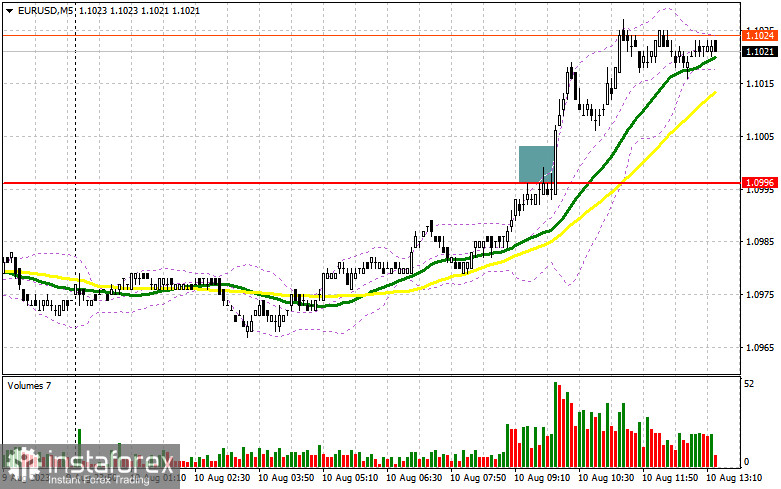

In my morning forecast, I focused on the 1.0996 level and suggested making market entry decisions from it. Let's look at the 5-minute chart to understand what transpired there. Growth and a false breakout at this level provided an entry point for short positions. However, the pair didn't decline as anticipated, resulting in losses. The technical picture was revised for the afternoon.

For opening long positions on EUR/USD:

During the American session, fundamental inflation data from the US is expected. A rise in price pressures below market expectations may lead to a substantial surge in the euro, which traders are banking on. If US inflation exceeds economists' forecasts, especially core prices, pressure on the euro will likely return, causing a sharp reversal of the morning's gains. In such a scenario, I'd prefer to act, relying more on the new support at 1.0998.

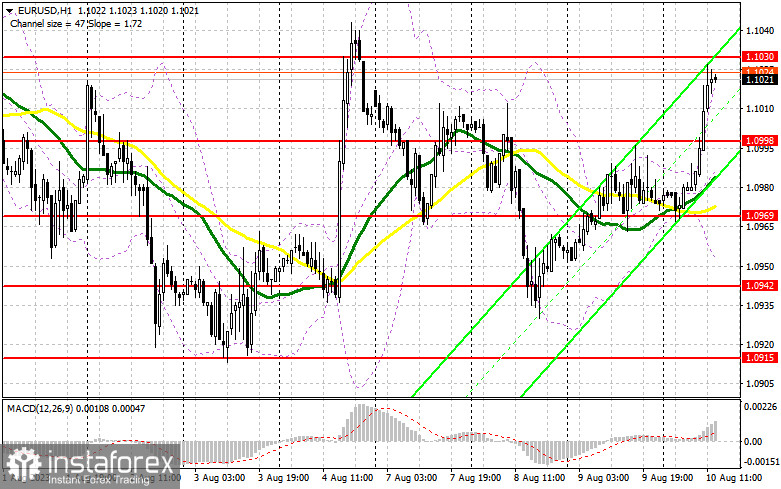

A decrease and the formation of a false breakout at this level will provide a buy signal, aiming for a new upward movement to update the resistance at 1.1030, which we have yet to reach. A breakout and a top-down test of this range, against the backdrop of declining US inflation, will strengthen demand for the euro, giving a chance to continue the upward trend and update the peak at 1.1063. The ultimate target remains the 1.1106 area, where I'll be taking profits. Buyers will face issues if the EUR/USD declines and there's no activity at 1.0998 in the latter half of the day. In this case, only the formation of a false breakout around the next support at 1.0969, where moving averages are located, will signal a euro purchase. I will initiate long positions immediately on a rebound from the 1.0942 low, aiming for an upward correction of 30-35 points within the day.

For opening short positions on EUR/USD:

Sellers can only hope for a sharp increase in US inflation in the afternoon, as there will sadly be no other chances to regain market control. Of course, bears might try something around 1.1030, but only the formation of a false breakout there will signal a sale with a return aim of 1.0998. If a sell signal is active when US data is released, it's best to place short stop orders just above this level. A breakout of 1.0998 following a strong US inflation report and a bottom-up test of this range will provide another sell signal, paving the way to a minimum of 1.0969. The ultimate target will be the 1.0942 area, where I'll be taking profits.

If EUR/USD moves upwards during the American session and there's an absence of bears at 1.1030, which is the direction we're heading in, the bulls will attempt to take full control of the market. Given such events, I will postpone my short positions until the next resistance at 1.1063. Selling can also be considered, but only after unsuccessful consolidation. I will open short positions immediately on a rebound from the high of 1.1106 with a target of a downward correction of 30-35 points.

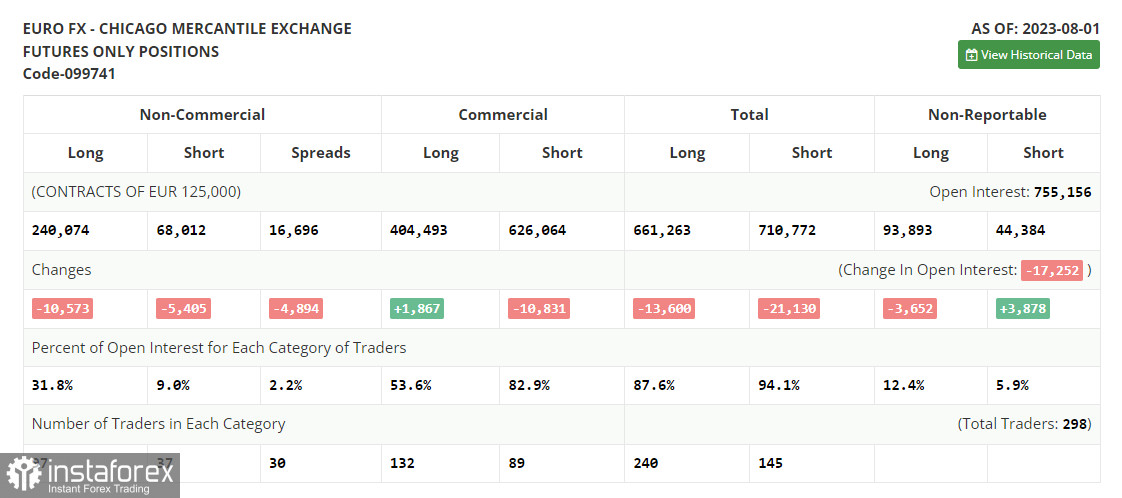

In the COT (Commitment of Traders) report for August 1st, a reduction was observed in both long and short positions. All of this happened after the Federal Reserve and European Central Bank meetings. Now traders are focused on the new statistics, allowing them to understand the regulators' plans better. The US inflation report will soon be released, clarifying things. A further decrease in price pressure will likely allow the Fed to take a break in September, while its increase, on the contrary, will fuel more discussions about the need for further policy tightening, playing in favor of the dollar. However, despite the downward correction, the optimal medium-term strategy remains to buy the euro on declines. The COT report indicated that non-commercial long positions decreased by 10,573 to 240,074, while non-commercial short positions dropped by 5,405 to 68,012. As a result, the spread between long and short positions decreased by 4,894, which favors the euro sellers. The closing price was lowered to 1.0999 compared to 1.1075 a week earlier.

Indicator signals:

Moving averages:

Trading is taking place above the 30 and 50-day moving averages, indicating the likelihood of the euro's rise.

Note: The author considers the period and prices of moving averages on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of an increase, the upper boundary of the indicator around 1.1030 will act as resistance.

Description of the indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.