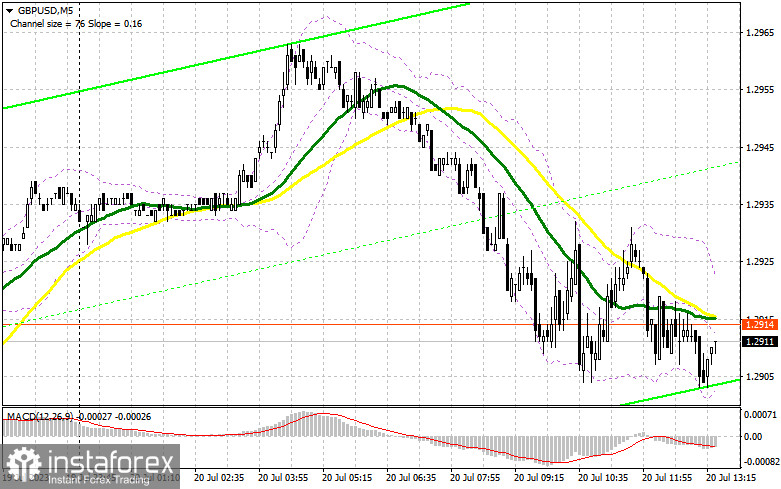

In my morning forecast, I highlighted several levels and recommended keeping them in mind when making market entry decisions. Let us take a look at the 5-minute chart and analyze what happened there. Pressure on the pound sterling persisted in the first half of the day, but there wasn't enough volatility to generate entry signals. Due to this, I have reassessed the technical outlook for the second half of the day.

When to open long positions on GBP/USD:

The pound sterling's performance has been impacted by the absence of significant data releases. However, the decline in inflation, which was reported yesterday, continues to exert pressure on the pair, and it is possible that after positive data from the American labor market, GBP/USD may continue its downward trajectory. Key data to watch today includes the weekly initial jobless claims and the Philadelphia Fed Manufacturing Index. Another important data release will be the US existing home sales data, which also depends heavily on the current record high interest rates in the country.

If the pair declines after positive American data, I will consider entering long positions on the pullback near 1.2871, after a false breakout is formed. The target in this case would be the new resistance level of 1.2928, which formed during the European session. A breakout and a consolidation above this range will provide an additional buy signal, with the target at 1.2981. The most distant target will be around 1.3032, where I will take profits. If GBP/USD declines during the American session and bulls are idle at 1.2871, which is quite likely, pressure on the pound sterling will persist. In such a case, I will wait for the defense of the next area at 1.2807, along with a false breakout of that level, before entering long positions. I plan to buy GBP/USD immediately if it rebounds off 1.2754, targeting an intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

Bears have full control over the market, as bulls showed little enthusiasm in the first half of the day. For this reason, I expect GBP to decline further pound depreciation amid favorable US statistics. If the data disappoints, I will postpone selling until a test of the new resistance at 1.2928, jshort positions until a test of the new resistance at 1.2928, just above which the moving averages align in favor of bulls. A false breakout at this level will present an optimal entry point for short positions. This could continue the bearish trend, which could then develop into a new trend and send GBP/USD down to 1.2871. A breakout and a subsequent upward retest of this range will deal another significant blow to buyer positions, pushing GBP/USD towards 1.2807. The most distant target remains around 1.2754, where I will take profits.

If GBP/USD rises, and bears show no activity at 1.2928 in the second half of the day, bulls will likely try to recoup some losses. In such a case, I will postpone opening short positions until the pair tests the resistance at 1.2981. A false breakout there would provide an entry point for short positions. If there is no downward movement at that point, I will sell the pound immediately on the rebound from 1.3032, targeting an intraday correction of 30-35 pips.

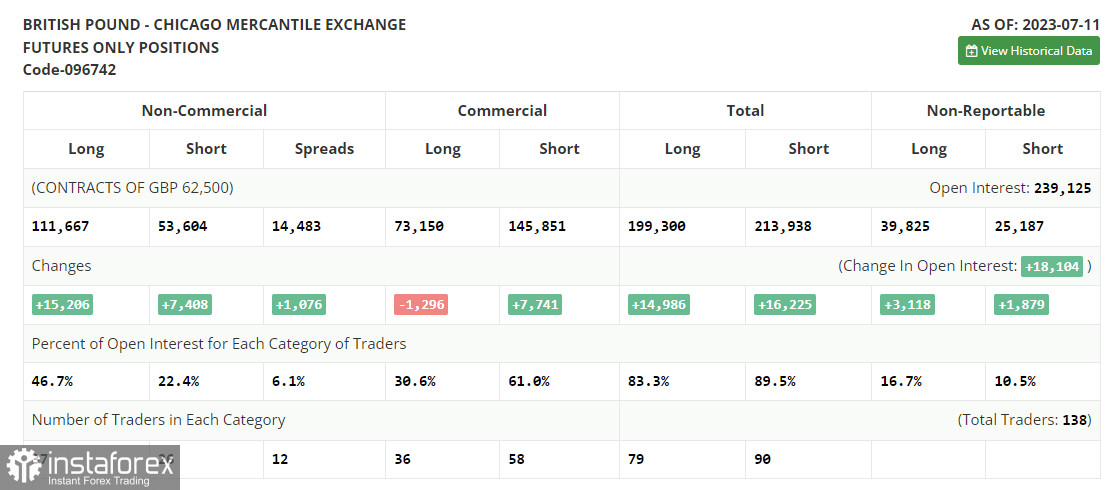

Commitment of Traders (COT) report

The latest Commitment of Traders (COT) report on July 11 revealed an increase in both long and short positions. However, the number of buyers exceeded sellers by a factor of two, confirming the ongoing bullish sentiment that has persisted throughout this month. Pound sterling bulls certainly have the upper hand and can continue to act more aggressively. On one hand, the Federal Reserve is content with the rapid decline in inflation, which reduces the likelihood of further rate hikes. On the other hand, the Bank of England, despite economic challenges, will maintain a high-interest-rate policy due to serious inflation issues affecting household living standards. The monetary policy divergence will strengthen the pound sterling and weaken the US dollar. Buying the pound on dips remains the most optimal strategy. According to the latest COT report, it is stated non-commercial long positions increased by 15,206 to 111,667 from 96,461, while non-commercial short positions rose by 7,408 to 53,604 from 46,196. This led to another surge in the non-commercial net position to 58,063, compared to 50,265 a week earlier. The weekly price increased to 1.2932 from 1.2698.

Indicator Signals:

Moving Averages

Trading is carried out below the 30-day and 50-day moving averages, indicating that GBP/USD is likely to decline further.

Note: The author considers the period and prices of the moving averages on the 1-hour chart (H1), which differ from the standard definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

If the pair increases, the upper boundary of the indicator around 1.3109 will act as resistance. If GBP/USD declines, the lower boundary of the indicator around 1.3050 will provide support.

Description of indicators

• Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

• Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

• Bollinger Bands (Bollinger Bands). Period 20

• Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• Total non-commercial net position is the difference between the short and long positions of non-commercial traders.