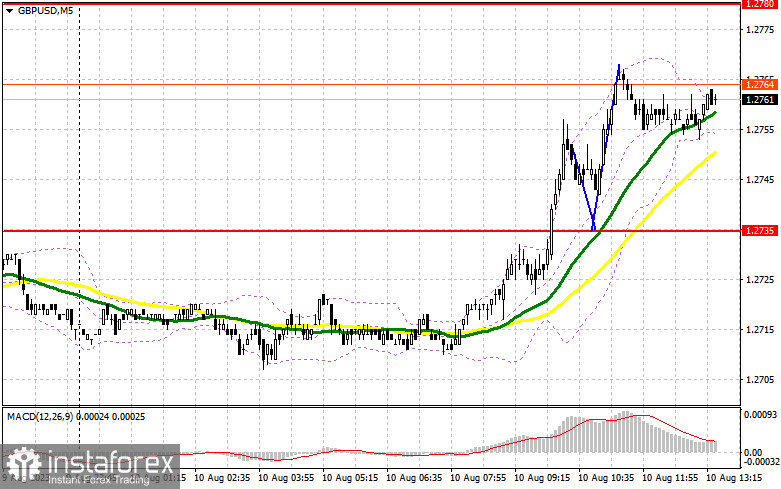

In my morning forecast, I noted the 1.2735 level and advised making decisions based on it. Looking at the 5-minute chart, we can figure out what happened. The pound did rise and broke the 1.2745 barrier, but it did not retest, which did not provide a buying signal. The technical picture had to be revisited for the latter half of the day.

To open long positions on GBP/USD, the following is required:

During the US session, significant US inflation data is anticipated. A surge in US prices in July could lead to a significant drop in the pound and a strengthening of the dollar. Thus, the growth observed during the European session doesn't conclusively indicate anything yet. However, if US inflation is below economists' predictions, especially if core prices drop, the pressure on the pound will likely ease further, leading to a sharp upward movement in the currency pair.

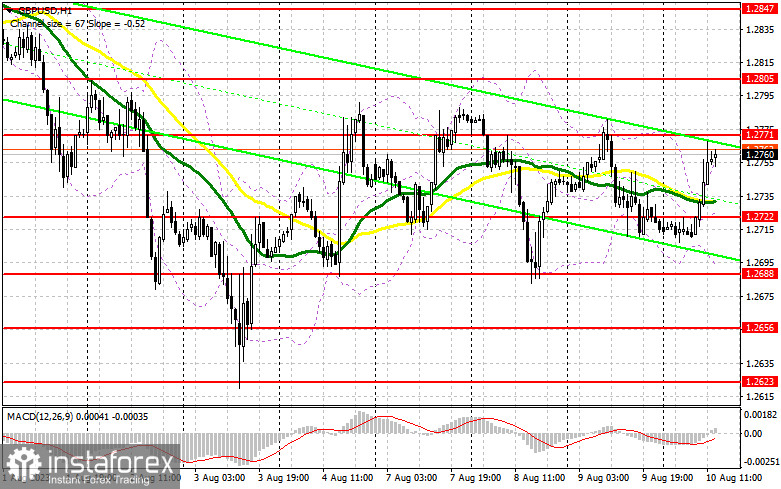

Yet, in current circumstances, acting on a drop is more favorable. A false breakout around 1.2722, where the moving averages lie, will signal opening long positions, continuing the upward correction to surpass the resistance at 1.2771 – formed from yesterday's outcomes. A breakout and firm position above this range presents a chance to shape a bullish market, renewing the weekly high of 1.2805. The ultimate target is the resistance at 1.2847, where I would recommend taking a profit. If there's a drop to 1.2722 without buyers present in the afternoon, pressure on the pound will increase. In such a scenario, only the defense of the next 1.2688 zone and a false breakout will signal the opening of long positions. I plan to buy GBP/USD immediately on a rebound only from the low of 1.2656, targeting a 30-35 point correction within the day.

To open short positions on GBP/USD, the following is required:

Despite the pound's growth, trading is still within a channel, so speaking of any buyer advantage takes time. Sellers should also be extremely cautious in the current situation. Only a failed firm position above 1.2771 will signal a sell, with the prospect of falling to new support at 1.2722. A breakout and a reverse test from below this range will strike a more significant blow to buyers' positions, allowing for a more significant GBP/USD drop to 1.2688. The furthest target is the low of 1.2656, where I will be taking a profit. If the GBP/USD grows and there's no activity at 1.2771 in the afternoon, trading will shift under the buyers' control. Bulls will then have a chance to shape an upward correction to 1.2805. Only a false breakout at this level will provide an entry point for short positions. If there's no downward movement, I plan to sell the pound immediately on a rebound from 1.2847, but only banking on a correction of 30-35 points within the day.

Indicator signals:

Moving Averages:

Trading occurs above the 30 and 50-day moving averages, indicating the pound's growth.

Note: The author considers the period and prices of moving averages on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator at around 1.2688 will serve as support.

Indicator Descriptions:

• Moving average (defines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (defines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

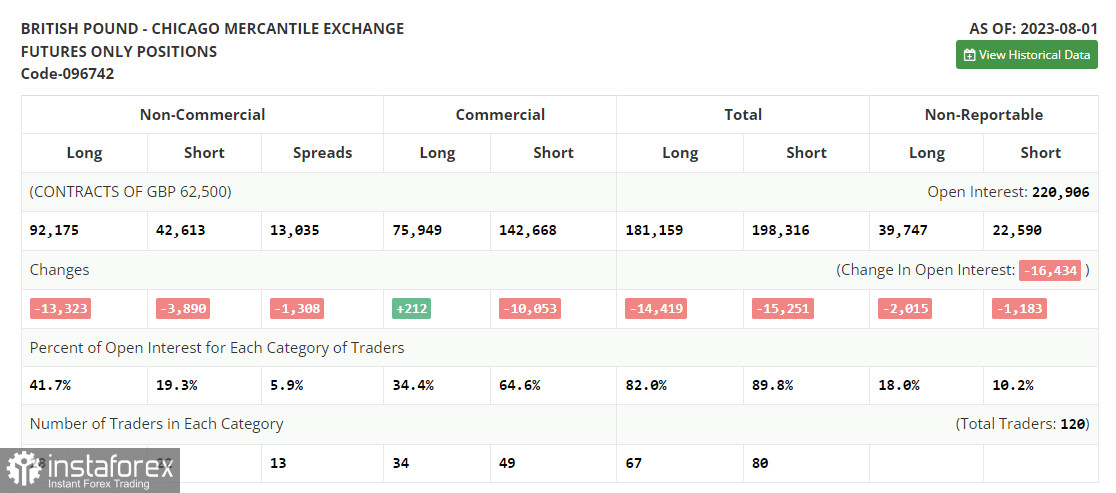

• Non-commercial traders - speculators, such as individual traders, hedge funds, and major institutions that use the futures market for speculative purposes and meet specific requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.