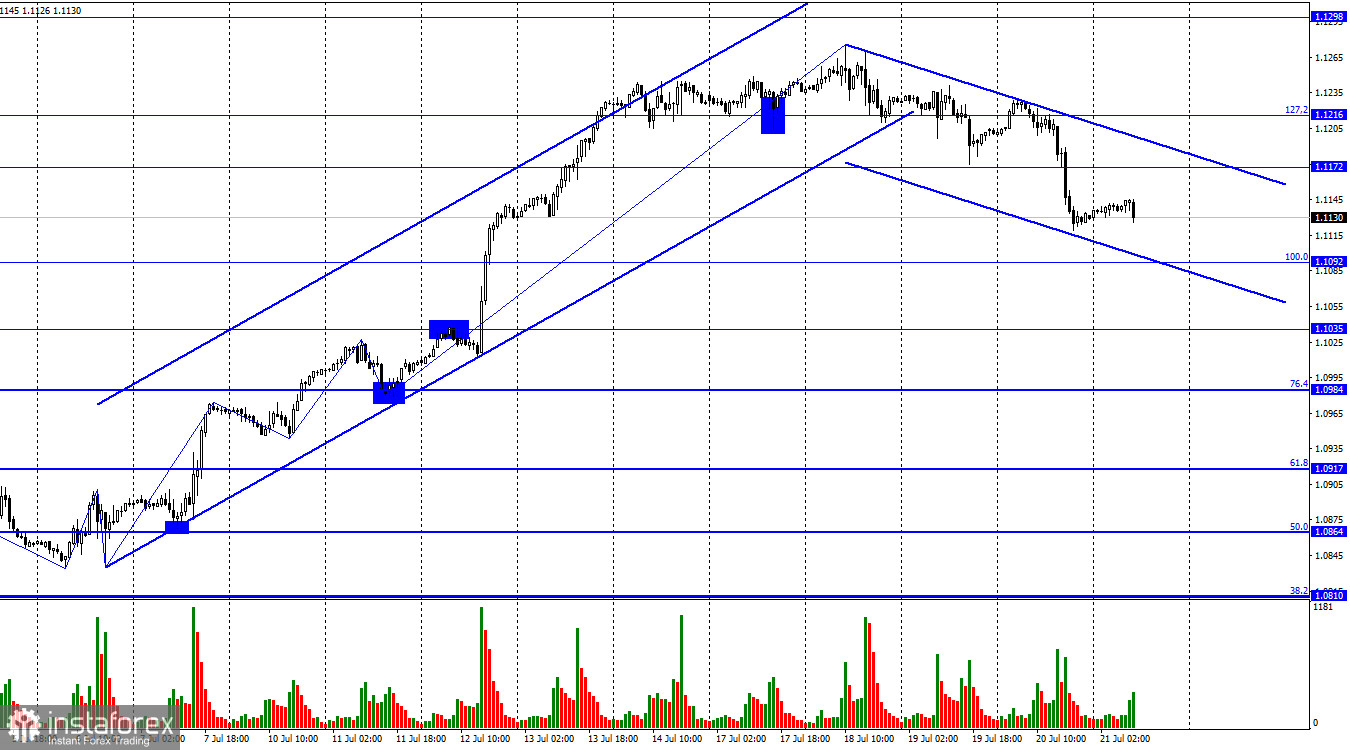

On Thursday, the EUR/USD pair underwent a new reversal in favor of the US currency, dropping below the 1.1172 level. Consequently, the decline may persist toward the Fibonacci level of 100.0% (1.1092). If the pair rebounds from this level, it will favor the European currency, leading to some growth towards the upper line of the descending trend corridor, which currently characterizes traders' sentiment as "bearish." A close above the channel will reverse the market sentiment to "bullish."

Despite the pair's decline over the past three days, the waves do not provide any new information. The last upward wave was strong and prolonged. Breaking its low would require a significant amount of time. Therefore, a more plausible scenario in the near future is the formation of an ascending wave that will not surpass the peak from the 18th of the month. This would confirm the trend change to "bearish." Currently, all movement is classified as a correction.

The information background yesterday was rather weak, but the dollar strengthened considerably. I do not associate the dollar's strength with US statistics, as it was contradictory. However, linking the euro's decline to next week's upcoming ECB interest rate hike makes much more sense. The euro has been rising recently, indicating that traders were factoring in future tightening measures in the Eurozone. On the other hand, traders have long stopped paying attention to the Fed as they await the completion of the tapering program.

Hence, the euro's decline is more favorable for this week and the next. However, we may also witness a single upward wave that confirms the beginning of the "bearish" trend.

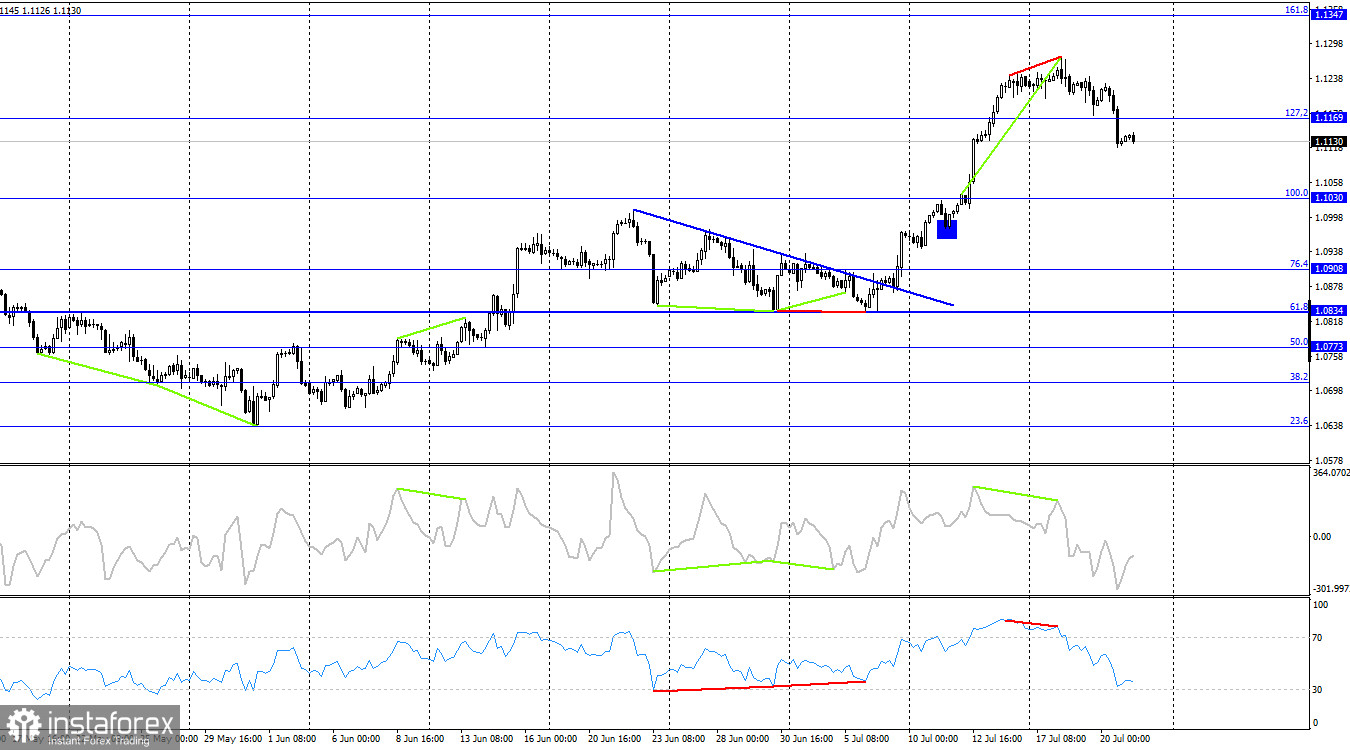

On the 4-hour chart, the pair reversed in favor of the US currency, settling below the Fibonacci level of 127.2% (1.1169), allowing it to continue declining toward the next corrective level of 100.0% (1.1030). Two "bearish" divergences in the RSI and CCI indicators also supported the US currency. There are no signals for buying or emerging "bullish" divergences.

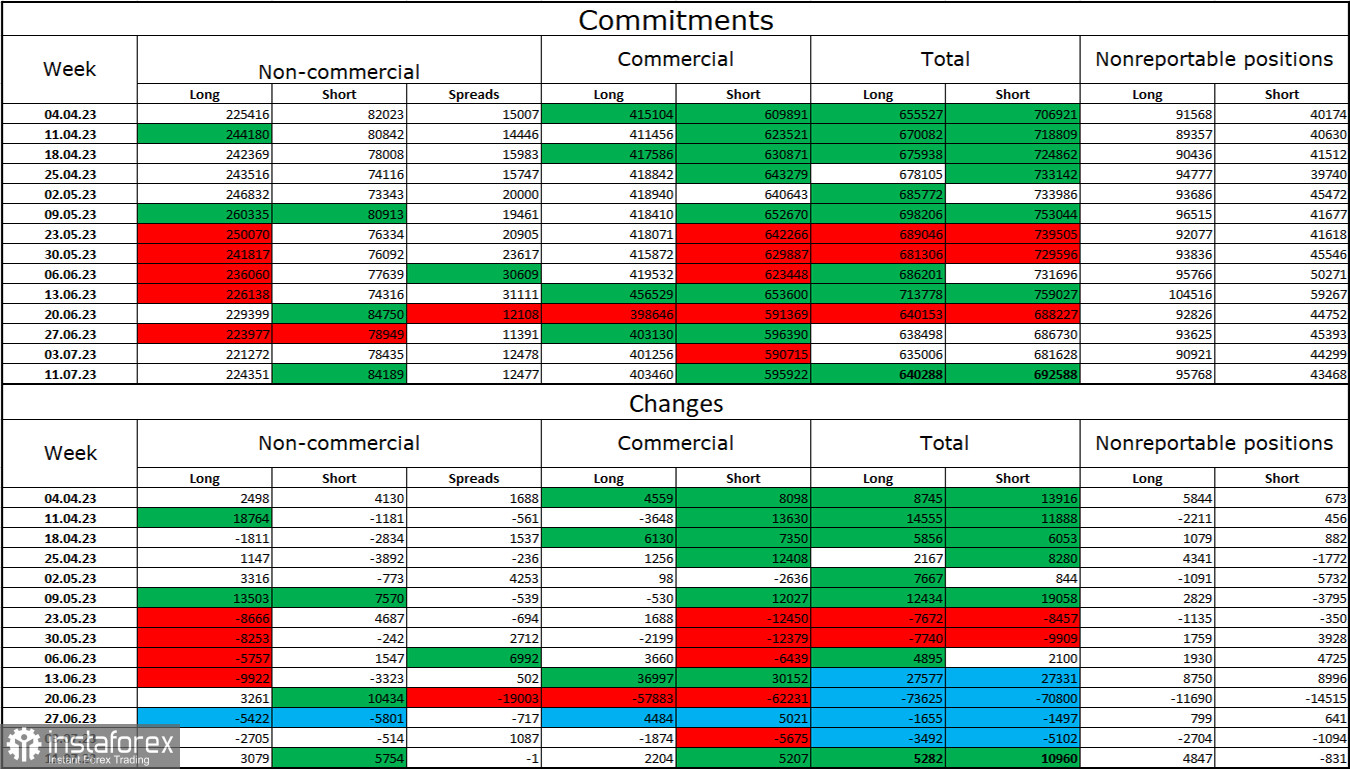

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 3,079 long contracts and 5,754 short contracts. The sentiment among major traders remains bullish but is gradually weakening. The total number of long contracts held by speculators now stands at 224,000, while short contracts amount to only 84,000. Although the bullish sentiment persists, the situation will soon change in the opposite direction. The significant number of open long contracts indicates that buyers may begin closing their positions soon (or have already started) due to the current strong bullish bias. Based on the current figures, I anticipate a potential decline in the euro in the coming weeks, especially considering its significant rise last week. However, there are currently no graphical signals for selling.

Economic Calendar for the USA and the Eurozone:

On July 21st, the economic events calendar does not feature any noteworthy entries. The influence of the information background on traders' sentiment for the rest of the day will be negligible.

Forecast for EUR/USD and trader advice:

Sales were viable when the pair settled below the 1.1216 level on the hourly chart, targeting 1.1172 and 1.1092. The first target has been achieved, and the second one remains. The trend is "bearish," providing more confidence in opening sales positions. Consider buying the pair with a target at 1.1172 in case of a rebound from the 1.1092 level on the hourly chart. However, buying is currently less preferable, so positions should not be substantial or extensive.