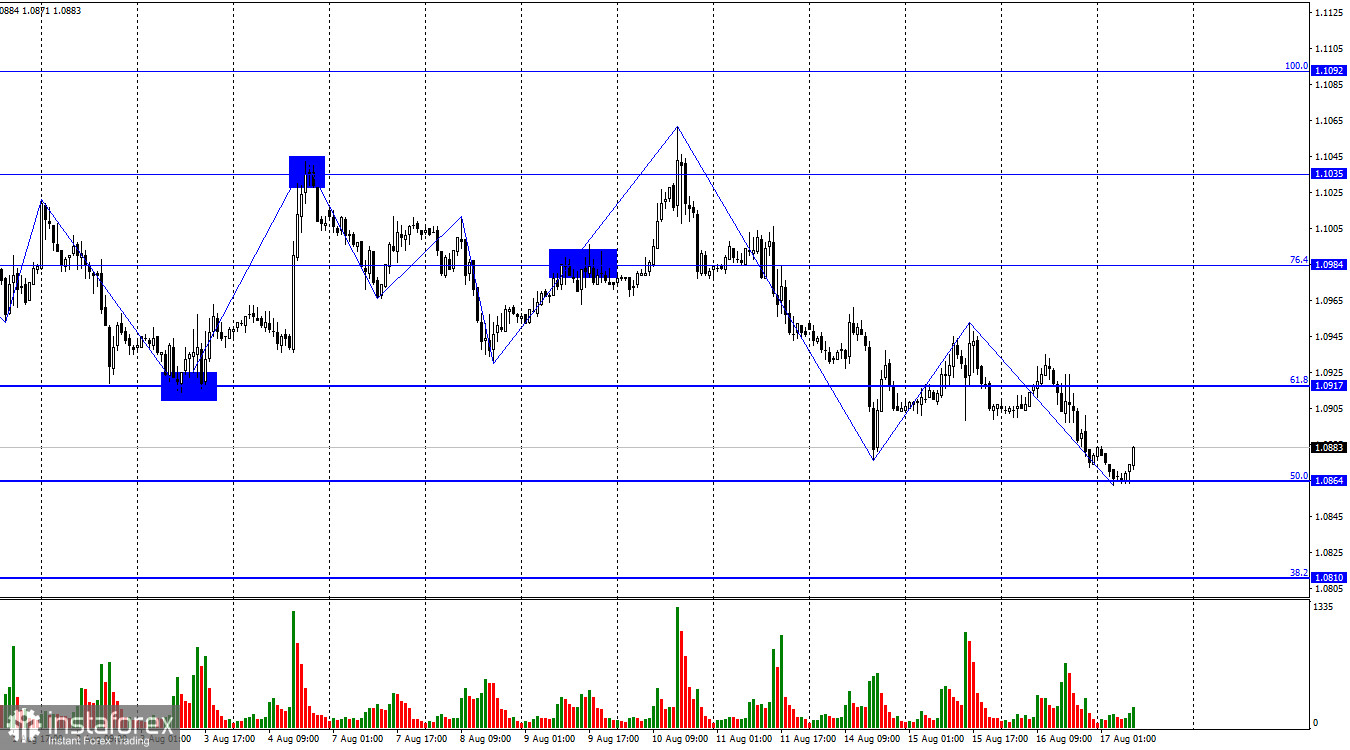

On Wednesday, the EUR/USD pair fulfilled a drop to the corrective level of 50.0% (1.0864). The rebound of quotes from this level favored the European Union currency, and a growth process began toward the Fibo level of 61.8% (1.0917). A rebound of quotes from this level will allow us to expect the pair's return to 1.0864. Fixing the rate below 1.0864 will increase the likelihood of a further decline in the direction of the next corrective level of 38.2% (1.0810).

The waves still tell us about the "bearish" trend. The new downward wave confidently broke through the last low, which means we don't have a single sign of the "bearish" trend ending. At this time, an upward wave may start forming. If its peak is not higher than the peak from August 15, then we will not receive a trend reversal signal, and a new downward wave with a low below 1.0864 can be expected.

Yesterday could have been interesting and positive for the European currency, but it was not. The GDP of the Eurozone in the second quarter did not impress traders, even though the indicator grew by 0.3%. However, this was known a month ago, and traders only considered it necessary to work out the same value once. Industrial production grew by 0.5% m/m with expectations of -0.1% in June, but traders also ignored this report. Thus, despite a positive information background, the euro needed strength to show growth. In my opinion, this is another sign of a steady "bearish" trend.

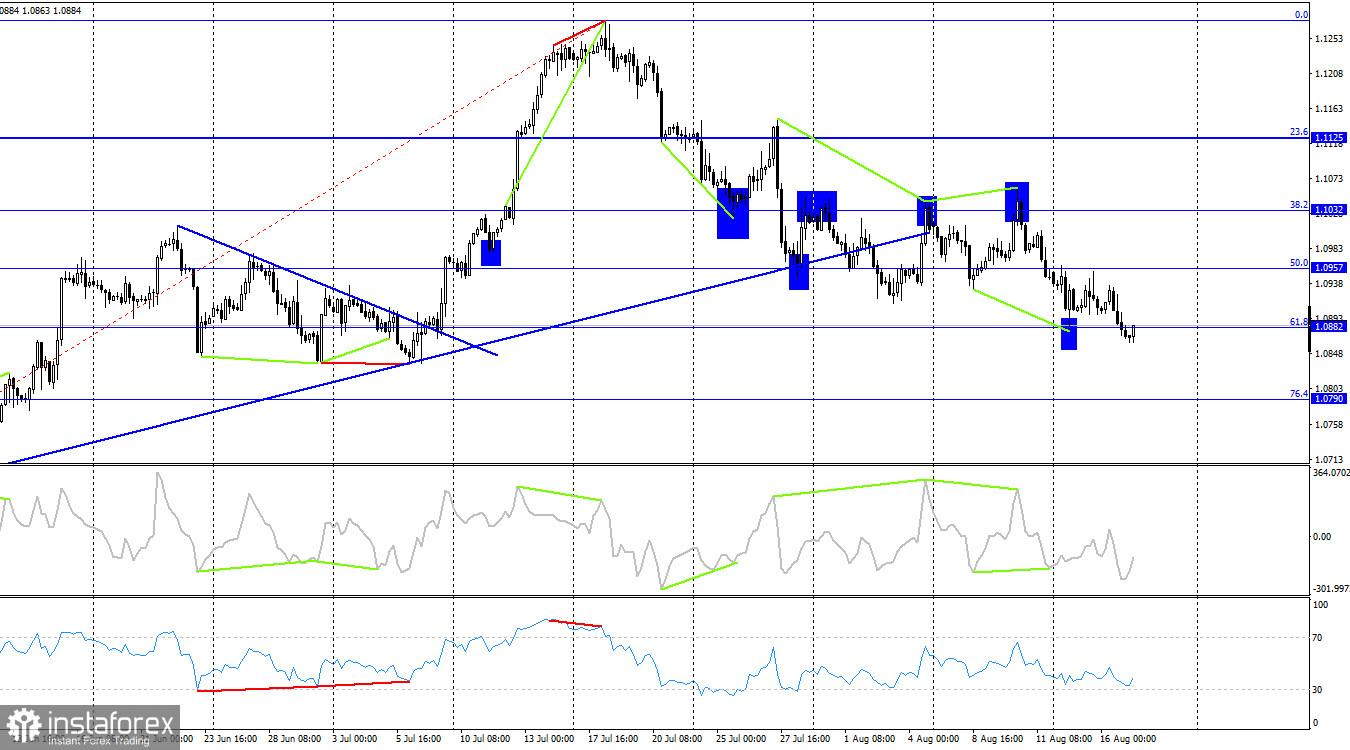

On the 4-hour chart, the pair consolidated below the ascending trendline and two rebounds from the Fibo level of 38.2% (1.1032). Thus, I expected the European currency to fall to the corrective level of 61.8% (1.0882), and it happened. The quotes have already closed below this level, but they found support in 1.0864 on the hourly chart. It is better to focus on the level of 1.0864 today. No new emerging divergences are observed at this time.

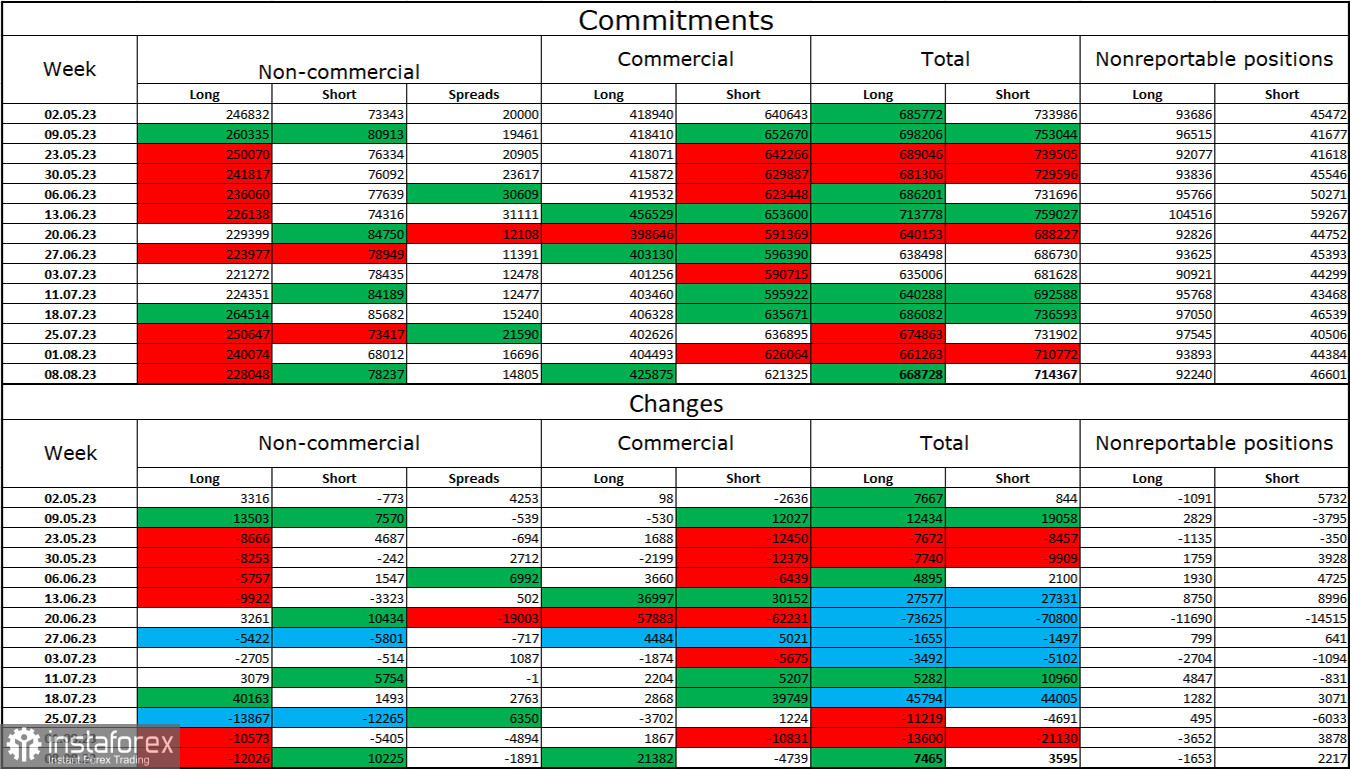

Commitments of Traders (COT) report:

In the last reporting week, speculators closed 12,026 long contracts and opened 10,225 short contracts. The sentiment of large traders remains "bullish," but it has significantly weakened over the past week. The total number of long contracts speculators hold now is 228 thousand, and short contracts are 78 thousand. The "bullish" sentiment remains, but I think the situation will continue to change in the opposite direction shortly. The high value of open long contracts suggests that buyers may continue to close them soon – there is too strong a bias towards bulls. I believe the current figures allow for the continuation of the euro's fall in the coming weeks. The ECB increasingly signals the imminent end of tightening the Monetary Policy procedure.

The economic calendar for the US and the European Union:

USA - Industrial Activity Index from the Philadelphia Fed (12:30 UTC).

USA - Initial Unemployment Benefit Claims (12:30 UTC).

The economic events calendar for August 17 contains two entries that could be more interesting. The influence of the information background on traders' sentiment during the day will be weak.

EUR/USD forecast and trader advice:

New sales can be recommended when rebounding from the 1.0917 level on the hourly chart or closing below the 1.0864 level on the same chart. The target will be the 1.0864 level in the first case and the second - 1.0810. Purchases are possible when rebounding from 1.0864 with a target of 1.0917.