The latest weekly gold survey shows that for the week ending on September 1st, most retail investors anticipate an increase in gold prices. However, market analysts are more cautious about the situation, with opinions evenly split. This comes after Fed Chairman Jerome Powell's speech in Jackson Hole on Friday made it clear that the Federal Reserve does not intend to deviate from its monetary policy tightening course in the near future.

Adrian Day, president of Adrian Day Asset Management, believed gold prices will drop this week. However, the decline won't last long. He suggests that the U.S. is approaching a recession and, therefore, before inflation is curtailed, the Federal Reserve will take a break.

Meanwhile, James Stanley, senior market strategist at Forex.com, thinks that the precious metal will continue to rise this week. He noted that gold was surprisingly strong last week, even despite a robust U.S. dollar. The reason behind this was the euro's weakness, which made up 57.6% of the DXY. From his perspective, the technical outlook for gold looks more optimistic. Stanley expects prices in the range of $1925–1932 per ounce.

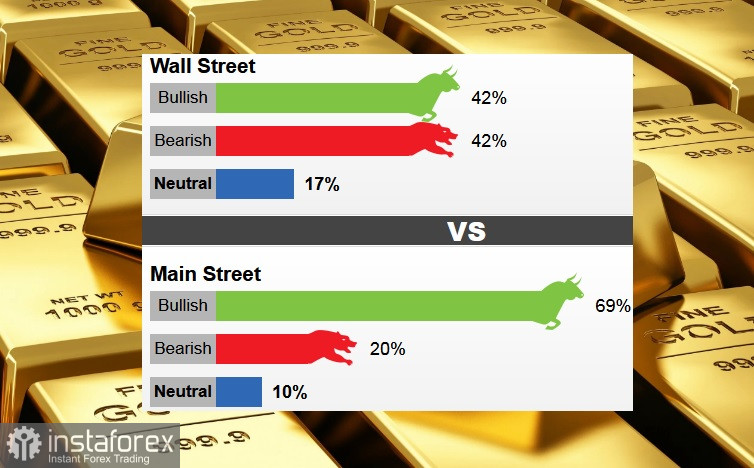

This week, 12 Wall Street analysts participated in the survey. Five experts, or 42%, predicted price hikes. Another five analysts, or 42%, anticipated a price drop. Two analysts, or 17%, were neutral.

In the online survey, 559 votes were cast, where 388 respondents, or 69%, expect price to rise this week. Another 114, or 20%, anticipate a decline, while 57 voters, or 10%, remained neutral.

The latest poll indicates that retail investors are forecasting a price around $1941 per ounce.