On the European stock markets, Stoxx 600 performed better, although Spanish stocks showed the worst performance after the inconclusive election results on Sunday.

This week is filled with significant policy decisions from central banks. Corporate reporting will also continue. In Europe, preliminary data on purchasing managers' indices showed a larger contraction in the private sector economy than expected. The manufacturing and service sectors in the UK also slowed sharply in July. These data underscore the challenging position for policymakers as traders prepare for potential interest rate hikes by the Federal Reserve and the European Central Bank this week, hoping for clear signals about further increases in the coming months.

It is expected that later this week, the Bank of Japan will announce that it will continue with its ultra-loose policy. However, the yen strengthened as officials are expected to consider raising the inflation forecast for this year.

Regarding the reporting season, over 500 major companies worldwide are set to release quarterly results, including large US companies such as Alphabet Inc. and Meta Platforms Inc. The next few days will be decisive for investors, who will closely monitor whether the economic slowdown will impact corporate profits. For this reason, the markets have entered a phase of anxious anticipation, but the key focus will be on corporate reports, as central banks are unlikely to deliver many surprises.

Over the weekend, China's Politburo signaled a loosening of property policies to stimulate the economy. Despite this, trading of the Chinese yuan remained dull.

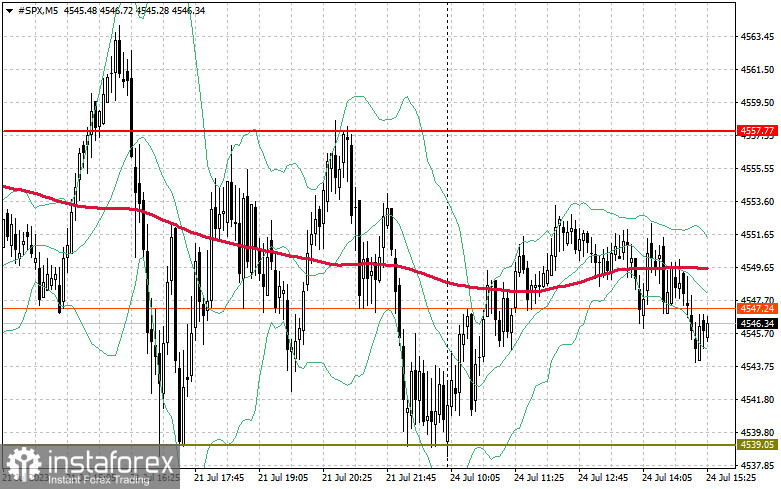

As for the S&P 500 index, the demand for the trading instrument remains. Bulls have a chance to continue the uptrend, but they need to settle the price above $4,557 and $4,582. From this level, there could be a surge to $4,609. An equally important task for bulls would be to maintain control above $4,637 to strengthen the bullish market. In case of a downward movement due to a decline in risk appetite, bulls should protect $4,539. A break below that level will quickly push the trading instrument back to $4,515 and $4,488.