The pound can currently rely on support from the cycle of interest rate hikes by the Bank of England, making it more attractive compared to other major competitors in the currency market. However, once the Bank of England stops raising interest rates, the pound will lose its support, and a reverse process may begin.

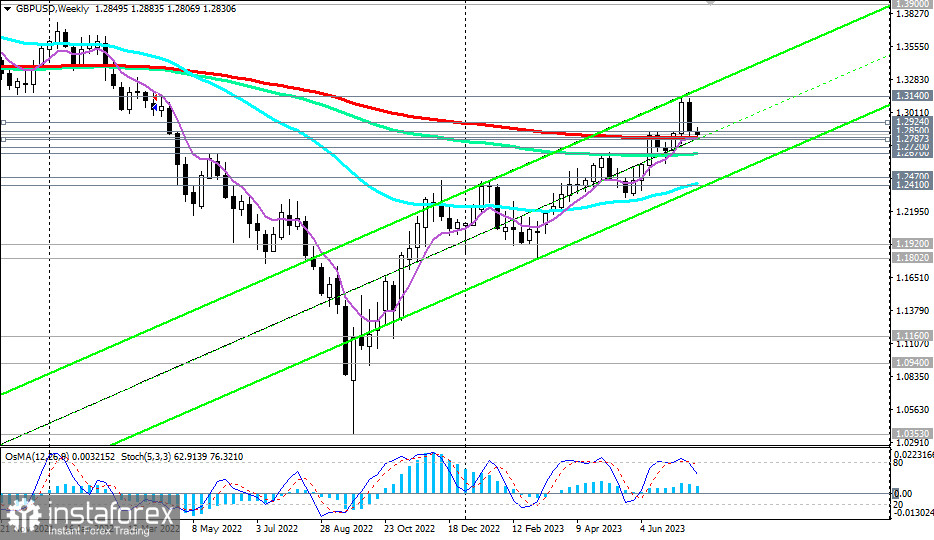

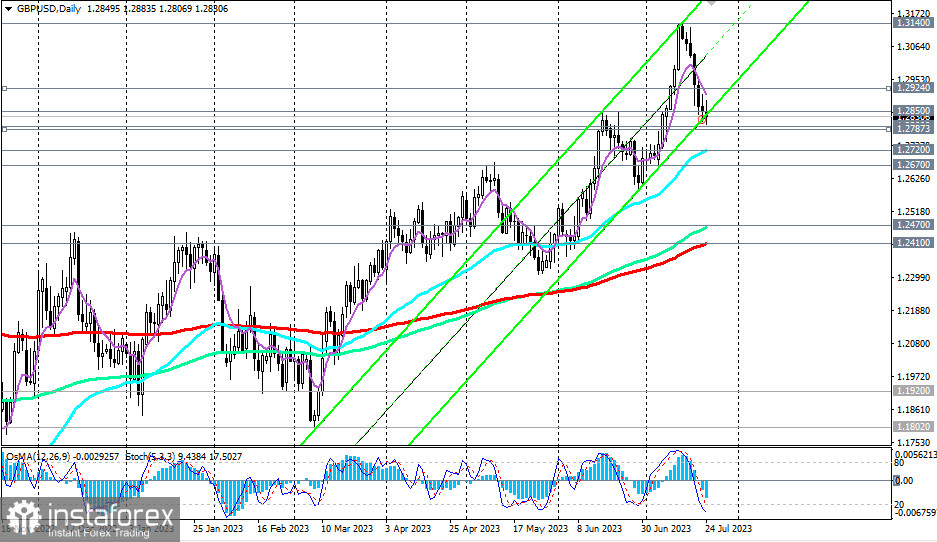

As of writing, the GBP/USD pair was trading near the 1.2830 level, sharply declining at the beginning of today's European trading session after the disappointing data on business activity in the UK, approaching closely to the key long-term support level at 1.2800 (200 EMA on the weekly chart).

Earlier this month, GBP/USD moved into the zone of the long-term bullish market, also reaching a high since May 2022 at the level of 1.3142.

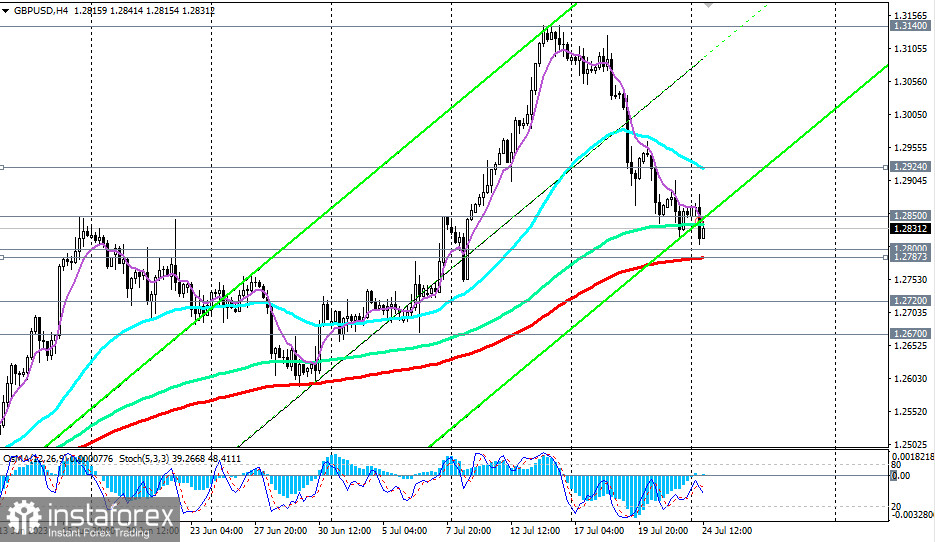

If market participants consider the Fed's decision on interest rates and accompanying statements about the prospects of monetary policy to be dovish, we should expect a resumption of growth in GBP/USD. A sequential breakout of resistance levels at 1.2850 (50 EMA on the monthly chart), 1.2900, 1.2924 (200 EMA on the 1-hour chart) will be a signal to resume long positions with the nearest targets near the local high of 1.3140.

Further growth will direct the pair towards key strategic resistance levels at 1.3900, 1.4335 (200 EMA on the monthly chart). Their breakout, in turn, will bring the pair into the zone of the global bullish market.

In an alternative scenario, a signal for selling may be a break below support levels at 1.2800 (200 EMA on the weekly chart), 1.2787 (200 EMA on the 4-hour chart).

A break below support levels at 1.2720 (50 EMA on the daily chart), 1.2670 (144 EMA on the weekly chart) will confirm the forecast for a decline in GBP/USD, and the break of key medium-term support levels at 1.2470 (144 EMA on the daily chart), 1.2410 (200 EMA on the daily chart) will return the pair into the zone of medium-term and long-term bearish markets.

Our main downside scenario for GBP/USD (Sell Stop 1.2890. Stop-Loss 1.2990. Take-Profit 1.2800, 1.2700, 1.2650, 1.2620, 1.2580, 1.2400, 1.2375, 1.2340) worked. We are moving the Stop-Loss to breakeven. Profit can be fixed for some short positions.

Support levels: 1.2800, 1.2787, 1.2720, 1.2670, 1.2600, 1.2470, 1.2410

Resistance levels: 1.2850, 1.2900, 1.2924, 1.3100, 1.3140, 1.3900, 1.4335