Market players find it quite difficult to adopt a positive outlook this week. Firstly, China presented lackluster data, suggesting that the economy may not be able to pull the global economy once again, as it did during the acute phase of the 2008-09 crisis and during the COVID-19 pandemic. Secondly, the contents of the July Fed minutes indicated the possible continuation of interest rate hikes in the US, as inflationary pressure persists in the region. Future decisions on monetary policy will depend on incoming data.

According to a report published on Wednesday, construction of single-family homes in the US surged, while production unexpectedly recovered. Investors now await the weekly report on jobless claims, which forecasts say will show a decrease to 240,000 compared to 248,000 the week before.

Manufacturing activity from the Philadelphia Fed will also come out, and it may show a rise from -13.5 points to -10.0 points.

Risk appetite remains muted in such an atmosphere, while dollar receives support along with government bond yields. The yield on the benchmark 10-year Treasury already reached values from mid-October of the previous year, and the ICE dollar index rose above 103.00, hitting July's local high.

Most likely, uncertainty and general pessimism will persist as long as the Fed does not stop with its promises to raise interest rates in the future. This will be the reason for the correction in the stock markets and the continuing high demand for dollar.

Forecasts for today:

EUR/USD

The pair broke out of the narrow range of 1.0915-1.1045 due to the pressure caused by growing dollar demand, slowing inflation in the eurozone, and possibility of a pause in interest rate hikes in September. As long as such factors persist, the pair may resume its decline to 1.0840 after a local rebound to 1.0900.

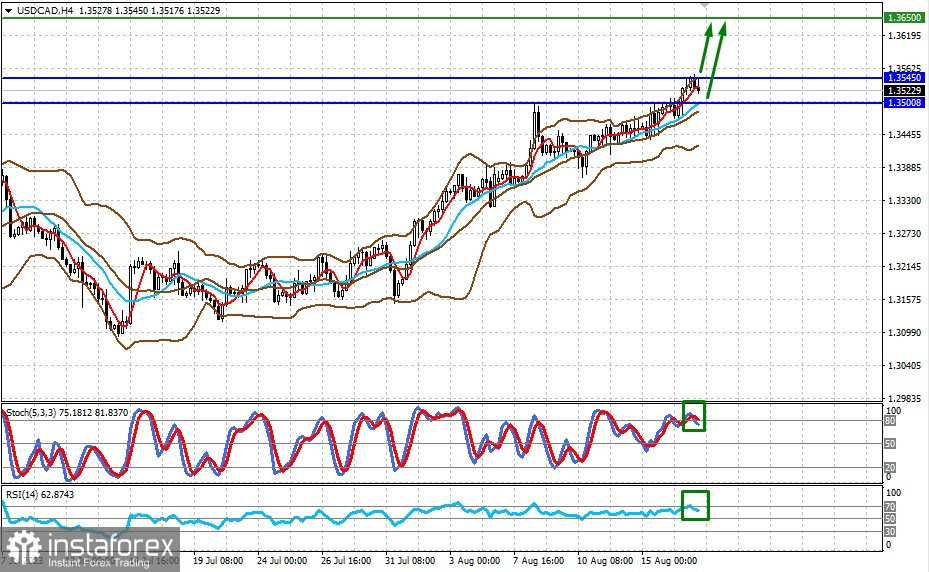

USD/CAD

The pair continues to grow confidently despite rising inflation in Canada. Even high oil prices cannot support the pair, so there may be a correction to 1.3500, especially if traders do not overcome 1.3540. But overall, on the wave of general pessimism, the pair may head towards 1.3650.