Tips for trading ETH

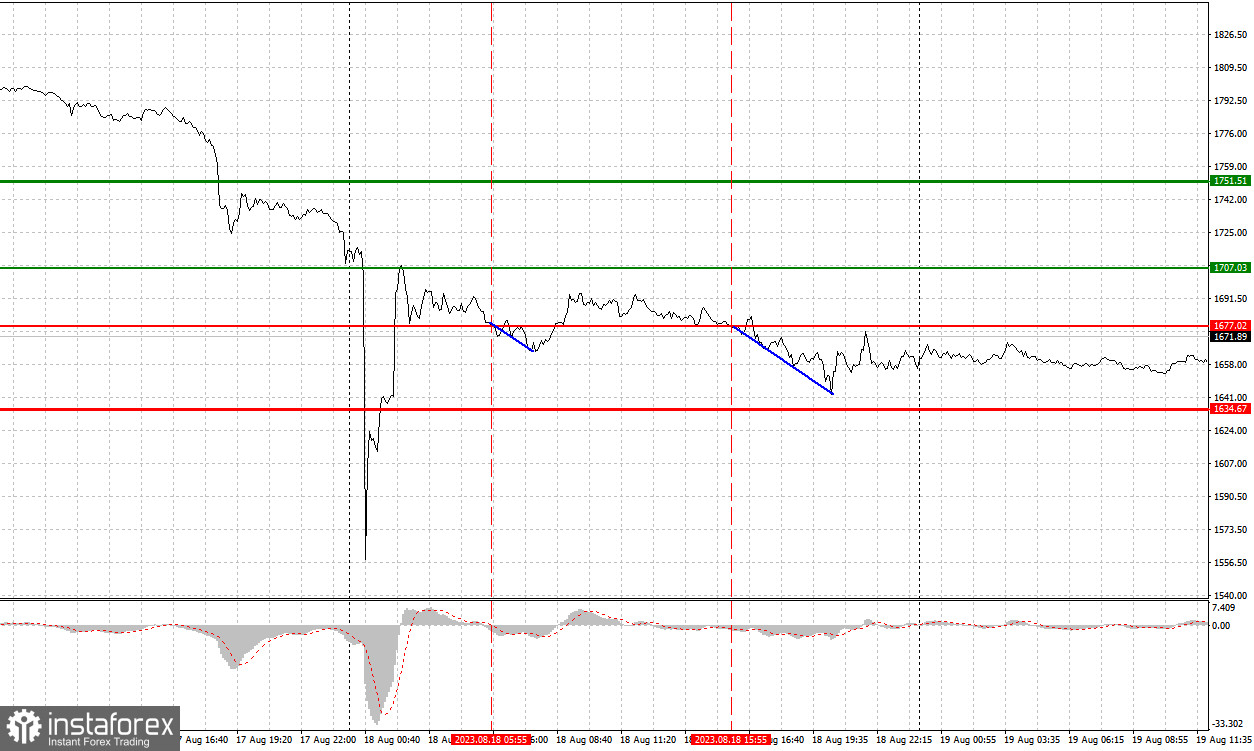

The price test at $1,677 coincided with the MACD indicator being in the negative zone, confirming the correct selling entry point for Ethereum. As a result, there was a drop to nearly the support level of $1,634, which was missed by a hair's breadth. It seems the pressure on Ethereum may persist, and we should anticipate further sharp declines in the trading instrument, given the decrease in buying incentives and market optimism since last week. The fact that ETH buyers missed out on $1,815 sooner or later had to lead to what we currently observe on the chart. It is better to be ready for the instrument's further decline, relying on scenarios 1 and 2.

Buy signal

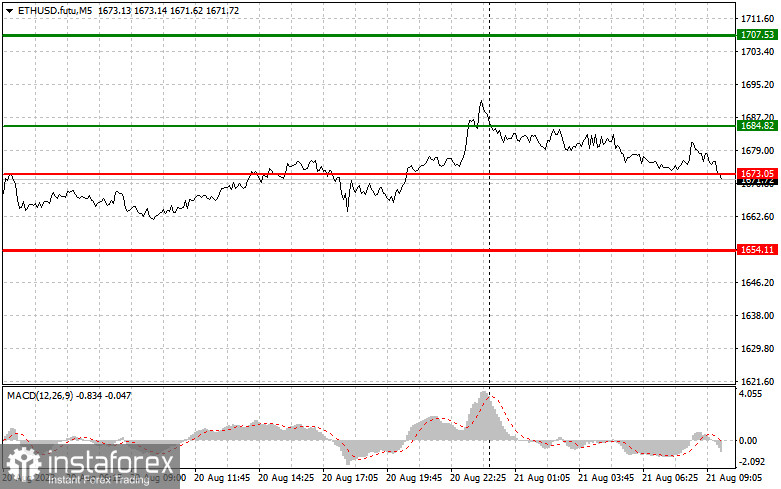

Scenario 1: One can buy Ethereum today at the entry point near $1,684 (green line on the chart), aiming for growth toward $1,707 (thicker green line on the chart). Near the level of $1,707, it is better to close long positions and open short ones. Ethereum is unlikely to grow today, especially following such a substantial sell-off that triggered numerous stop-loss orders. Important! Before buying ETH, make sure that the MACD indicator is above zero and just beginning to rise from it.

Scenario 2: You can also buy Ethereum today in the case of two consecutive price tests at $1,673. This may limit the downward potential of the trading instrument and lead to an upward reversal. We can expect ETH to grow towards the opposite levels of $1,684 and $1,707.

Sell signal

Scenario 1: You may sell Ethereum today after $1,673 is breached (red line on the chart), leading to a swift drop in the trading instrument. Bears see their key target at $1,654, where it is better to close short positions and open long ones. Pressure on Ethereum may surge at any moment. Important! Before selling ETH, make sure that the MACD indicator is below zero and just starting to decline from it.

Scenario 2: One can sell Ethereum today in the case of two consecutive price tests at $1,684 when the MACD indicator is in overbought territory. This may limit the trading instrument's upward potential and trigger a downward reversal. We can also expect a decline toward the opposite levels of $1,673 and $1,654.

What's on the chart:

Thin green line - entry price for buying the trading instrument.

Thick green line - assumed price for placing take-profit orders or locking in profits manually, as further growth beyond this level is unlikely.

Thin red line - entry price for selling the trading instrument.

Thick red line - assumed price for placing take-profit orders or locking in profits manually, as further decline below this level is improbable.

MACD Indicator. When entering the market, adhere to overbought and oversold zones.

Important. Novice cryptocurrency market traders must exercise extreme caution when making market entry decisions. It is best to stay out of the market before significant fundamental reports to avoid being caught in sharp price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without proper stop orders, you can quickly deplete your deposit, especially if you're not using money management and are trading with substantial volumes.

Remember that successful trading necessitates a clear trading plan, similar to the one outlined above. Spontaneously making trading decisions based on the current market situation is inherently a losing strategy for intraday traders.