Prior to the publication of this morning's British PMI indices, many economists believed that the Bank of England might raise the interest rate to 5.50% or even 6.00% if inflation remains high. However, S&P Global Market Intelligence noted that August PMI data will fuel speculation that rates may soon peak.

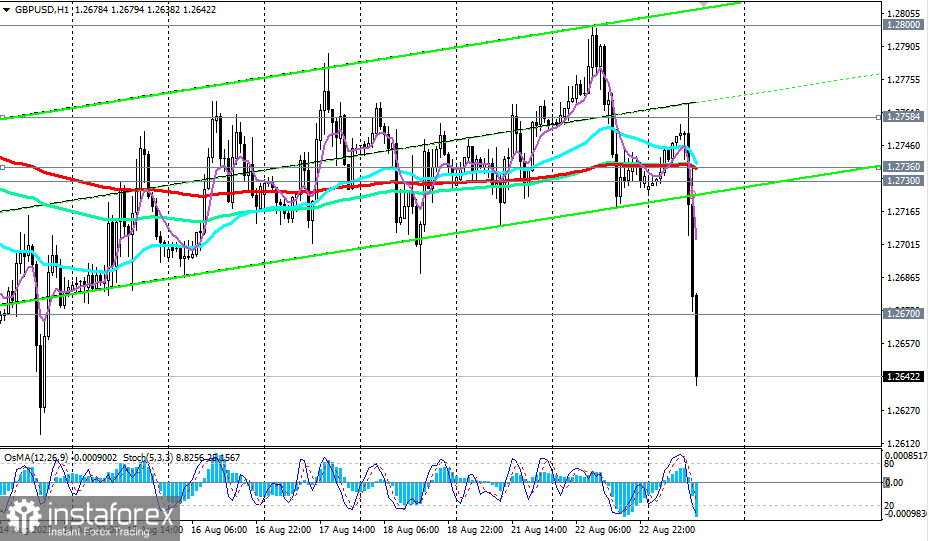

The pound sharply declined after the release of PMI data, and the GBP/USD pair corrected downwards. As of writing, the pair's decline continued, reaching a mark of 1.2642.

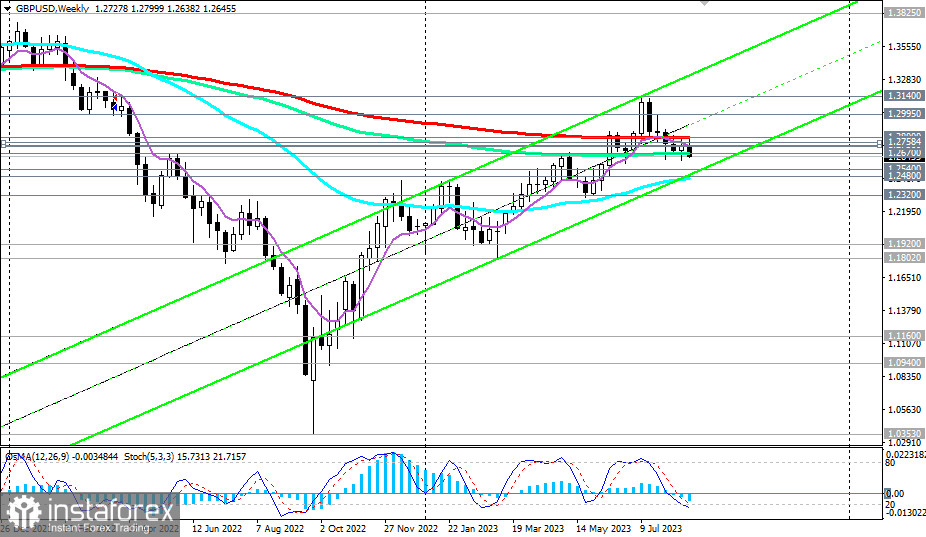

After stabilizing below the key support level of 1.2670 (144 EMA on the weekly chart), and in the event of further decline, the targets become key support levels 1.2540 (144 EMA on the daily chart), 1.2500, 1.2480 (200 EMA on the daily chart). A break below these would confirm GBP/USD's return to a bear market zone.

In an alternative scenario, the pair's decline will stop near current levels or the "round" support level of 1.2600. The first signal for purchases might be a rise above the level of 1.2670, with confirmation coming from breaking through important resistance levels of 1.2730 (50 EMA on the daily chart) and 1.2736 (200 EMA on the 1-hour chart). A rise above the key resistance level at 1.2800 (200 EMA on the weekly chart) will confirm GBP/USD's return to a long-term bull market zone.

Support levels: 1.2600, 1.2540, 1.2500, 1.2480, 1.2400, 1.2320

Resistance levels: 1.2670, 1.2700, 1.2730, 1.2736, 1.2758, 1.2800, 1.2900, 1.3000, 1.3100, 1.3140, 1.3250, 1.3300, 1.3860, 1.3900, 1.4300.