Trading tips for BTC

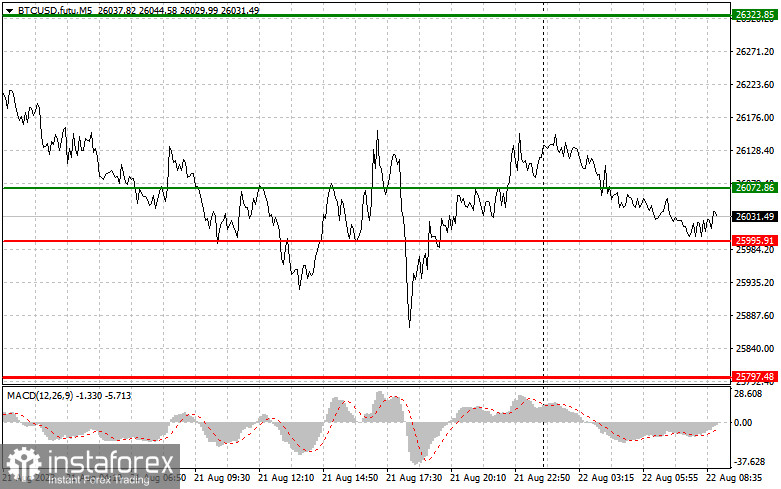

The price test at $26,031 occurred as the MACD was in the negative zone and starting its downward movement. Following the significant Bitcoin sell-off in the preceding days, this scenario was ideal for building short positions, confirming the right entry point. As a result, BTC dipped to around $25,925. Currently, long positions on BTC are out of consideration as pressure on risk assets has not subsided. Contemplating the recovery of the world's first cryptocurrency will only be viable after the Jackson Hole symposium at the end of the week. As for now, it is better to sell BTC, relying on scenarios 1 and 2. Of course, buyers might propose something after breaching $26,072, but caution is crucial in action there.

Buy signal

Scenario 1: One can buy Bitcoin today at the entry point around $26,072 (green line on the chart) with the target of ascending to the level of $26,323 (thicker green line on the chart). Near the level of $26,323, it is better to close long positions and open short ones. We can also anticipate a robust Bitcoin rise only within the boundaries of correction, as it is unlikely that bulls will reverse the market in their favor. Important! Before buying BTC, make sure that the MACD indicator is above zero.

Scenario 2: You may buy Bitcoin today in the event of two consecutive price tests at $25,995. This will constrain the downward potential of the trading instrument and lead to a market upward reversal. We can expect growth towards opposite levels at $26,072 and $26,323.

Sell signal

Scenario 1: You can sell Bitcoin today after the level of $25,995 is reached (red line on the chart), which will prompt a swift decline in the trading instrument. Sellers' key target will be the level of $25,797, where you can close short positions and open long ones. Pressure on Bitcoin will persist and continue. Important! Before selling BTC, confirm that the MACD indicator is below zero.

Scenario 2: One can also sell Bitcoin today if two consecutive price tests at $26,072 occur. This will limit the upward potential of the trading instrument and lead to a downward market reversal. We can also anticipate a decrease towards the opposite levels of $25,995 and $25,797.

What's on the chart:

Thin green line – entry price for purchasing the trading instrument.

Thicker green line – assumed price for setting take-profit orders or locking in profits manually, as further growth beyond this level is improbable.

Thin red line – entry price for selling the trading instrument.

Thicker red line – assumed price for setting take-profit orders or locking in profits manually, as further decrease below this level is unlikely.

MACD Indicator. When entering the market, it is important to consider overbought and oversold zones.

Important. Novice cryptocurrency market traders need to approach market entry decisions with extreme caution. Prior to significant fundamental reports, it is better to stay out of the market to avoid exposure to sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders in place, you can quickly lose your entire deposit, especially if you do not employ proper money management and trade with substantial volumes.

Remember that successful trading necessitates a clear trading plan, similar to the one presented above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.