Formally, events progressed quite logically, as the euro fell amid extremely disappointing reports. And although the manufacturing PMI rose from 42.7 points to 43.7 points, the services PMI fell from 50.9 points to 48.3 points. Thus, the composite PMI fell from 48.6 points to 47.0 points. In general, the preliminary PMIs turned out to be noticeably worse than forecasts.

Then, the dollar started to weaken, as the situation in the United States turned out to be no better. Specifically, the manufacturing PMI fell from 49.0 points to 47.0 points. The services PMI dropped from 52.3 points to 51.0 points. As a result, the composite PMI fell from 52.0 points to 50.4 points. Thus, the reports were noticeably worse than the forecasts. However, the scale of movements, which turned out to be atypical for such data, is surprising. Apparently, the market just got tired of being stagnant and needed some activity.

Speaking of today, despite incoming reports on unemployment benefit claims and orders for durable goods, we are unlikely to see anything like yesterday. No matter how you look at it, today marks the beginning of the Jackson Hole symposium, and the market is focused on it. And although Federal Reserve Chairman Jerome Powell and European Central Bank President Christine Lagarde are scheduled to speak tomorrow, some statements or comments regarding the future course of actions of key central banks may sound today. So, economic reports are not important for the next few days.

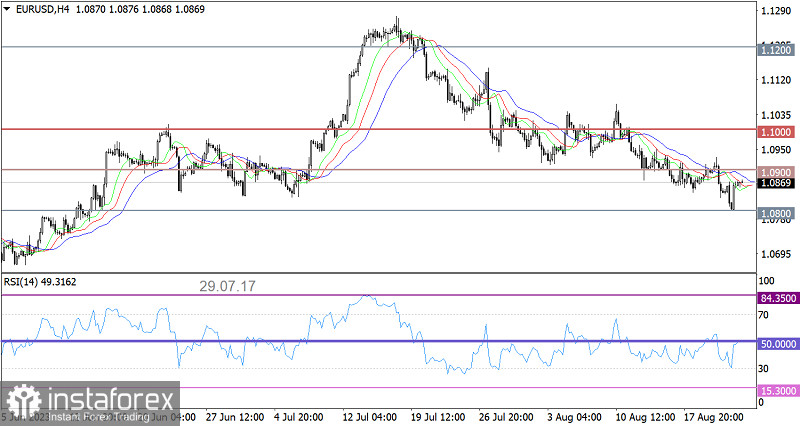

The volume of short positions for the EUR/USD pair fell around the 1.0800 support level. As a result, a rebound, and the euro pared losses from the recent decline.

On the four-hour chart, the RSI has reached the oversold zone, which coincided with hitting the 1.0800 support level. The indicator confirmed the pullback.

Analyzing the MA sliding lines on the 4H Alligator indicator, you can notice an attempt to slow down the trend. However, there is no clear signal of a crossover of the sliding lines yet.

Outlook

The downward cycle from the peak of the medium-term trend is still relevant, despite the current pullback. For this reason, returning to the 1.0800 support level could become a technical signal to break the level. This will extend the downward movement. As for the alternative scenario, to confirm the end of the downward cycle, the exchange rate must rise above the 1.0950 mark.

The comprehensive indicator analysis in the short term and intraday periods indicates a price pullback.