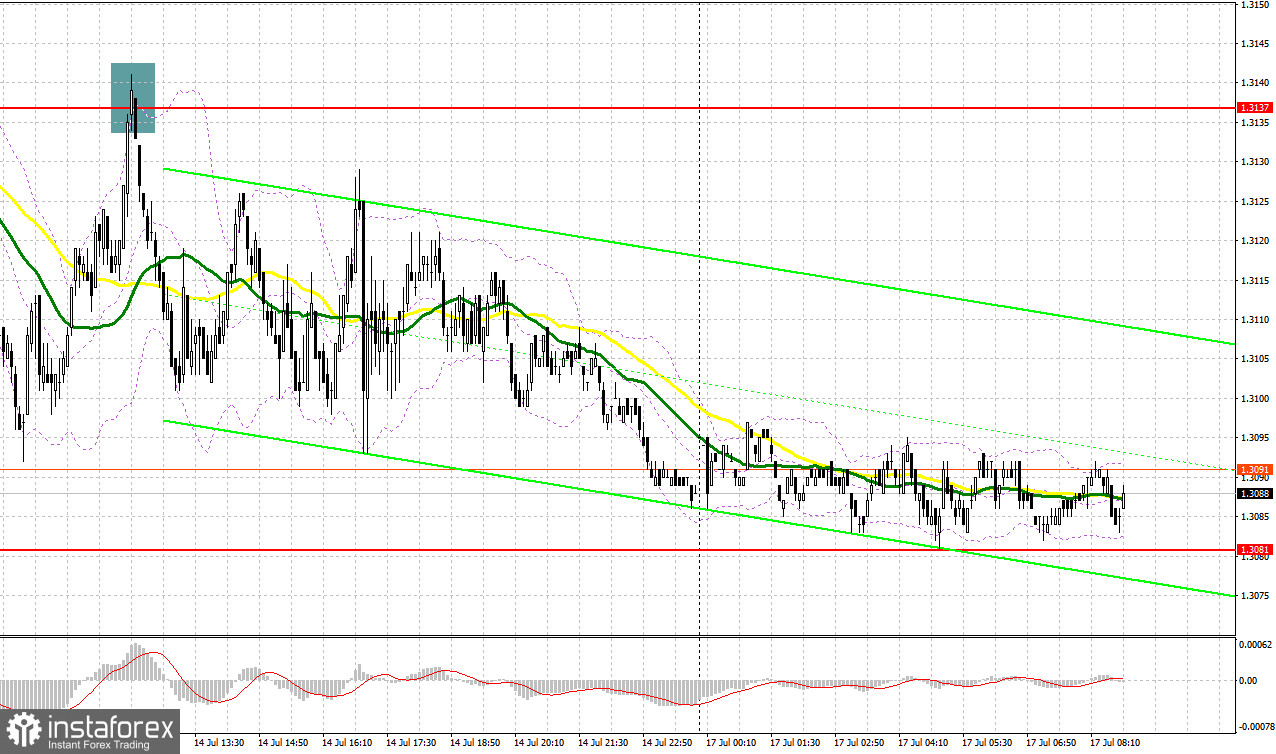

On Friday, the pound/dollar pair formed just one entry signal. Let's have a look at the 5-minute chart. In my morning review, I mentioned the level of 1.3137 as a possible entry point. A rise to this level and its false breakout created a good entry point into short positions. As a result, the pair dropped by more than 30 pips. In the second half of the day, there were no good entry points due to low volatility.

For long positions on GBP/USD:

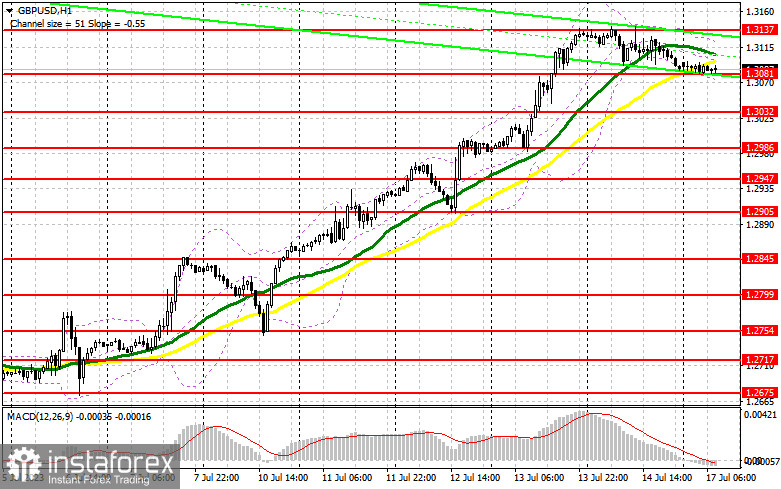

The pound sterling showed no reaction to the US inflation data signaling strong demand even despite being at the current highs. However, considering how high the pair has climbed, it is not advisable to rush things at the beginning of the week. The pressure on GBP/USD may rise amid the lack of any incoming data, potentially leading to a prolonged downward correction. For this reason, I will only enter the market on a decline towards the support level at 1.3081, where the moving averages support the bulls. A false breakout of this level will confirm the presence of strong buyers in the market, providing a signal to open long positions and paving the way to 1.3137. Since the pair failed to break above this level on Friday, only a breakout and a firm hold above this range will generate an additional signal to buy the pair with a target at 1.3195. The ultimate target will be the level of 1.3253 where I will take profit.

If the pair declines to 1.3081 and no bulls are found at this level, considering that a correction in the pair has been due for a while, the growth of the pair will be limited. In such a case, buyers will have to defend the area of 1.3032. A false breakout of this level will generate a buy signal. I plan to buy GBP/USD only on a rebound from 1.2986, with a correction target of 30-35 pips within the day.

For short positions on GBP/USD:

Bears are not very active but bulls are not rushing back into the market. The main task for the bears today will be to defend the nearest resistance at 1.3137, which the bulls failed to break above on Friday. If the pair moves up, a false breakout at this level will provide an excellent selling signal similar to what I discussed earlier. A movement to the target of 1.3081 will increase the pressure on the pair. A breakout and a subsequent upward test of this range will deliver a more significant blow to buyers' positions. If so, GBP/USD may decline even deeper to 1.2986. The ultimate target remains the low of 1.2947 where I will take profit.

In the case of GBP/USD's rise and a lack of bearish activity at 1.3137, the bullish market will continue. If so, I will sell the pair only when it tests the resistance at 1.3195. Its false breakout will serve as an entry point for short positions. If there is no downward movement at this level, I will sell the pound immediately on a rebound from 1.3253, anticipating a downward correction of 30-35 pips within the day.

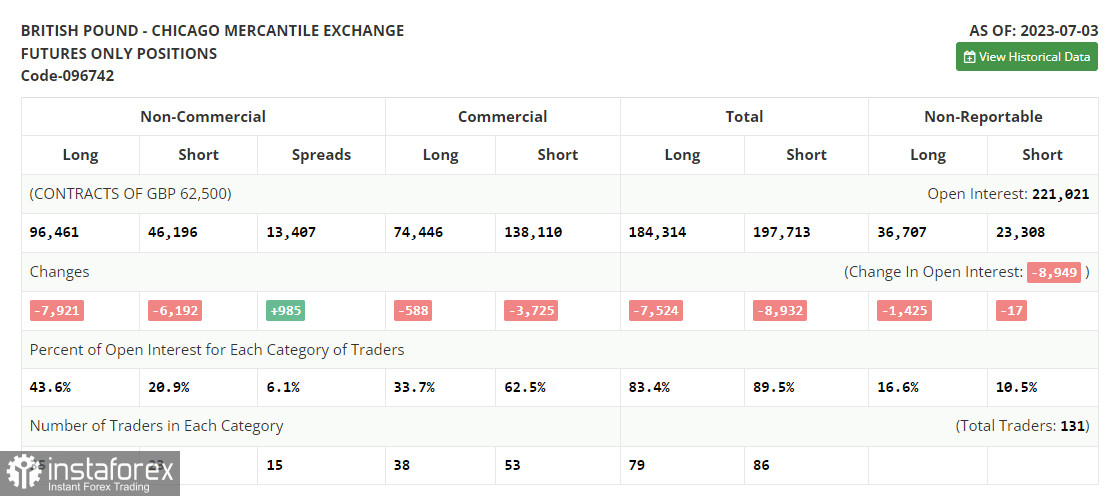

COT report:

The Commitments of Traders report for July 3 recorded a drop in both short and long positions. Pound buyers have all the reasons to maintain their aggressive stance as the Bank of England will continue to pursue a policy of high interest rates due to serious inflation issues affecting household living standards. As for the Federal Reserve, regardless of what policymakers say, traders begin to review their attitude towards the US dollar, betting on its weakening in the medium term. The reason for this is interest rates in the US which are about to reach their peak levels. Buying the pound on pullbacks remains the optimal strategy for now. The latest COT report indicates that short positions of the non-commercial group of traders decreased by 6,192 to 46,196, while long positions decreased by 7,921 to 96,461. This led to a slight decrease in the non-commercial net position to 50,265 compared to 51,994 in the previous week. The weekly closing price declined to 1.2698 from 1.2735.

Indicator signals:

Moving Averages

Trading around the 30- and 50-day moving averages indicates a downward correction in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower band of the indicator at 1.3081 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.