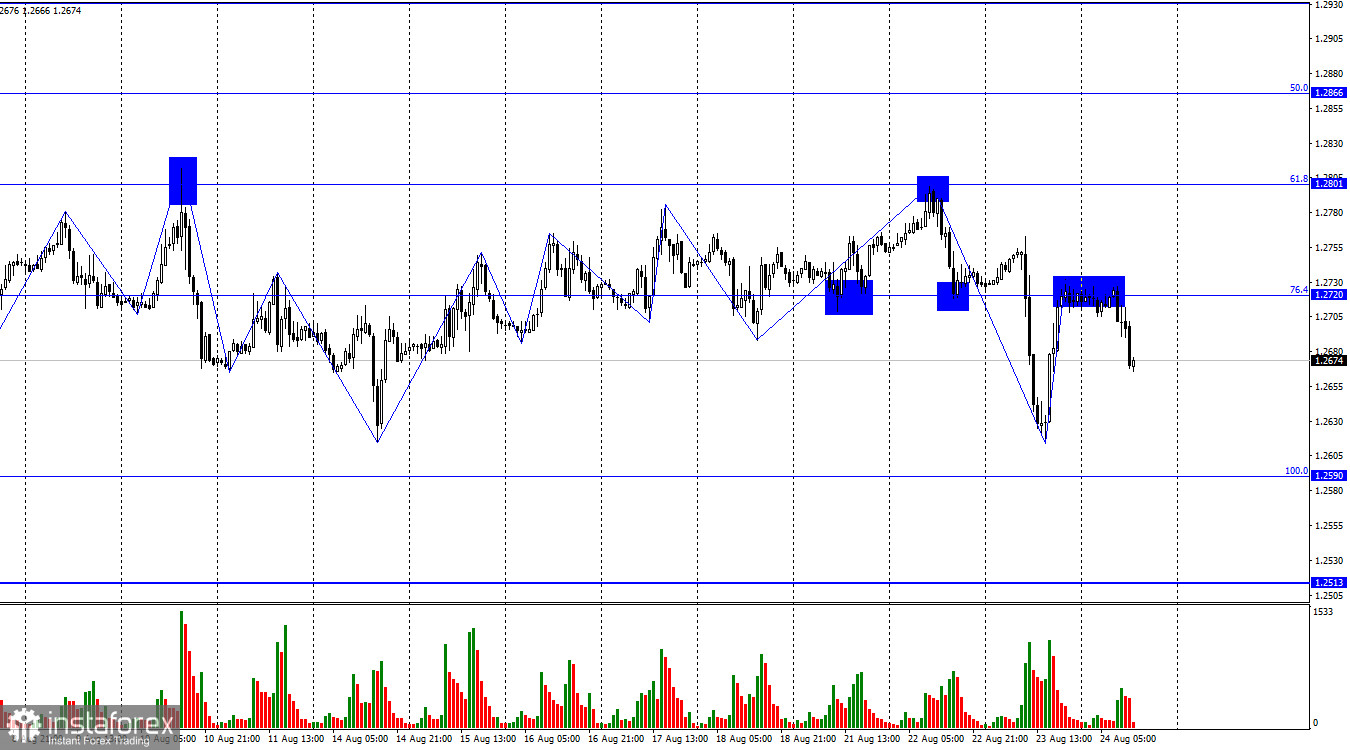

On the hourly chart, the GBP/USD pair underwent a significant drop on Wednesday after consolidating below the corrective level of 76.4% (1.2720). However, by today, it had returned to the 1.2720 level. A rebound from this level suggests a continued drop toward the next Fibonacci level of 100.0% (1.2590).

After the pair formed seven upward waves, one might have thought that a "bullish" trend had emerged. Indeed, I wrote about this yesterday. But this "bullish" trend occurred within a horizontal channel, which the pair has been in for several weeks. Thus, a conclusion around the 1.2801 level could have been anticipated. A downward wave has formed, covering 3 of the last 4 lows, and the subsequent upward wave failed to return the pair to 1.2801. This set up a new "bearish" trend within the horizontal channel.

Business activity indices were also released yesterday in the UK. These reports also indicated a decline in August, exerting additional pressure on the pound. In the latter part of the day, equally disappointing business activity indices were released in the US, allowing the pound to recover slightly. But the chart and information suggest a continued drop is more likely.

Today, two reports will be released in the US, and the Jackson Hole symposium will begin. Jerome Powell will speak, but there's no scheduled speech by Andrew Bailey on the calendar. The Federal Reserve chair might provide the market with information that could influence all dollar-related pairs.

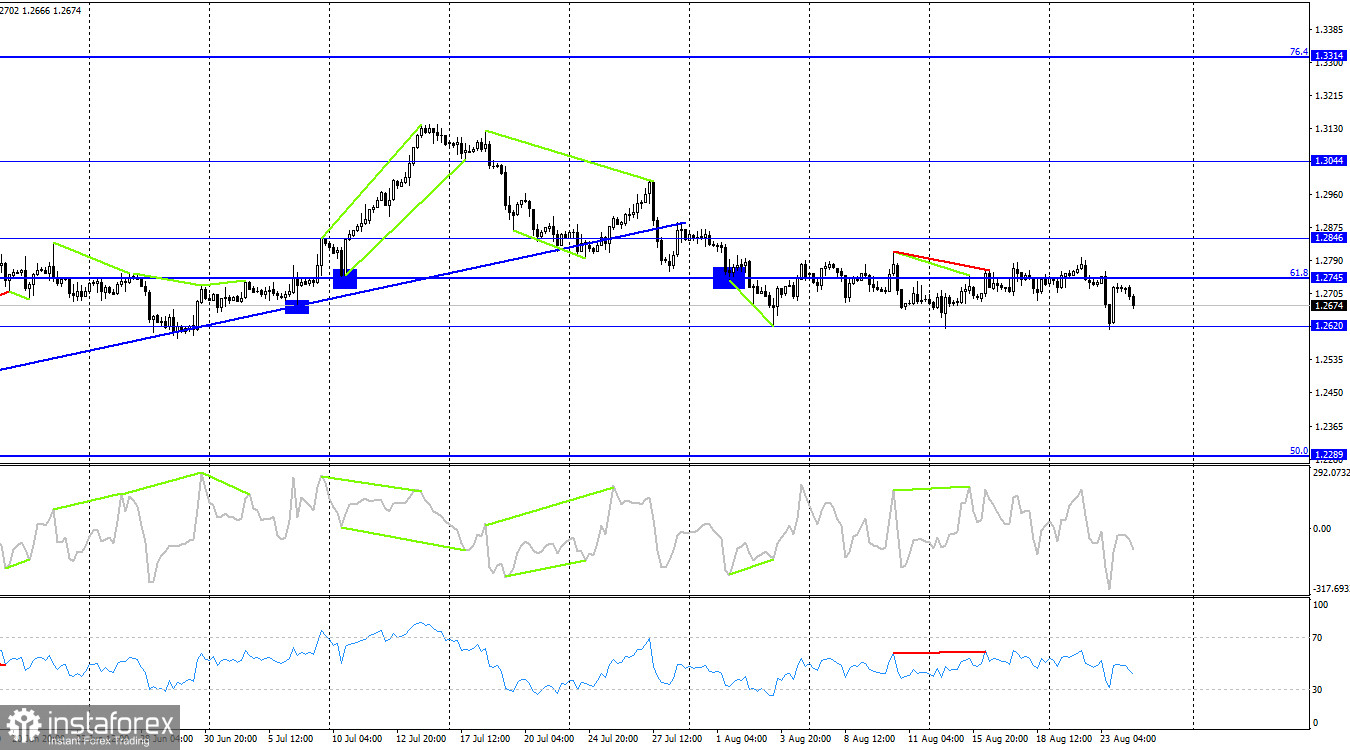

On the 4-hour chart, the pair has dropped to the 1.2620 level, the third such drop in recent weeks. The horizontal channel is visible; I expect a significant drop in the pair once it consolidates below the 1.2620 level. But a further drop in the pound looks more likely to me. As of today, no upcoming divergences are observed in any of the indicators.

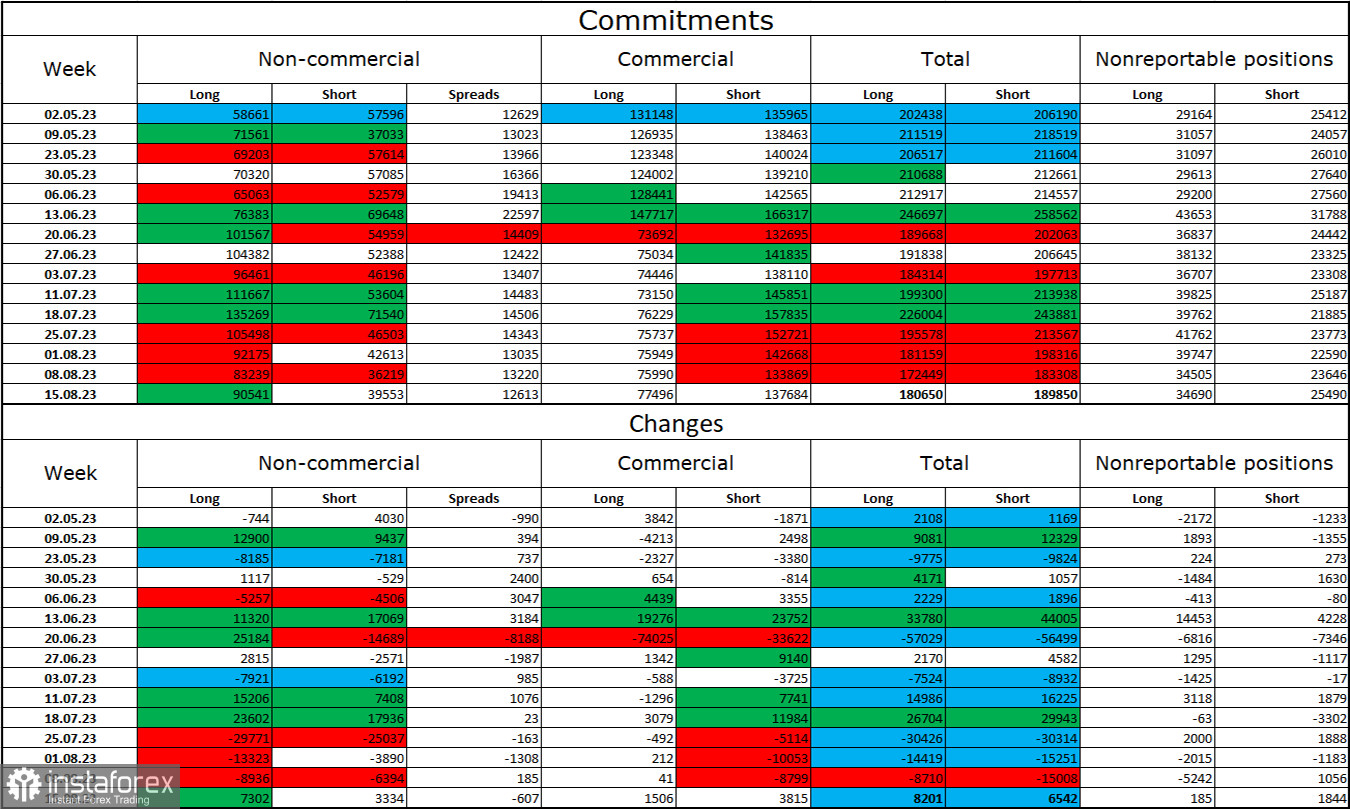

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more "bullish" over the past reporting week. The number of long contracts held by speculators increased by 7,302 units, while the number of short contracts increased by 3,334. The overall mood of major players remains "bullish," and there's now more than a twofold gap between the number of long and short contracts: 90,000 versus 39,000. The pound had decent growth prospects a few weeks ago, but now, many factors have favored the US dollar. Betting on a strong surge in the pound has become very challenging. In recent weeks, we've seen bulls cut their positions, decreasing them by almost 50,000. Bear positions are also declining, but the gap is mainly increasing.

News calendar for the US and UK:

USA – Core Durable Goods Orders (12:30 UTC).

USA – Initial Unemployment Claims (12:30 UTC).

On Thursday, the economic event calendar has several interesting entries. For the rest of the day, the influence of the news backdrop on market sentiment may be moderate in strength.

GBP/USD forecast and advice for traders:

Selling the pound was possible upon closing below the 1.2720 level on the hourly chart or rebounding from below. The nearest target is 1.2590. For purchases today, there's only one signal – consolidating above 1.2720. The target is 1.2801.