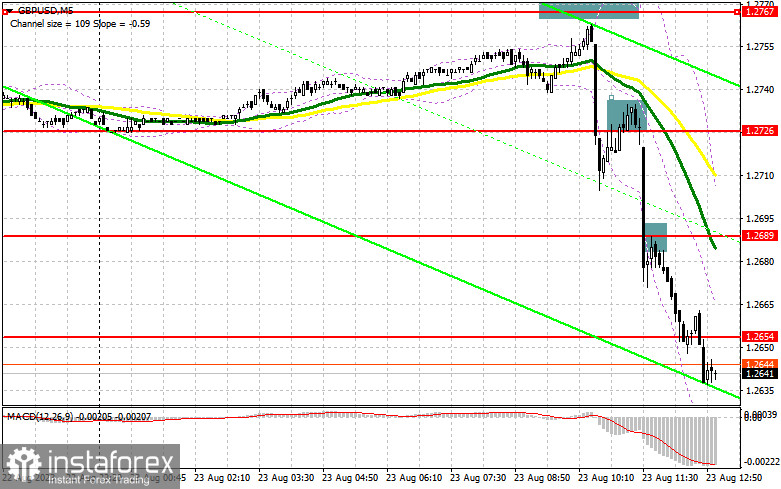

In the morning forecast, I pointed out the 1.2726 level and suggested making market entry decisions from there. Let's examine the 5-minute chart to understand what happened. The breakthrough and retest of this range led to an excellent sell signal, resulting in a 35-point drop. A similar situation with 1.2689 after the weak PMI data resulted in a sell signal and a further drop of 40 points. The technical outlook was revised for the latter half of the day.

To open long positions for GBP/USD, it's necessary to:

Of course, after publishing dreadful manufacturing and services activity statistics for the UK, any talk of buying on a rebound was out of the question. During the American session, the pressure on the pair might persist as similar reports are expected from the US. If these indicators show a relatively stable state, we can expect another wave of decline for the pair. If the activity significantly decreases or even shows a contraction, the pound might partially compensate for its losses, which is unlikely after falling more than 100 points from the day's opening level.

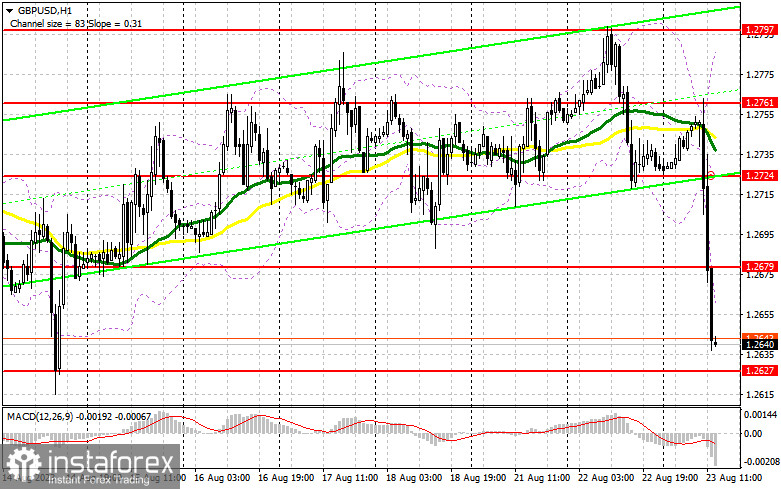

Considering the bearish market sentiment, I plan to act on a decline after forming a false breakout around the new support level of 1.2627, formed last week. This might not provide the perfect, but an entry point aiming for the 1.2679 resistance. A breakthrough and top-down test of this range, against the backdrop of weak US data, will form an additional buying signal, restoring the pound's strength and allowing it to reach 1.2724. In case of breaking even higher, we can talk about a surge to 1.2761, where I would lock in profits. If the GBP/USD falls and there are no buyers at 1.2627, which is more likely, the pressure on the pair will persist, leading to another major selloff. If this happens, I will postpone long positions until 1.2591. I'll only consider buying there on a false breakout. Opening long positions for GBP/USD right on a rebound can be done from 1.2557, targeting a correction of 30-35 points within the day.

To open short positions for GBP/USD, it's necessary to:

Bears fully control the market, but selling at current lows is very risky – especially after such a significant pair decline seen in the first half of the day. For this reason, I'll try to wait for the GBP/USD recovery after weak US data and the formation of a false breakout around 1.2679. This will form a sell signal in anticipation of a further decline and a test of the nearest support at 1.2627. A breakthrough and a bottom-up retest of 1.2627, similar to what I analyzed above, will provide an entry point for selling with a target to reach 1.2591, renewing the bearish trend for the pound. A further target will be the 1.2557 area, where I would lock in profits.

When GBP/USD rises, and no bears are present at 1.2679 during the second half of the day, the bulls will attempt to re-enter the market. In such a case, only a false breakout around the next resistance level at 1.2724 will form an entry point for short positions. If there's no activity even there, I advise selling GBP/USD from 1.2761, expecting a recoil of the pair downwards by 30-35 points within the day.

The COT report (Commitment of Traders) dated August 15 showed growth in both long and short positions. Following the UK GDP data, traders increased their positions, which was better than economists' expectations. The price drop in the USA also influenced the power balance, supporting the pound, just as the high base pressure in the UK did. At the end of this week, there will be a symposium in Jackson Hole which may further strengthen the British pound in the short term. It's crucial to hear what Fed Chairman Jerome Powell will say about the future monetary policy of the US. As before, the optimal strategy remains to buy the pound on declines since the difference in central banks' policies will impact the prospects of the American dollar, exerting pressure on it. The latest COT report indicates that long non-commercial positions increased by 7,302 to 90,541, while short non-commercial positions jumped by 3,334 to 39,553. As a result, the spread between long and short positions narrowed by 607. The weekly price dropped and was 1.2708 against 1.2749.

Indicator signals:

Moving Averages:

Trading is taking place below the 30 and 50-day moving averages, indicating a further pound decline.

Note: The author considers the period and prices of the moving averages on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.2665, will serve as support.

Description of indicators:

• Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.