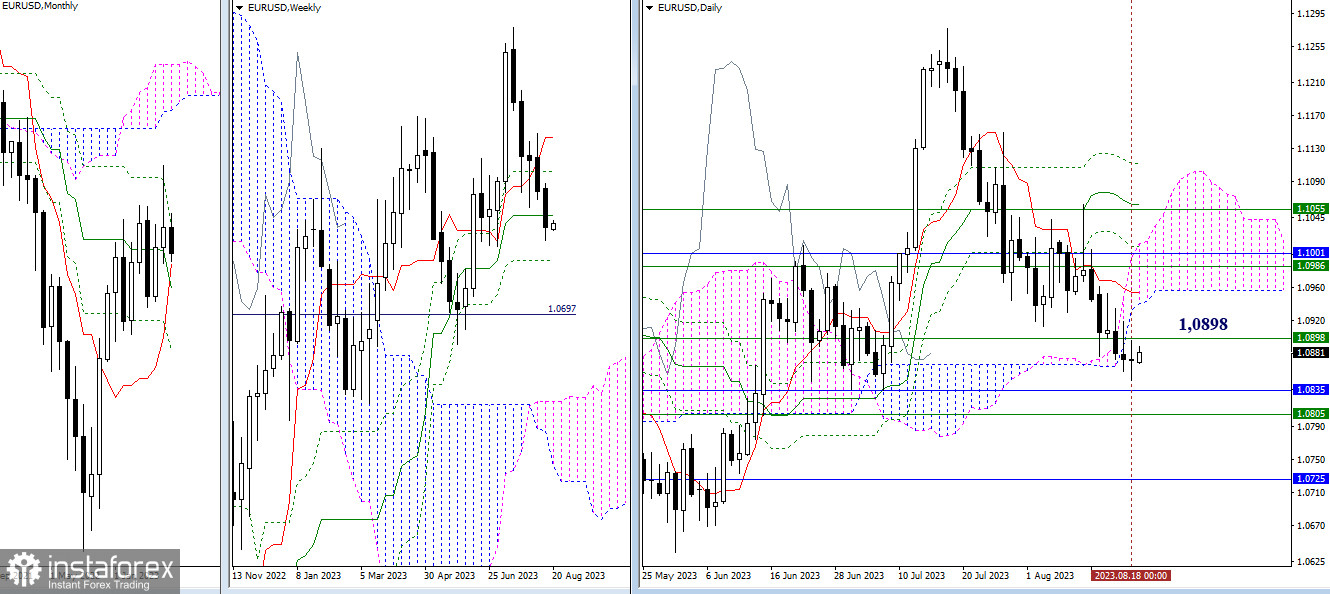

EUR/USD

Higher Timeframes

Bearish players slowly and cautiously broke through the daily cloud last week, reinforced by the weekly medium-term trend (1.0898), and closed the week below the encountered supports. Consolidation in the bearish zone relative to the cloud and continued decline opens new perspectives and opportunities. The nearest supports now are 1.0835–05 (monthly short-term trend + final level of the weekly cross). Further attention will be directed to the support of the monthly medium-term trend (1.0725) and the achievement of the daily target for breaking the Ichimoku cloud.

A change of mood and a return to the market of bullish players will bring back the relevance of the attraction and influence of the weekly medium-term trend (1.0898), and above, the market will face resistance from the lower border of the daily cloud and the daily short-term trend (1.0954). There is a fairly wide resistance zone from levels of different timeframes above (1.0986 – 1.1001 – 1.1055 – 1.1112).

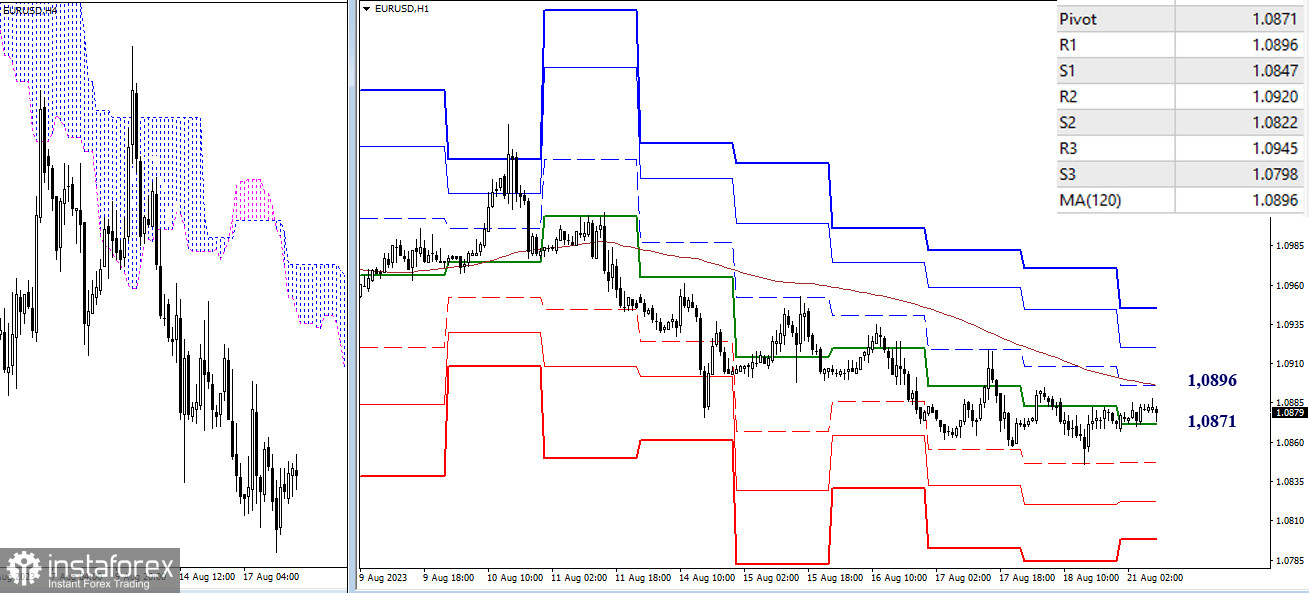

H4 – H1

As of writing, the main advantage on the lower timeframes belongs to the bearish players. However, the pair is in the correction zone, using the central pivot point (1.0871) as the current support. The next resistance is the weekly long-term trend (1.0896). This level is key and is responsible for the current balance of power. Consolidation above and a reversal of the moving average can transfer the main advantage to the bullish side. The next targets for the intraday rise will be the resistance levels of the classic pivot points (1.0920 – 1.0945). If the correction stops and the pair updates the low of the correction (1.0846), the downward trend will be restored. Targets for the continuation of the decline will be the supports of the classic pivot points (1.0822 – 1.0798).

***

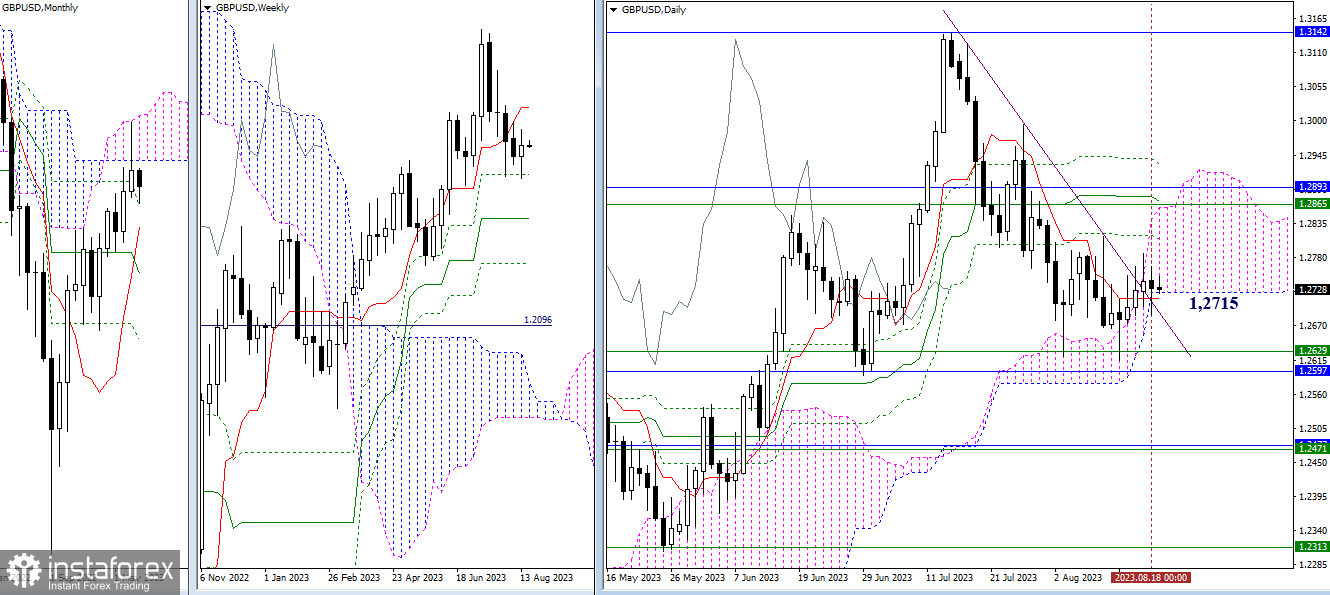

GBP/USD

Higher Timeframes

Last week, the pair once again tested the weekly support (1.2629) for strength and again marked the slowdown and rebound. The daily cloud continued to support the bullish players. As a result, the pair consolidated above the daily short-term trend (1.2715) in the daily cloud. The unpassed and left-behind levels (1.2629 – 1.2597) still retain their value and continue to serve as the nearest important supports for this area. Just as the resistance zone 1.2816 – 1.2865 – 1.2893 – 1.2940 (levels of the daily Ichimoku cross + weekly short-term trend + lower border of the monthly cloud) has not changed its position and significance.

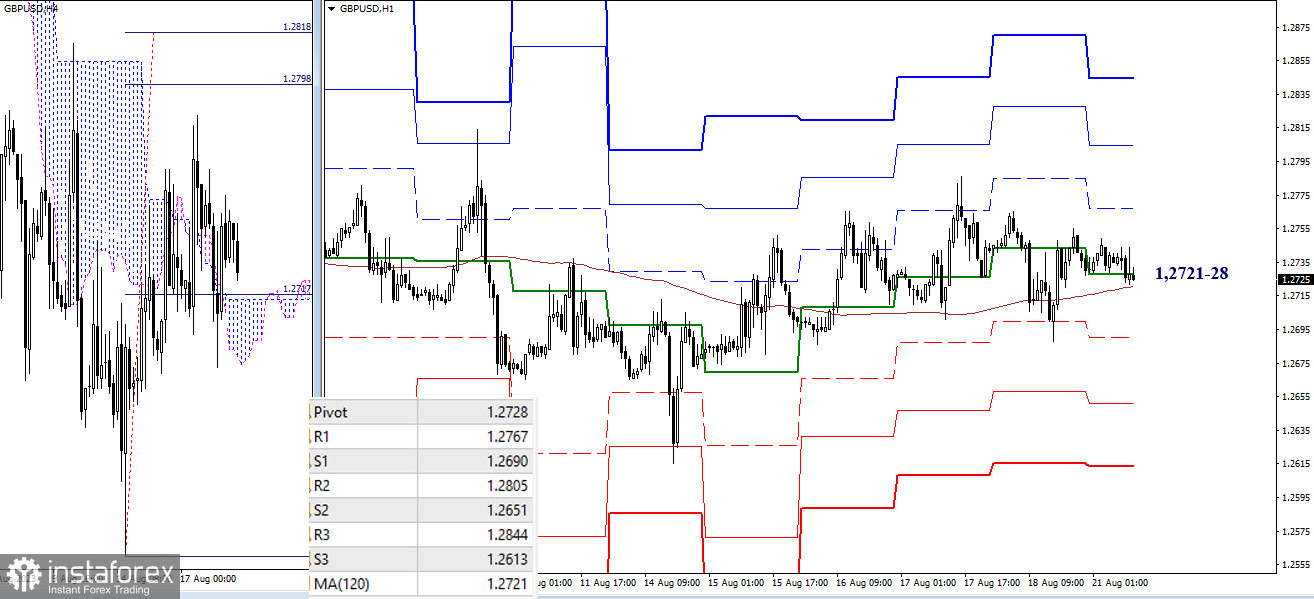

H4 – H1

On the lower timeframes, there is uncertainty. The key levels today have joined forces around 1.2721–28 (central pivot point + weekly long-term trend). A prolonged stay above the key levels has allowed the bullish players to retain some advantage, thus forming a bullish target for breaking the H4 cloud (1.2798 – 1.2818). In the development of directional movement, the classic pivot points will come into play. The bullish players will benefit from resistances (1.2767 – 1.2805 – 1.2844), while the bearish players will need supports (1.2690 – 1.2651 – 1.2613).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)