On Thursday, the GBP/USD currency pair continued its decline for about half of the day. In the second half, there was a slight upward movement, but it's challenging to pinpoint the exact reason for it as there could be several factors at play. One possibility is that the market had been actively selling the pound in the weeks leading up to the Bank of England meeting, anticipating a dovish scenario and pricing it in advance. Therefore, after the meeting results were announced, there were no more reasons for the market to sell the pound, resulting in the upward movement.

Another reason could be a simple technical correction. Prices cannot continuously move in one direction, so a small upward retracement can occur at any time, even without fundamental or macroeconomic justifications. Additionally, the market may have interpreted Andrew Bailey's statements as having a slightly hawkish tone, which was unexpected. These reasons may have contributed to the strengthening of the British currency, but overall, it's not strong enough to be of significant attention.

We maintain our belief that the British pound is heavily overbought, and despite its drop by 400 pips, it might not be immediately noticeable on the 24-hour time frame due to its significance on the 4-hour time frame. On the daily chart, the pair "touched" the Ichimoku cloud, which could trigger a resumption of the global uptrend in the current circumstances. The consolidation of the price above the moving average on the 4-hour time frame and above the critical line on the 24-hour time frame might signal a potential entry point for a new upward trend, even without strong fundamental justifications. Similar justifications were absent several months ago, yet it did not deter the market from buying the GBP/USD pair.

Regarding Andrew Bailey's remarks, after the recent meeting, the Bank of England remains a "dark horse." The interest rate predictably increased by 0.25%. Bailey's statements, as usual, did not contain explicit hints about the central bank's plans. However, he indicated that the cycle of monetary policy tightening is not over, and he expects inflation to decrease to 5% in October and 7% in July. He attributes the higher inflation rate in the UK compared to the EU to a smoother decline in energy prices, while food inflation has likely peaked, but service price inflation remains concerning.

Bailey addressed the issue of excessive wage growth, which is surpassing the central bank's projections, contributing to a slowdown in inflation decline. He stated that the Bank of England does not have a fixed plan for future changes in monetary policy, and the interest rate will be adjusted based on macroeconomic data. The central bank has the necessary tools to bring inflation back to 2%, but it may require more time and effort. Bailey emphasized that the Bank of England continues to monitor inflation.

Based on this, we can conclude that the Bank of England's interest rate will continue to rise in future meetings. However, it's challenging to predict whether this will provide new support to the pound, as the market often anticipates significant events in advance. It's possible that the potential rate hike to 6% has already been priced in, considering the pound's growth by almost 3000 pips in the past 10-11 months. We expect the downtrend to continue.

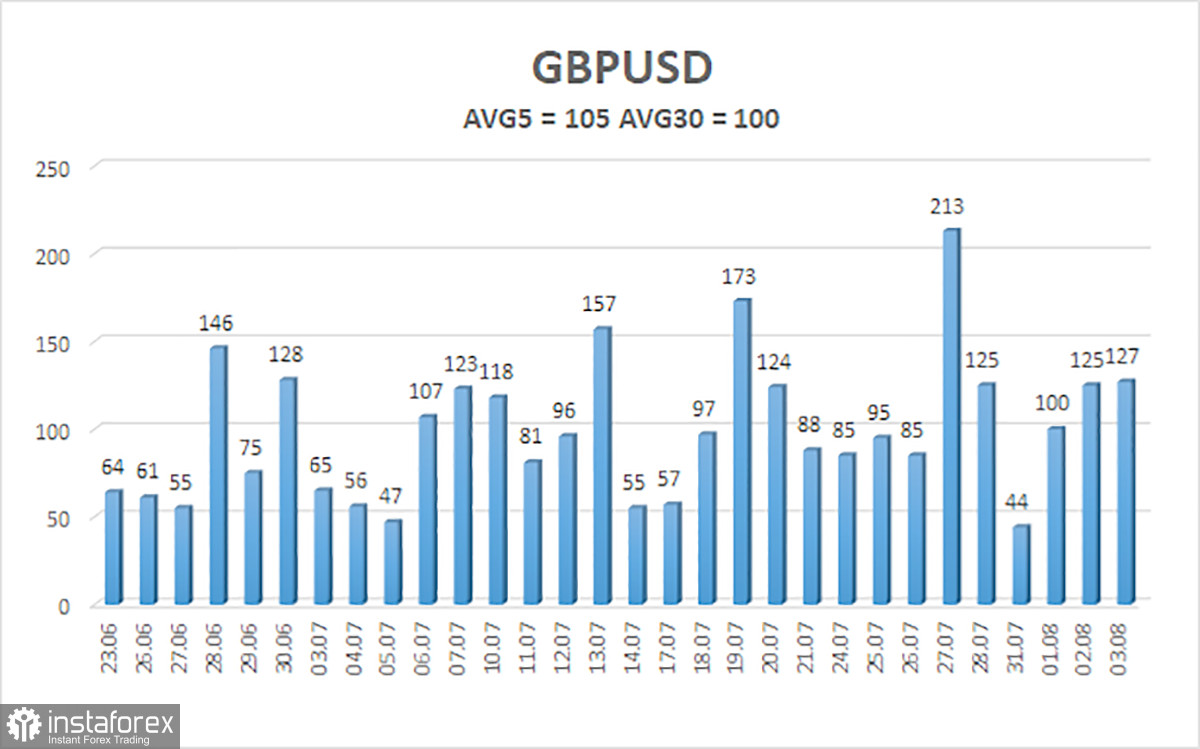

The average volatility of the GBP/USD pair over the last 5 trading days as of August 4th is 105 pips, which is considered "high" for the pound/dollar pair. Consequently, on Friday, August 4th, we expect movements within the range limited by the levels of 1.2623 and 1.2833. A reversal of the Heiken Ashi indicator back downward will signal the resumption of the downward movement.

Nearest support levels:

S1 - 1.2695

S2 - 1.2634

S3 - 1.2573

Nearest resistance levels:

R1 - 1.2756

R2 - 1.2817

R3 - 1.2878

Trading recommendations:

The GBP/USD pair continues to be below the moving average on the 4-hour timeframe. Short positions with targets at 1.2634 and 1.2623 are currently relevant and should be considered if the Heiken Ashi indicator reverses downward. On the other hand, long positions can be contemplated if the price consolidates above the moving average, with targets set at 1.2833 and 1.2878.

Explanations for the illustrations:

- Linear regression channels help determine the prevailing trend. When both channels point in the same direction, it signifies a strong ongoing trend.

- The moving average line (settings 20,0, smoothed) identifies short-term trends and the recommended trading direction at present.

- Murray levels are target levels for potential price movements and corrections.

- Volatility levels (red lines) indicate the probable price channel within which the pair may trade in the next 24 hours, based on current volatility indicators.

- The CCI indicator's entry into the oversold area (below -250) or overbought area (above +250) signals an upcoming trend reversal in the opposite direction.