The yen is again declining today, and the USD/JPY pair is on the rise.

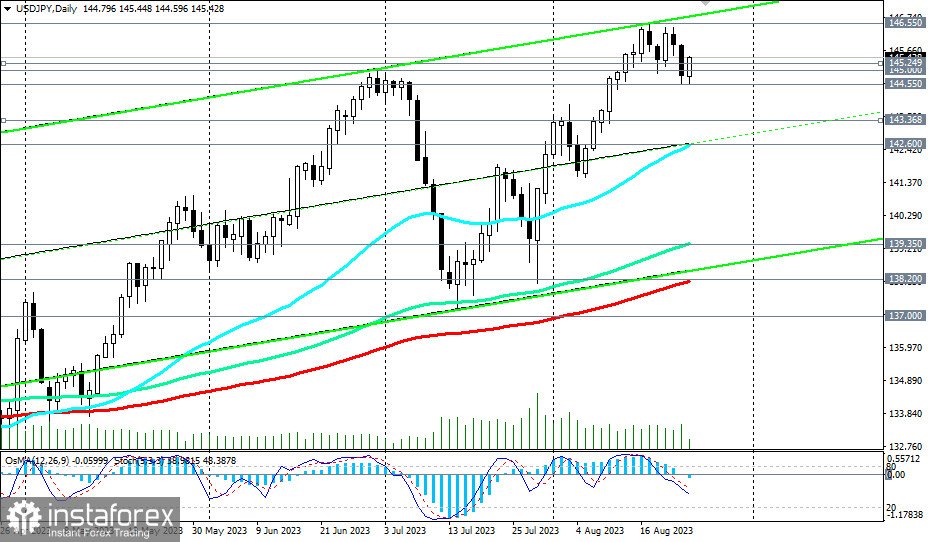

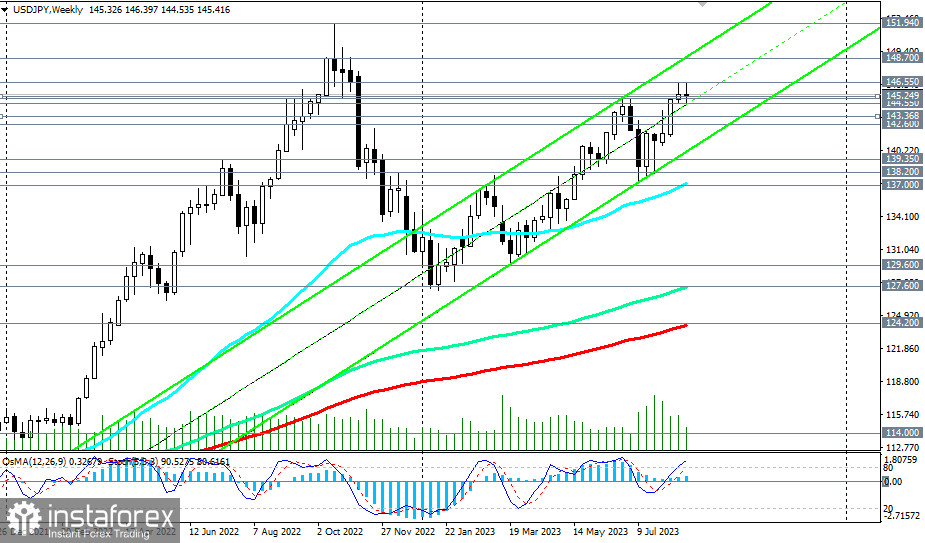

The breakout of the significant short-term resistance level at 145.25 (200 EMA on the 1-hour chart) signaled the resumption of long positions and the return of USD/JPY to the bullish market zone: medium-term (above the support level of 138.20—200 EMA on the daily chart), long-term (above the support level of 124.20—200 EMA on the weekly chart), and global (above the support level of 112.30—200 EMA on the monthly chart).

The nearest growth target is the upper boundary of the range formed between levels 144.55 and 146.55. The upper boundary of the upward channel on the daily chart also runs through this mark. If it's broken, the USD/JPY will head towards the upper boundary of the upward channel on the weekly chart and the 148.70 mark.

In an alternative scenario, if the price breaks the mentioned support level of 144.55, it will head towards significant support levels at 143.37 (200 EMA on the 4-hour chart) and 142.60 (50 EMA on the daily chart).

Considering the strong upward momentum of the pair and unchanged expectations regarding the monetary policy prospects of the Federal Reserve and the Bank of Japan, a deeper correction and a decline in USD/JPY are unlikely. Therefore, near support levels of 143.68, 143.00, and 142.60, deferred limit orders to purchase USD/JPY would also be appropriate.

Long positions remain preferable. They can be entered "on the market" with stops below support levels of 145.25 and 145.00.

Support levels: 145.25, 145.00, 144.55, 144.00, 143.37, 143.00, 142.60, 139.35, 138.20, 137.00

Resistance levels: 146.00, 146.55, 147.00, 148.00, 148.70.