The main commodity currencies such as the Canadian, Australian, and New Zealand dollars are losing value against the US dollar. The decline began last week, partly due to a drop in oil prices and other commodities.

Friday's data showed that the University of Michigan's preliminary consumer sentiment index came in at 72.6 in July, well above the forecast of 65.5 and the previous readings of 64.4, 59.2, 57.7. This encouraged dollar buyers and forced sellers to close some dollar positions by the end of the week.

As we noted in our AUD/USD review, it makes sense to close some short dollar positions ahead of final inflation indicators for Canada, New Zealand, the euro area, and the UK to be released this week. If inflation slows down in these regions as well, the US dollar will gain upside momentum.

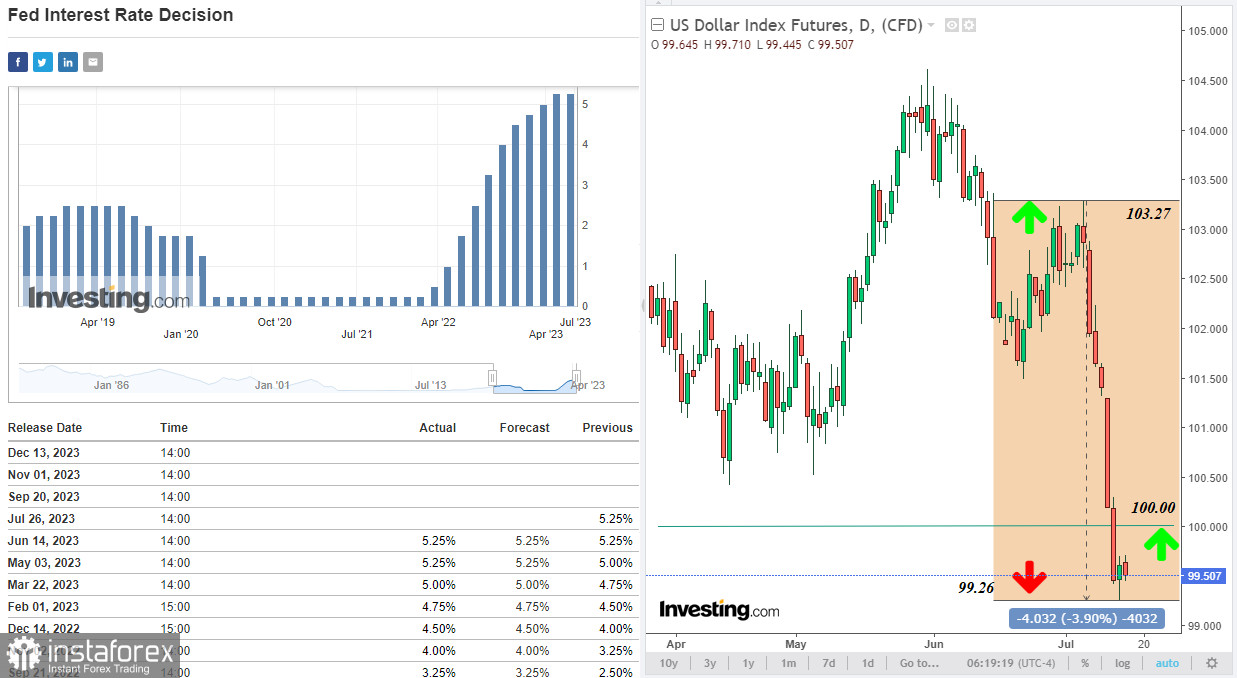

Overall, being the most demanded among major global currencies, the US dollar remains under pressure, given expectations regarding the Federal Reserve's further monetary steps. Its meeting will take place next week (on July 25 and 26). There is a likelihood that Fed officials may announce a new pause in rate hikes during or after the meeting. If their statements signal a possible shift in monetary policy by the end of the year or in early 2024, the US dollar will most likely extend weakness.

Therefore, the dollar's current upside momentum, especially against commodity currencies, should be viewed as short-lived. After the recent release of data on the US labor market and inflation, which indicated its further cooling, the dollar continues to lose ground.

Interestingly, the US dollar index resumed its decline today after hitting a new low since May 2022 at 99.26 last week (in early 2021, the DXY dropped to a multi-year low near 89.17). The asset broke through the psychologically important level of 100.00 and hit the critical support levels of 99.50 (EMA200 on the weekly DXYchart) and 99.25 (EMA50 on the monthly DXY chart).

Above these levels, the DXY is in the long-term bullish market zone. Their breakout will trigger further losses, dragging the index down to the support levels of 94.70 (EMA144 on the monthly chart) and 93.60 (EMA200 on the monthly chart) which separate the global bullish market from the bearish one.

Thus, from a technical point of view, there is a high probability of a rebound from current levels and the 99.50 and 99.25 marks followed by a resumed bullish run.

Meanwhile, the main European currencies such as the euro, pound, and franc are trying to resist the greenback and resume gains.

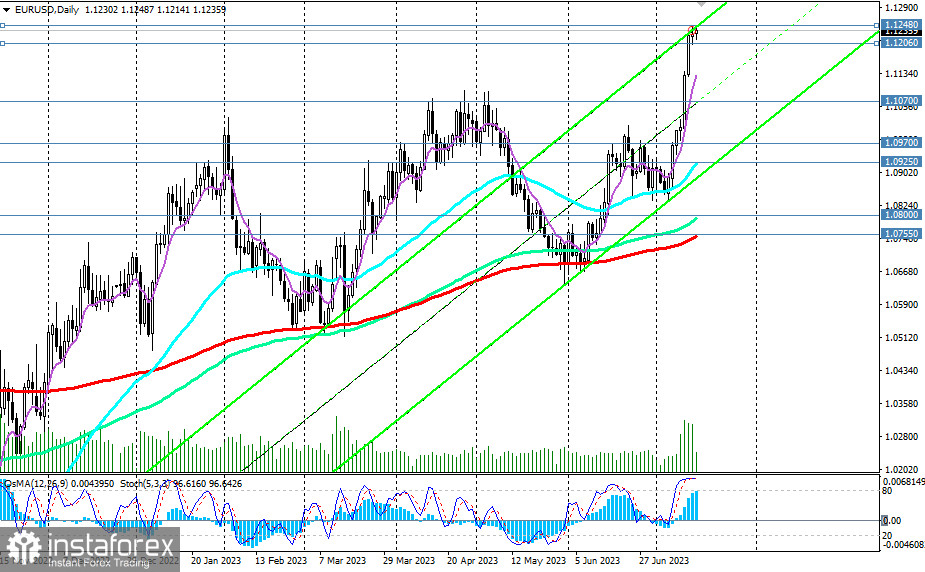

Notably, the euro has hit a new high against the dollar today, surpassing the March 2022 level at 1.1248. Last week, EUR/USD posted its largest one-week gain in 2023, adding nearly 250 pips.

While the Federal Reserve is now expected to pause rate hikes and eventually start cutting rates, the European Central Bank is forecast to maintain its tight stance on monetary policy.

As noted today by ECB governing council member and Slovenian central bank governor Bostjan Vasle, policymakers need to keep tightening policy at the next ECB meeting amid resilient core inflation in the euro area.

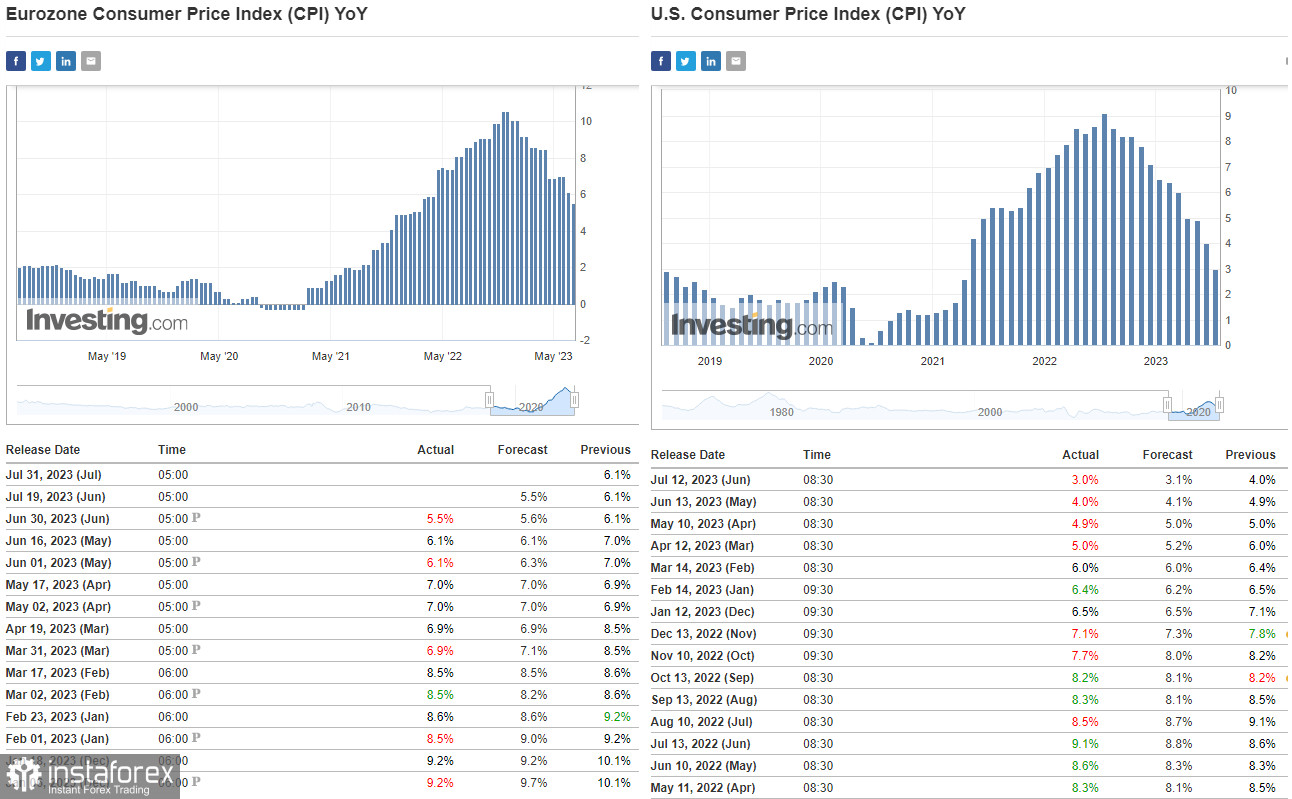

On Wednesday, traders will receive final data on June inflation in the euro area. The indicators are likely to meet preliminary figures, with the consumer price index remaining at 0.3% (on a monthly basis) and 5.5% (year-on-year). The core CPI is expected to stand at 0.3% and 5.4%, respectively.

- Previous CPI figures (year-on-year): +6.1%, +7.0%, +8.5%, +8.6%, +9.2%, +10.1%, +10.6%.

- Previous core CPI figures (year-on-year): +5.3%, +5.6%, +5.6%, +5.3%, +5.2%, +5.0%, +5.0%.

As data shows, despite a relative decline, inflation remains well above the target level of 2.0%.

For comparison, US data released last week showed that inflation in the country was up 3.0% in June, below the forecast of 3.1% and the previous reading of 4.0%. Meanwhile, annual core inflation fell to 4.8% compared to the previous 5.3% and the forecast of 5.0%. Inflation in the euro area is currently more than 1.5 times higher than in the US. This means that the ECB will most likely keep monetary policy tight, unlike the Federal Reserve, which may pause rate hikes after the July meeting, as mentioned above.

This in turn acts as a driving force behind the EUR/USD pair's gains.

If the price breaks through today's local high at 1.1248, the volume of long positions on EUR/USD will increase further.

*) copying signals at InstaForex -

https://www.ifxtrade.center/forexcopy_system

**) PAMM-system at InstaForex -

https://www.ifxtrade.center/pamm_system

***) open a trading account with InstaForex -