Analyzing Wednesday's trades:

EUR/USD on 30M chart

The EUR/USD pair continued the same sluggish correction it did on Tuesday. Formally, there is currently no correction, and this is clearly seen in the chart. The pair has been moving sideways for four days now, but within this sideways movement, there may still be areas of both growth and decline. Therefore, Wednesday's drop of a "whopping" 30 points should not evoke any sense of euphoria among sellers. The euro is at a standstill. Even breaking the ascending trend line does not guarantee anything for the US dollar.

The macroeconomic backdrop was very weak. The EU released its final estimate of the inflation report for June, which completely coincided with the first one. Despite the slowdown in inflation to 5.5%, core inflation still increased to 5.5%. The euro did not fall, neither during the first estimate nor the final one. In addition, the single currency failed to overcome the first significant level on its way down - 1.1184. Therefore, further prospects for a decline are quite unclear.

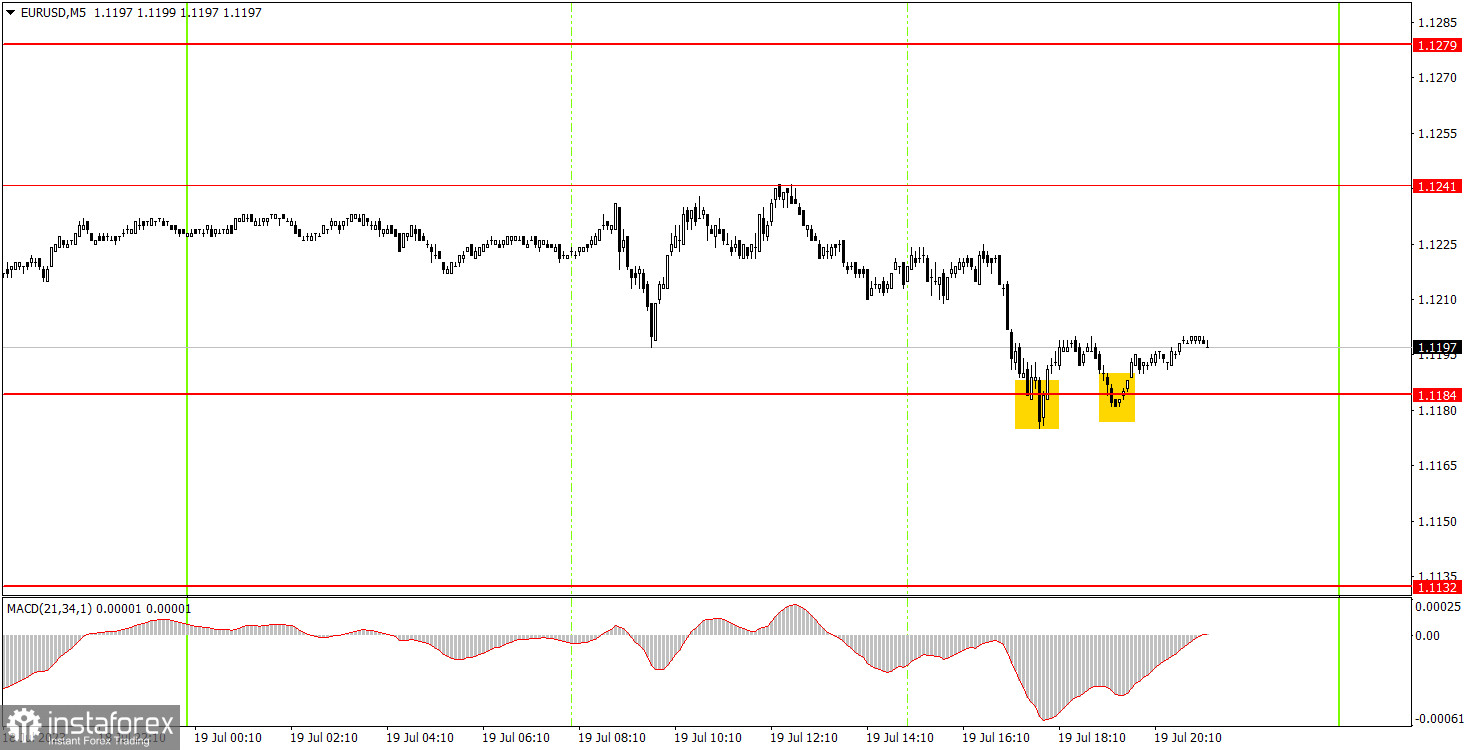

EUR/USD on 5M chart

There were only two signals on the 5-minute chart, both closer to the evening. Both signals did not result in losses, as the pair failed to settle below the level of 1.1184. However, traders could have earned a maximum of 10 points on them. Nevertheless, for a total movement of 65 points, this is not a bad result. The level of 1.1241 is new and represents the peak of Wednesday.

Trading tips on Thursday:

On the 30M chart, the pair continues to form an uptrend. In the last few days, there have been enough opportunities for bearish corrections, but as we can see, the market is not eager to close longs and open shorts. Market logic is still absent. The euro could start an upward movement again this week. The key levels on the 5M chart are 1.0901, 1.0932, 1.0971-1.0977, 1.1038, 1.1091, 1.1132, 1.1184, 1.1241, 1.1279-1.1292, 1.1330, 1.1367. A stop loss can be set at a breakeven point as soon as the price moves 15 pips in the right direction. On Thursday, there is nothing lined up for the EU. The US will release a report on unemployment claims, which will only give a reaction if the latest numbers significantly deviate from forecasts. But even this may not help the dollar strengthen.

Basic trading rules:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.