The EUR/USD currency pair moved upwards and downwards over the past day. Such a movement does not surprise us, as we have repeatedly mentioned that the current move to the south is fairly weak, and corrections and pullbacks occur quite frequently. So it's not surprising that the euro initially dropped and then increased. Overall, it continues to decline, just not very rapidly or hastily.

Yesterday showed us what many had realized long ago. The European economy is just shy of sliding into a recession. For several quarters, GDP indicators have been teetering on the brink of negative values. But what can one expect when the European Central Bank regularly raises its rate? It's worth noting that the GDP is going through tough times with a not-so-high key rate, especially when compared to rates in the UK and the US, where they are much higher. While the British economy is also struggling, the American economy is growing briskly, giving the dollar a strong advantage.

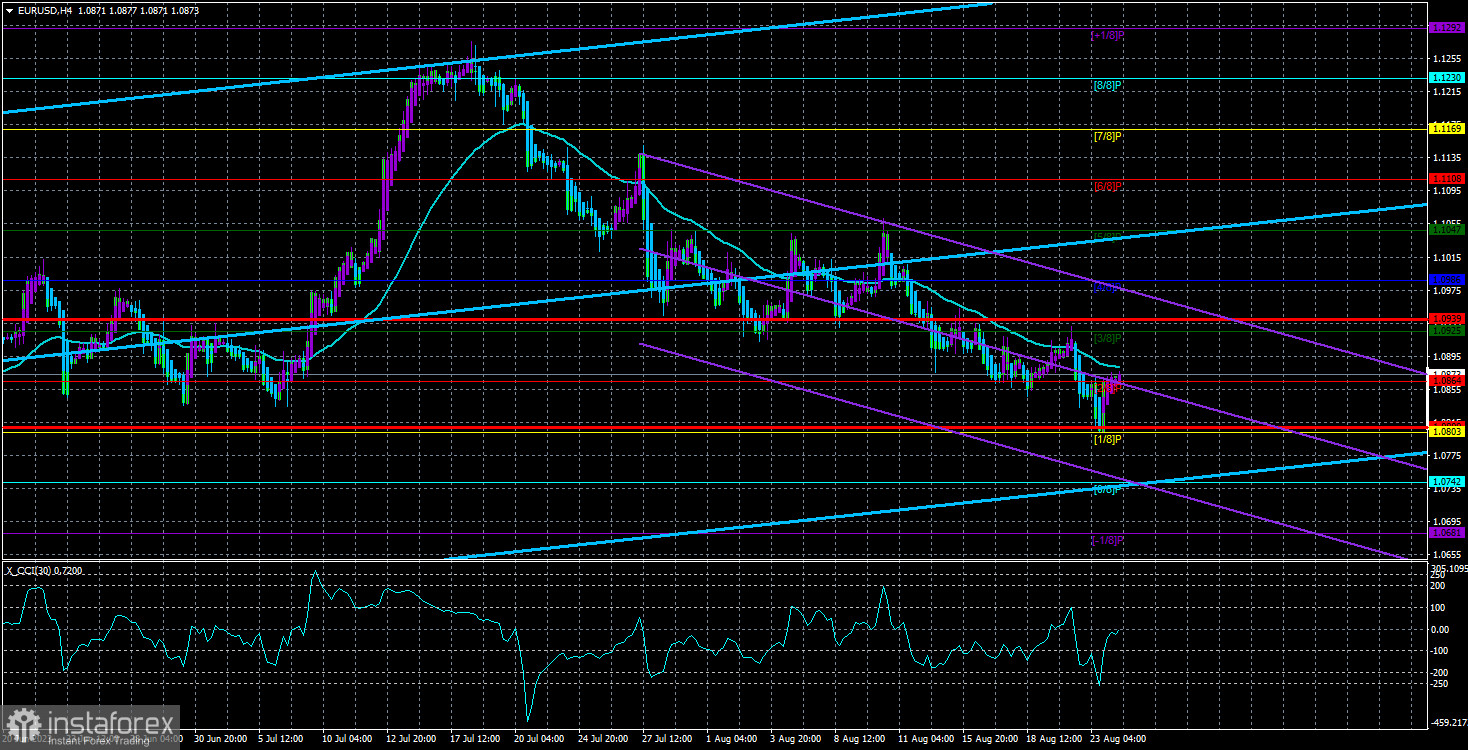

We will discuss business activity indices. For now, it's worth noting that the downward trend for the pair continues, but the CCI indicator went into the oversold zone yesterday. This is a strong buying signal, so we can expect a stronger upward correction soon. Especially since, on the 24-hour timeframe, we are still looking for a confident breakthrough of the Ichimoku cloud. Thus, the pair continues its correction within the global upward trend, but the main movement can resume anytime. What are the fundamental reasons for this? There aren't any. However, it's important to remember that the forex market doesn't always move strictly with fundamentals and macroeconomics.

The European economy is sliding into the abyss.

The service sector in the European Union and Germany has fallen below the "waterline." If the manufacturing sector has been in the negative business activity zone for over a year, the service sector entered it in August. Now, both sectors in Germany and the EU are below the key level of 50.0, which does not bode well for the European economy. For instance, business activity indices in the US could be in better shape but still higher than in the EU or Germany. Hence, we can only state the obvious: US statistics continue to outperform European ones.

It's worth noting that the American currency has been falling for almost a year now. This happens when the Federal Reserve's rate rises faster and stronger, and the US economy appears much more stable and confident than the European one. Recognizing this fact leads us to believe that the European currency is extremely overbought and unjustifiably expensive. Based on this, we anticipate a further decline in the European Union's currency. This week, we are awaiting the speeches by Jerome Powell and Christine Lagarde. Although we think both officials will only provide a little significant information, the market might still grasp certain hints. Both leaders hint at a pause in September; if one doesn't, it might support their country's currency. Given the sharp decline in business activity in the European Union, we believe the likelihood of "dovish" rhetoric from Christine Lagarde is much higher. But the Federal Reserve has also adopted a "two meetings – one hike" policy, so Powell is unlikely to discuss the need for immediate tightening without seeing the August inflation report.

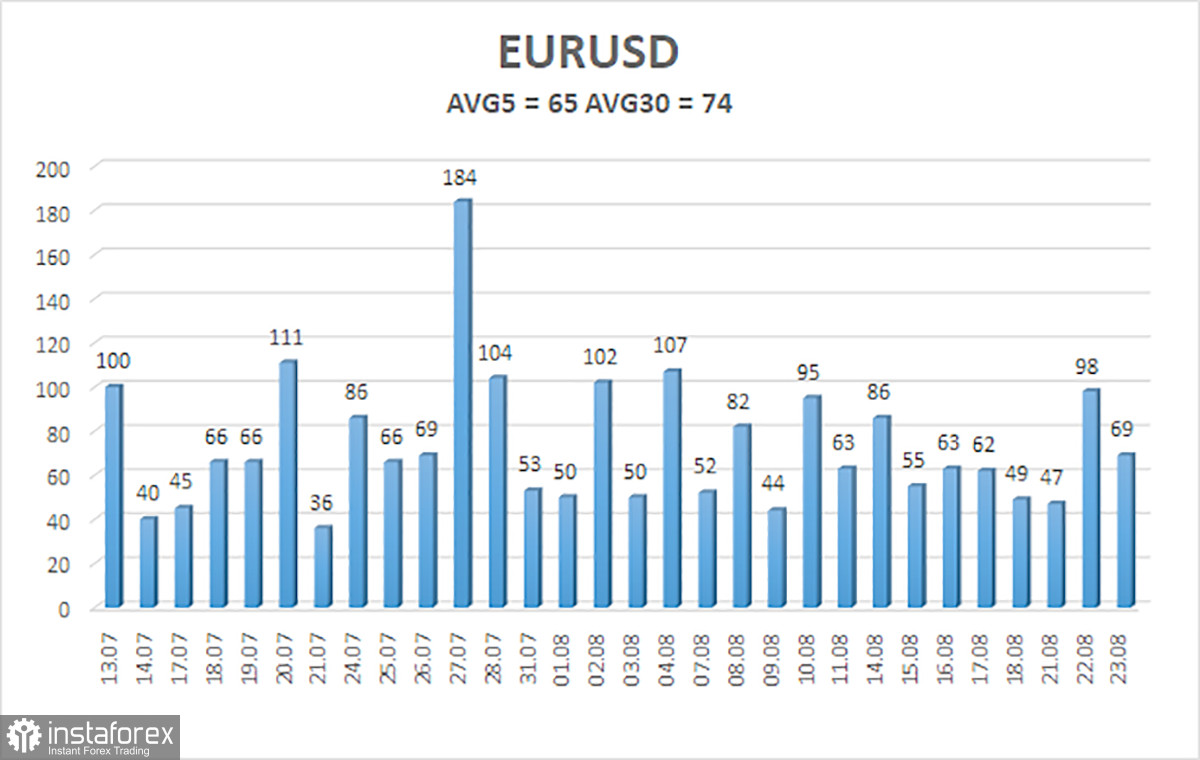

The average volatility of the EUR/USD currency pair over the last five trading days as of August 24 is 65 points and is characterized as "average." Therefore, we anticipate the pair to move between levels 1.0809 and 1.0939 on Thursday. A downturn in the Heiken Ashi indicator will signal a resumption of the downward movement.

Nearest support levels:

S1 – 1.0803

S2 – 1.0742

S3 – 1.0681

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0925

R3 – 1.0986

Trading recommendations:

The EUR/USD pair currently maintains a downward trend. New short positions should be considered with targets at 1.0803 and 1.0742 in case of a downward reversal in the Heiken Ashi indicator or a price rebound from the moving average. Long positions can be considered if the price consolidates above the moving average, with targets at 1.0939 and 1.0986.

Explanations for illustrations:

Linear regression channels – help determine the current trend. The current trend is strong if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should proceed.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will operate in the next 24 hours, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.