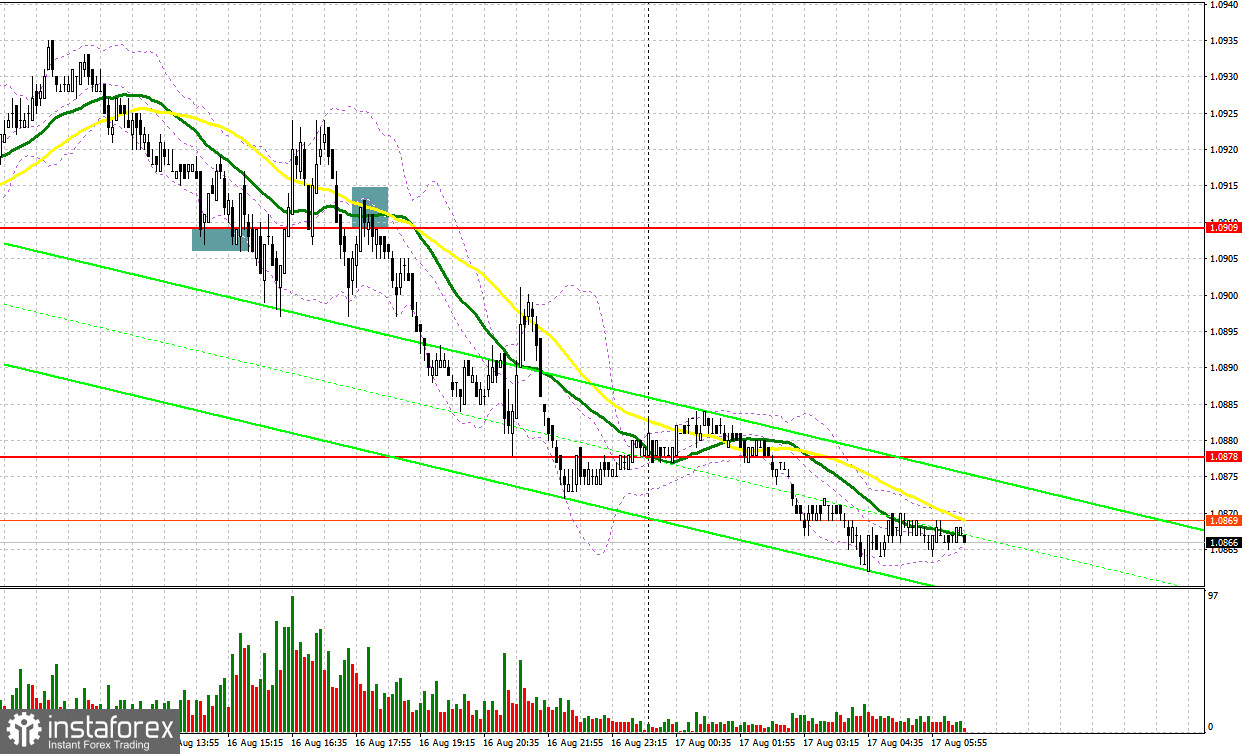

Yesterday, the pair formed several good signals to enter the market. Let's analyze what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0915 as a possible entry point. A breakout of this level occurred without a retest, so we couldn't get entry signals from this mark in the first half of the day. During the US session, a false breakout of the 1.0909 level generated a buy signal, but this did not result in a sharp rise. A breakout and an upward retest of this range formed a sell signal. As a result, the pair fell by more than 30 pips.

For long positions on EUR/USD:

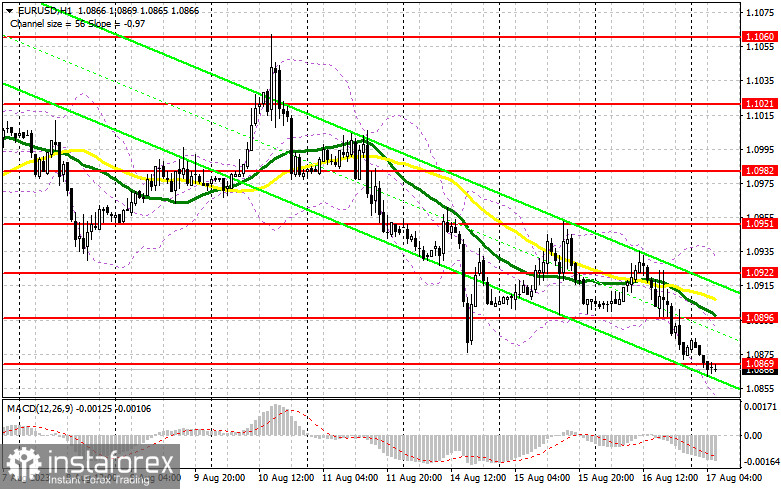

The USD was in demand on Wednesday as the latest Federal Reserve monetary policy minutes began to show that policymakers are still concerned about inflation and that officials are split between overtightening. As the minutes showed, most officials continued to see significant risks to inflation, which may require more rate hikes. This is good for the dollar and bad for a number of risk assets, including the euro. There's a good chance that the pair will be under pressure today, as there are no other economic reports scheduled for the day except for the euro area's balance of trade data.

A decline and false breakout near the nearest support level at 1.0836 can form a good entry point to buy the euro, with a prospect to reach the resistance level at 1.0869. A breakout and test of this range will boost the demand for the euro, giving it a chance to continue correcting higher to 1.0896, which is in line with the bearish moving averages, and maybe even 1.0922. The ultimate target remains the area of 1.0951 where I will be locking in profits. If EUR/USD declines and there is no buying activity at 1.0836, the bearish market will persist. In this case, only the formation of a false breakout near the next support level at 1.0808 will present an opportunity to buy the euro. I will open long positions immediately on a rebound from the low of 1.0777, considering an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

For today, sellers have the opportunity to maintain pressure on the pair, but they need to make sure that they are active in the area of the new resistance level at 1.0869, which is where the pair is trading right now. A false breakout there, coupled with weak data from the eurozone, will give a sell signal leading to another drop to the support at 1.0836. A breakthrough and subsequent consolidation below this range, followed by an upward retest, can signal a selling opportunity, paving the way to the low of 1.0808. An update of this mark will signal a good bear market. The ultimate target lies at 1.0777 where I will be looking to lock in profits.

If EUR/USD trends upward during the European session and if no selling activity is observed at 1.0869, which is possible with the current low volume, bulls will attempt to regain control of the market. In such a scenario, I would wait until the price hits the next resistance at 1.0896. I would also consider selling there, but only after a failed consolidation above this level. I will go short immediately on a pullback from the high of 1.0922, keeping in mind a downward correction of 30-35 pips.

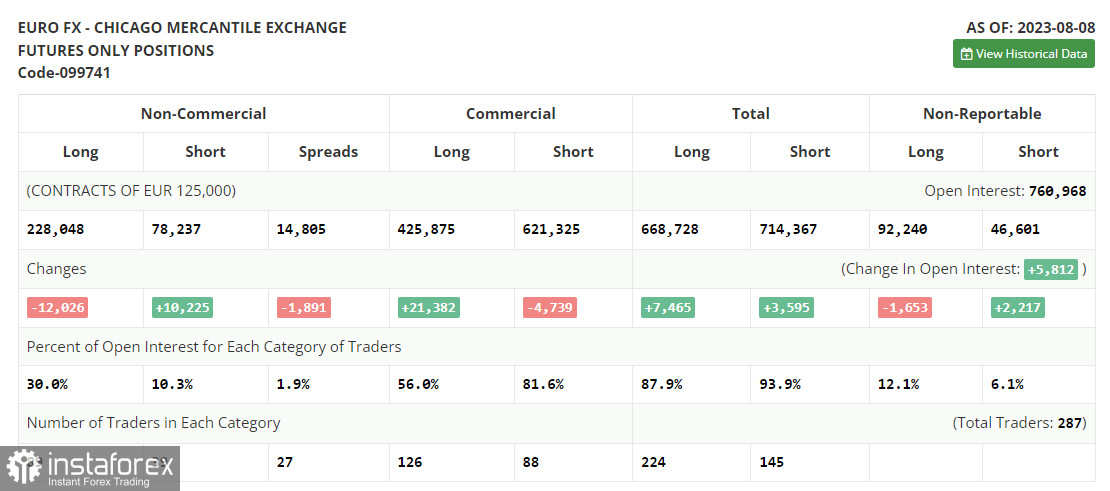

COT report:

The Commitments of Traders report for August 8 indicated a decrease in long positions and a rise in short ones. This shift occurred prior to the release of crucial inflation data from the US. In theory, this data should have provided clarity regarding the forthcoming policies of the Federal Reserve. However, it didn't play out that way. Prices in the US rose again in July, laying the groundwork for potential further rate hikes by the regulator. Despite this, the decline in the euro presents an appealing opportunity. Regardless of the mentioned data, the optimal medium-term strategy in the current conditions remains buying risk assets on dips. The COT report highlighted that non-commercial long positions decreased by 12,026 to 228,048, while non-commercial short positions increased by 10,225, reaching 78,237. As a result, the spread between long and short positions narrowed by 1,891. The closing price dropped to 1.0981 from 1.0999 recorded in the previous week.

Indicator signals:

Moving averages:

Trading is taking place below the 30-day and 50-day moving averages, indicating a further decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0855 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.