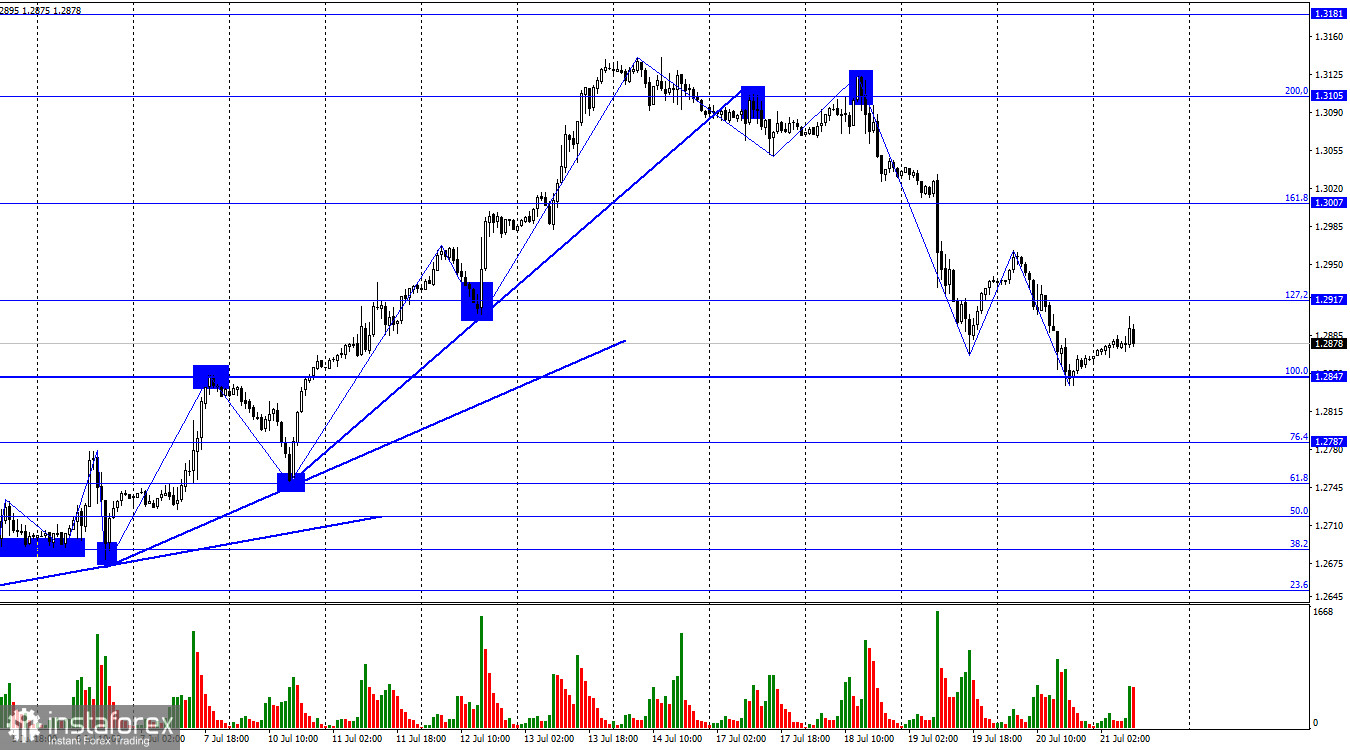

On the hourly chart, the GBP/USD pair underwent a new reversal in favor of the American currency on Thursday, resulting in a decline to the corrective level of 100.0% (1.2847). After rebounding from this level, the pound saw a slight rise, but it failed to reach the 1.2917 level. If the pair closes below 1.2847, it will likely resume its decline toward 1.2787 and 1.2749.

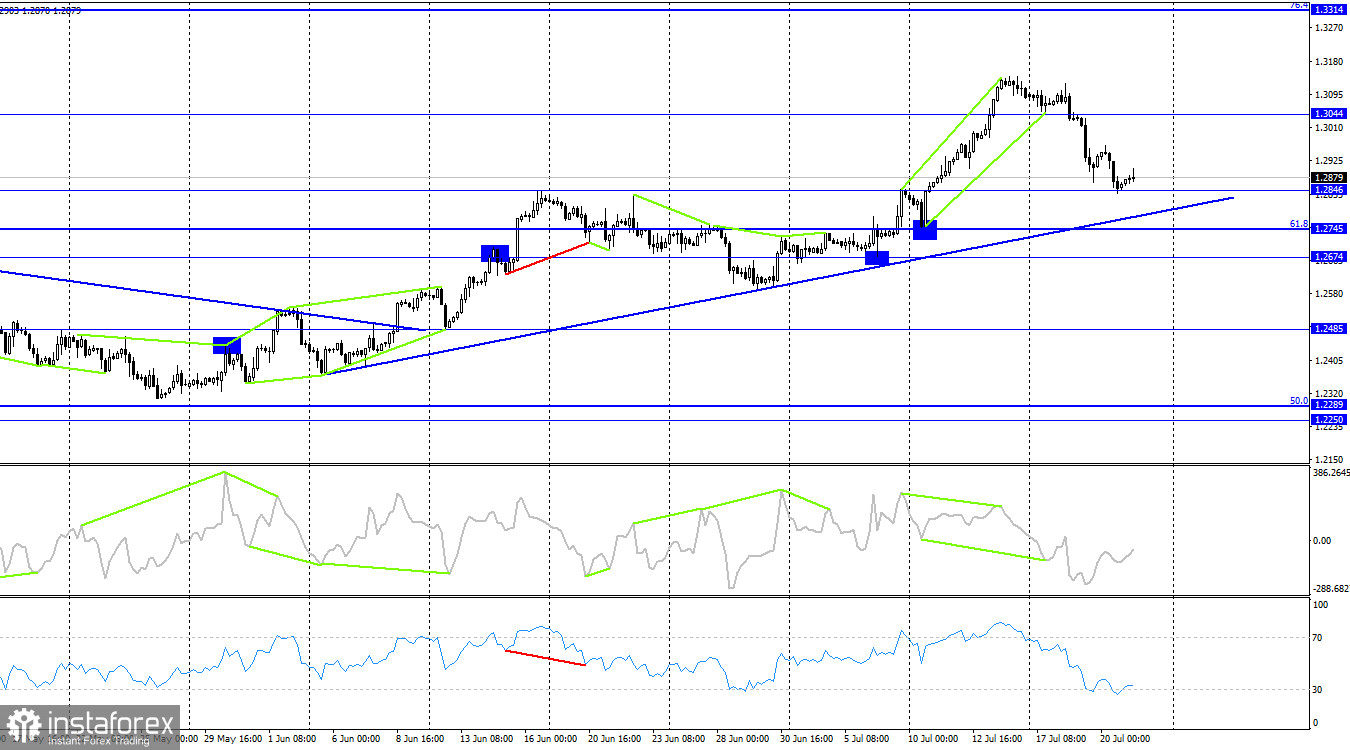

The waves indicate a single trend: a shift to a "bearish" one. Each subsequent wave's low is lower than the previous one, and the peak of each new wave is also lower. This clearly indicates a "bearish" trend, and there are no signs of its completion.

Yesterday, the US released the weekly report on initial jobless claims, which was 14,000 lower than expected. However, the Philadelphia Fed Manufacturing Index grew weaker than forecast, remaining at -13.5 in negative territory. Consequently, the US dollar needed to receive strong support from this data.

Today, the UK released the retail sales report for June, showing a growth of 0.7% against market expectations of 0.2% m/m. Sales volumes, excluding fuel, also increased by 0.8% compared to the expected 0.2%. However, this report needed to be more significant to support the pound. Shortly after the report's release, the British pound began a new decline, fitting well within the "bearish" trend framework. Today, the pound may continue to fall even with significant information background. It is only a few points away from breaking the last low.

On the 4-hour chart, the pair reversed in favor of the American currency, declining to 1.2846. A rebound from this level or the trendline could favor the pound and potentially result in a rise toward 1.3044. However, the rise may be significantly below this level as the hourly chart already shows a "bearish" trend. A sustained decline below the trendline significantly increases the probability of further depreciation. Currently, no emerging "bullish" divergences are observed in any indicators.

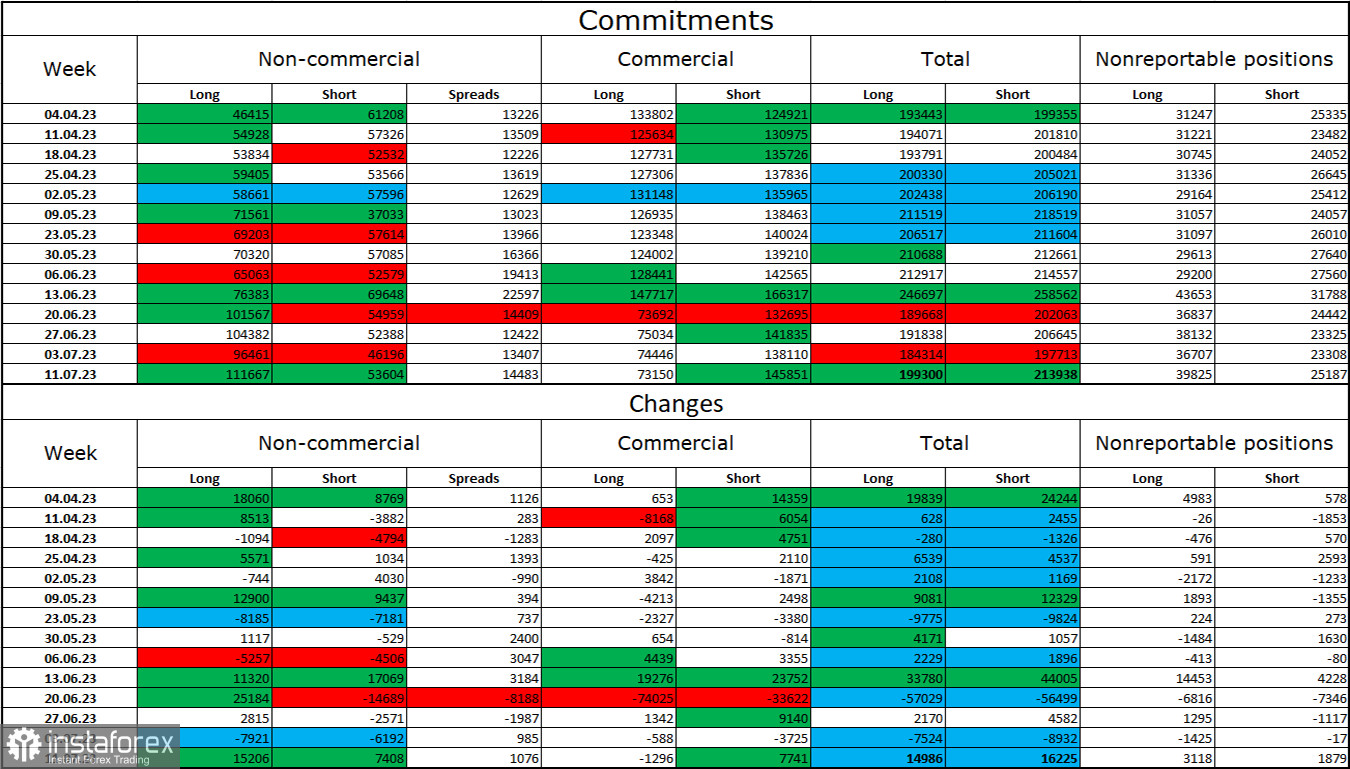

Commitments of Traders (COT) report:

The mood among "Non-commercial" traders became more optimistic during the last reporting week. Speculators increased their long contracts by 15,206 units, while short contracts only rose by 7,408. The overall sentiment of major players remains mostly positive, and there is a significant gap between the number of long and short contracts: 111,000 versus 53,000. The British pound shows promising potential for further growth, supported more by the current information background than the dollar. However, expecting a substantial rise in the pound sterling is becoming increasingly challenging. The market is not considering many supportive factors for the dollar, and the pound is rising primarily based on expectations of further rate hikes by the Bank of England.

Economic Calendar for the USA and the UK:

UK - Retail Sales Volume Change (06:00 UTC).

On Friday, the economic events calendar contains only one entry, which has already been released. The rest of the day will not be influenced significantly by important news.

Forecast for GBP/USD and trader advice:

Previously, I recommended selling the British pound if there was a rebound on the hourly chart from 1.3105. After that, signs of a trend reversal appeared, and selling positions could be increased. Currently, those positions can be held open with a target of 1.2787 (the first target at 1.2847 has been reached). I suggest caution when considering buying the pound, as the trend has shifted to "bearish." In the event of a rebound from the levels of 1.2847 or 1.2787, the target should be set at the nearest level.