After the publication of encouraging inflation level reports in the United States on July 12, trading activity in the cryptocurrency market significantly increased. Bitcoin reached a local high of $31.8k for the second time in 14 days. Subsequently, investors expected further price movement towards the $32k level.

However, bullish expectations turned against them in the cruelest way possible. The BTC price formed a bearish engulfing pattern after breaking through another order block. As a result, Bitcoin experienced a bearish breakdown of the key support area at $30.8k–$31k and continued its downward movement towards the $30.5k support level.

Passion around the key rate

The positive fundamental background had a favorable impact on the prospects of BTC's upward movement at the beginning of last week. Mostly because the deflationary movement gave investors hope that the Federal Reserve would not raise the key rate at the end of July. The investor expectation indicator significantly decreased from the initial 95%.

However, on Friday, Consumer Sentiment Index data was released, showing a significant increase from 64.4 to 72.6 points. This indicates an activation of consumer sentiment and a willingness to spend money actively. The active growth of this index significantly raises the probability of inflation growth in July and practically guarantees a rate increase at the Federal Reserve meeting on July 26.

Considering these facts, investors had to quickly adjust their strategies regarding high-risk instruments. As a result, cryptocurrency market volatility increased, and Bitcoin declined significantly to $30.5k–$30.8k. Subsequently, the asset price dropped even further into the range of $29.8k–$30.5k.

Cryptocurrency market comes alive

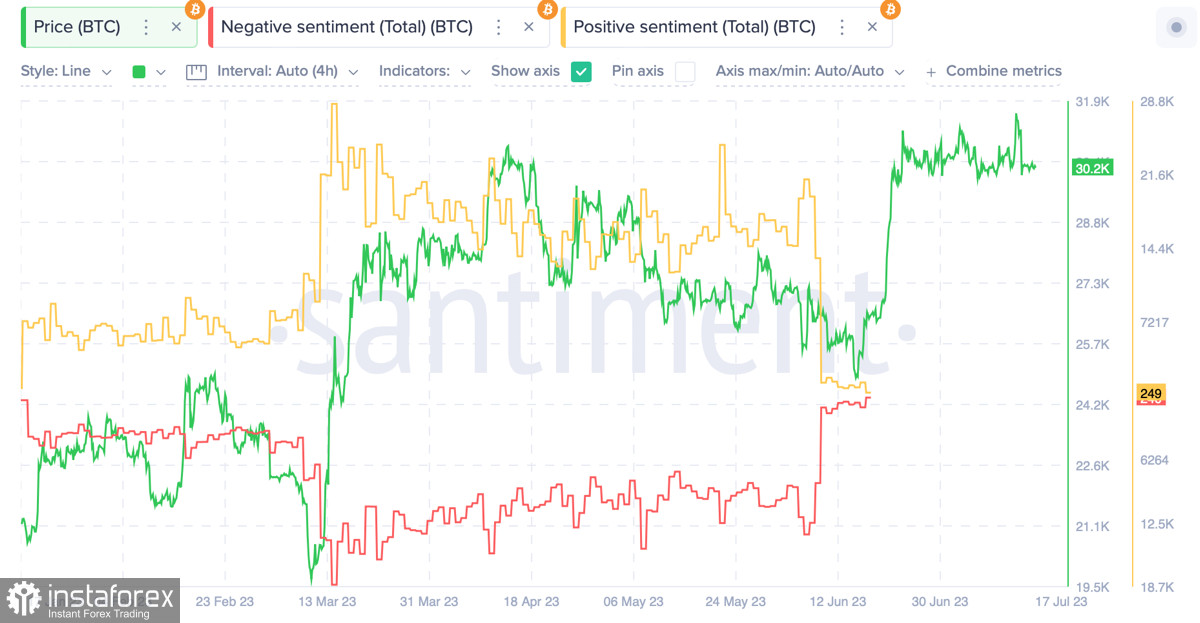

Despite the decline in Bitcoin and the market at the end of the previous trading week, RTRS believes that there are clear signs of the end of the crypto winter. Kaiko reports that the aggregate trading volume of stablecoins has already exceeded $3 billion. On-chain analysis also indicates that private traders' bullish sentiment has returned to the levels of 2021, and "smart money" has reduced bearish expectations to a minimum.

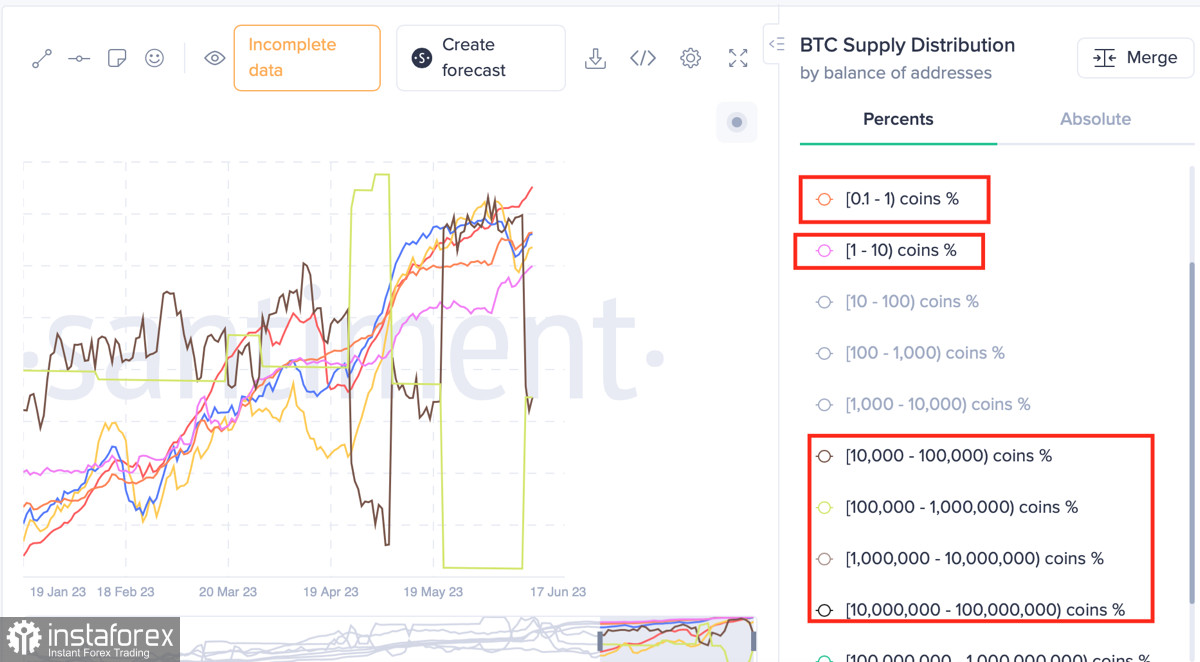

Glassnode also notes the continuation of the trend of BTC accumulation by all categories of investors. Long-term investors are not starting to take profits despite frequent price highs. The number of BTC coins that have not moved for over three years has reached 40%, indicating a fundamental belief in the asset.

At the same time, "shrimps" and "hamsters" have started actively acquiring BTC as the price rises above $30.5k. Santiment points out that "whales," on the other hand, have begun to unload their portfolios as the price of BTC rises, but these profit takings are insignificant. The level of Bitcoin dominance has also significantly decreased due to the resolution of the Ripple situation, with its trading volumes increasing 15 times in the last five days.

BTC/USD Technical Analysis

At the end of the previous trading week, it can be noted that Bitcoin made a bullish breakout of the "triangle" pattern. However, this breakout turned out to be false, as indicated by the formation of a "bearish engulfing" pattern on Friday, July 14. Despite this, Bitcoin is holding onto the key support area of $29.8k–$30.5k, which is necessary for further upward movement.

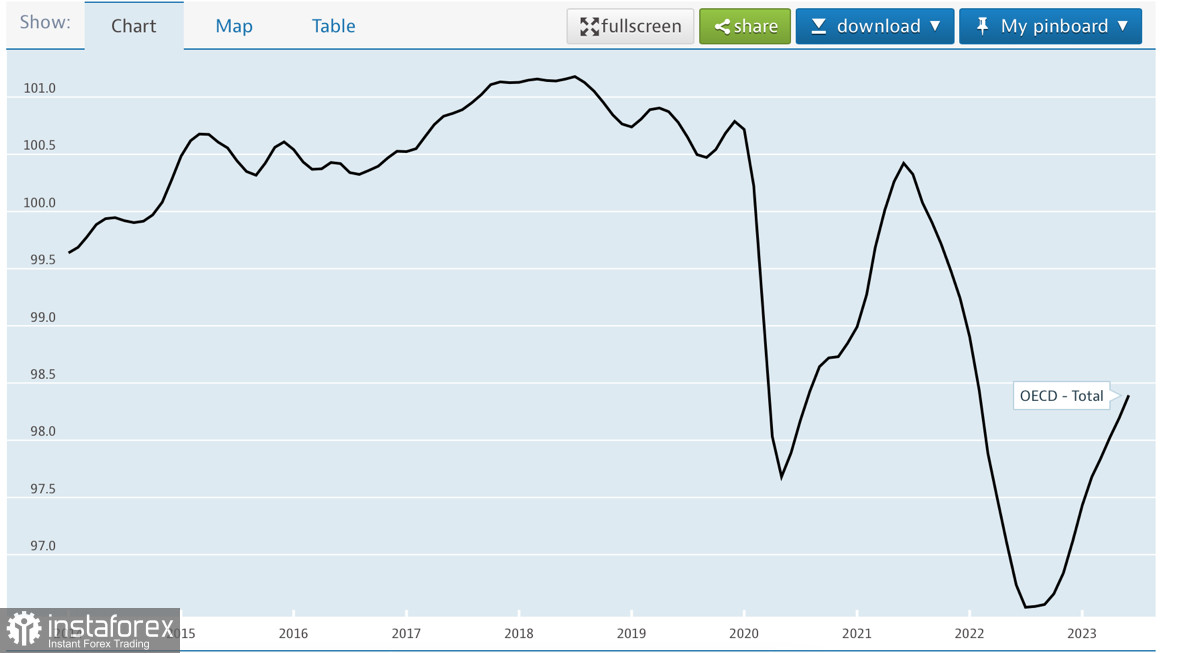

In the near future, BTC will be heavily influenced by the earnings reports of major U.S. companies for the second quarter. The level of correlation between the cryptocurrency and the SPX and NDX indices has reached its lowest point in the past year. This suggests that a decrease in trading activity can be expected, with the main capital transitioning to the stock market, where conditions for another bullish rally are forming.

At the same time, it is possible that positive earnings reports in the stock market will have a corresponding effect on the cryptocurrency market, causing digital assets to move upward. In this case, the key task for BTC in the week ahead will be to consolidate above $31k. The range of $30.5k–$30.8k has been fully tested, and therefore, bulls should pass through it without much effort.

Conclusion

Bitcoin maintains its bullish momentum, and the situation in the cryptocurrency market is becoming more positive, while strong earnings reports from S&P 500 companies can reinforce investor optimism. Taking this into account, we can expect movement within the consolidation range of $29.8k–$31k, where it is better to engage in intraday trading on hourly charts. As for the short-term targets for Bitcoin, they remain the same—the range of $31.5k–$32k.