Formally, the single currency has edged up, but not only is the growth insignificant, but in general, nothing has changed. The euro has simply moved to the upper band of the range in which it has been trading for in the last few days. And, apparently, the situation will remain unchanged until the end of this week. After all, the economic calendar is practically empty, and the only thing that can move the market is Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole Symposium. This will happen on Friday evening, right before the closing of the US trading session. Therefore, we will probably see the market's reaction next week.

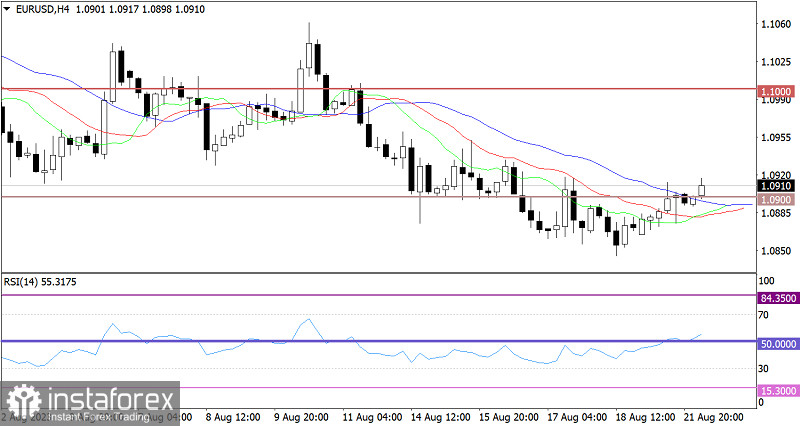

The EUR/USD pair opened the trading week with an increase in the volume of long positions. As a result, the exchange rate climbed above the 1.0900 mark, which could signal the possible end of the corrective phase.

On the four-hour chart, the RSI upwardly crossed the 50 middle line, thus reflecting bullish sentiment among traders.

On the same time frame, the Alligator's MAs are intersecting each other, which indicates the possibility that the current corrective phase is coming to an end.

Outlook

Keeping the price above the 1.0900 level may favorably affect the euro's exchange rate. However, unless the pair passes the 1.0950 mark, we cannot confirm that sellers have finally retreated and the corrective move will no longer resume.

In terms of complex indicator analysis, it suggests that EURUSD will recover after the current cycle.