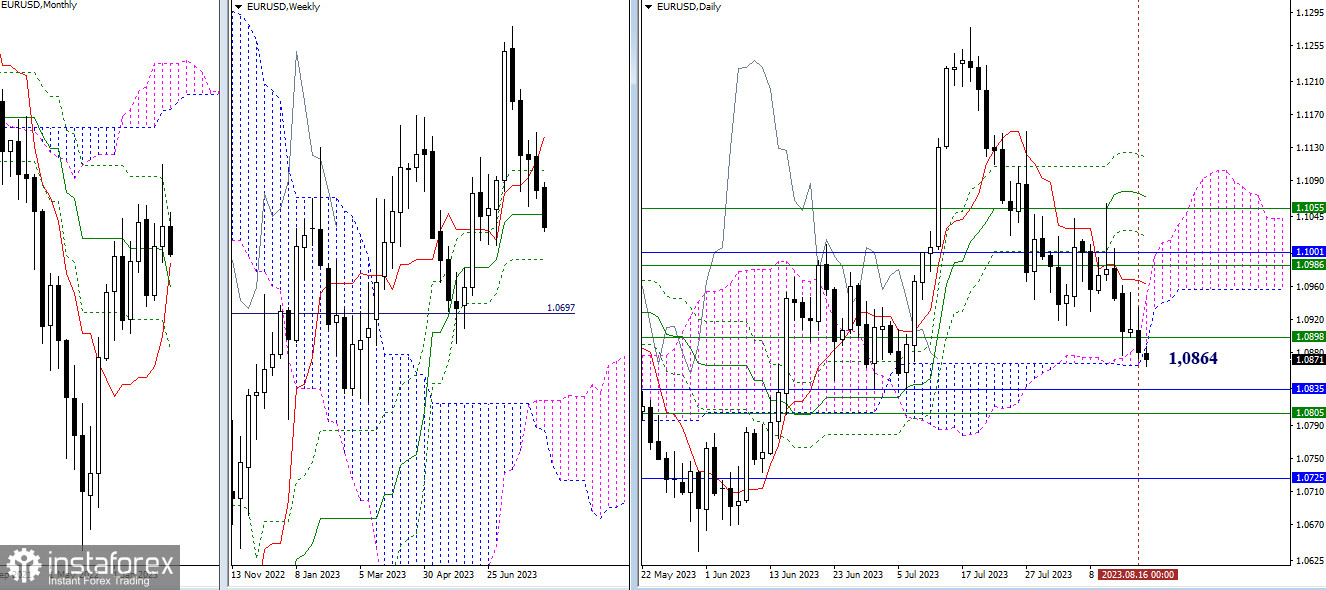

EUR/USD

Higher Timeframes

Bearish players have entered into a battle with the daily Ichimoku cloud. A breakout and firm establishment in the bearish zone relative to the cloud (1.0864) will allow for the formation of a downward target and will also open up new prospects for bearish players. For example, the next tasks will be the elimination of the weekly golden cross of Ichimoku (1.0805) and testing the monthly cross (1.0835 – 1.0725). If this fails, bullish players will primarily face resistance from the weekly medium-term trend (1.0898) and the daily short-term trend (1.0962). In the coming days, the daily cloud will also be located between these levels, which is currently changing its position.

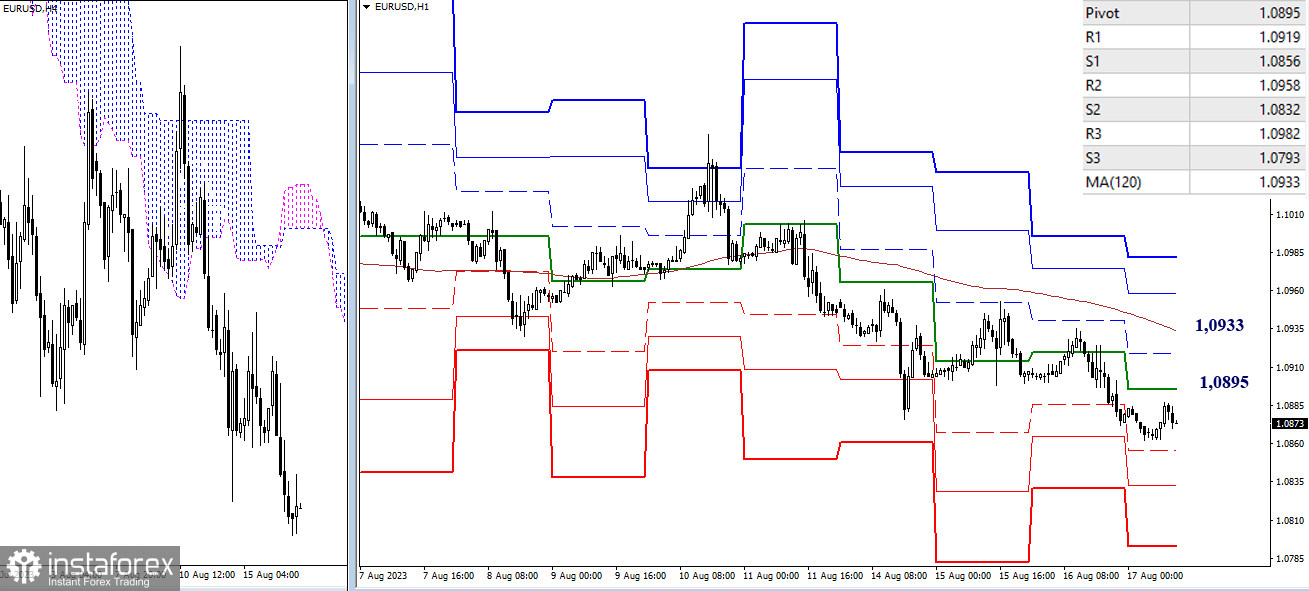

H4 – H1

On the lower timeframes, the main advantage today belongs to the bearish players. The supports of the classic pivot points (1.0856 – 1.0832 – 1.0793) are the targets for further decline within the day. The key levels now act as resistances. In the event of an upward correction, they will meet the pair at the borders of 1.0895 (central pivot point of the day) and 1.0933 (weekly long-term trend). Consolidation above and reversal of the moving average will change the current balance of power.

***

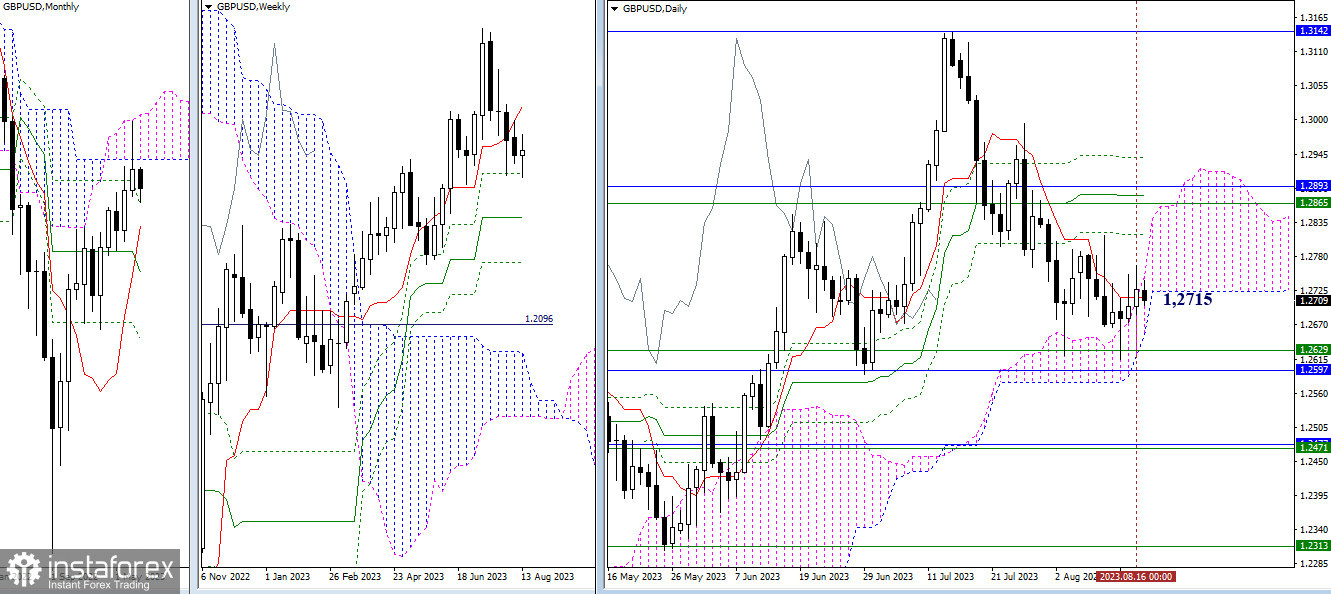

GBP/USD

Higher Timeframes

The upper border of the daily cloud continues to hold back bearish activity, but this support is not enough for bullish players to bounce back and achieve results. Breaking through the daily cloud and securing in the bearish zone relative to it (1.2653) will help change the situation. Subsequently, the levels 1.2597 – 1.2629 of the higher timeframes will become targets. For bullish players, today's targets have not changed: 1.2816 – 1.2865 – 1.2893 – 1.2940 (levels of the daily Ichimoku cross + weekly short-term trend + lower border of the monthly cloud).

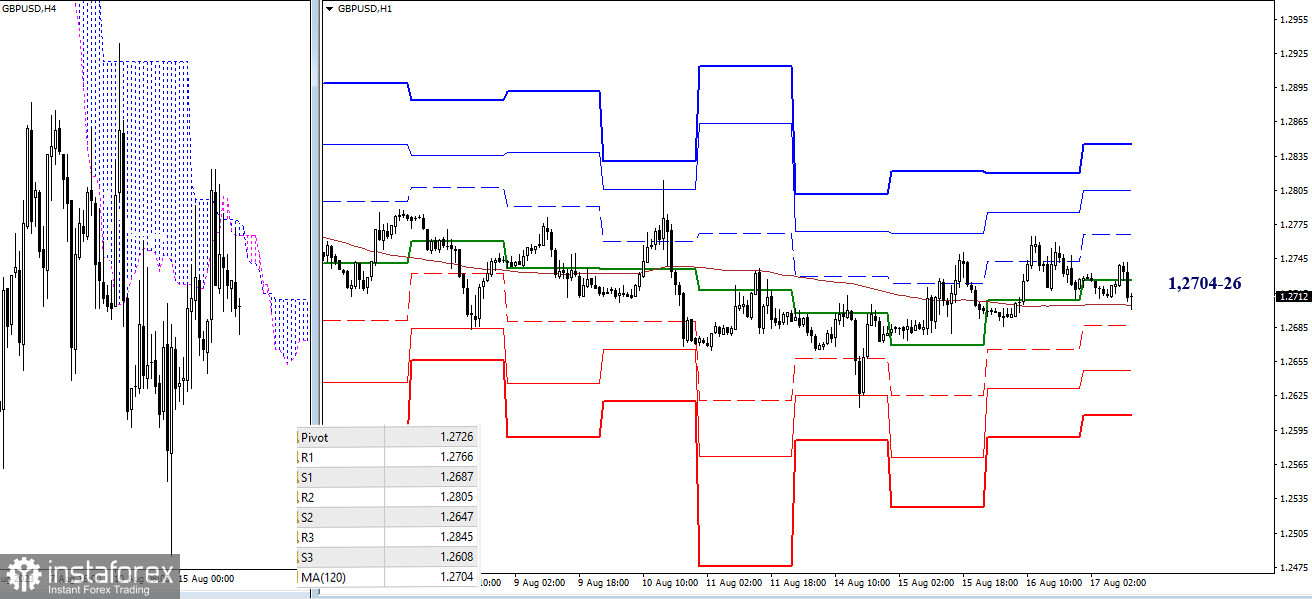

H4 – H1

On the lower timeframes, the pair is now attached to the key levels 1.2704-26 (weekly long-term trend + central pivot point) and is in their attraction zone. Such a state leads to uncertainty, for which directed movement is needed. If such movement occurs and develops, the market within the day can use supports (1.2687 – 1.2647 – 1.2608) and resistances (1.2766 – 1.2805 – 1.2845) of the classic pivot points.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)