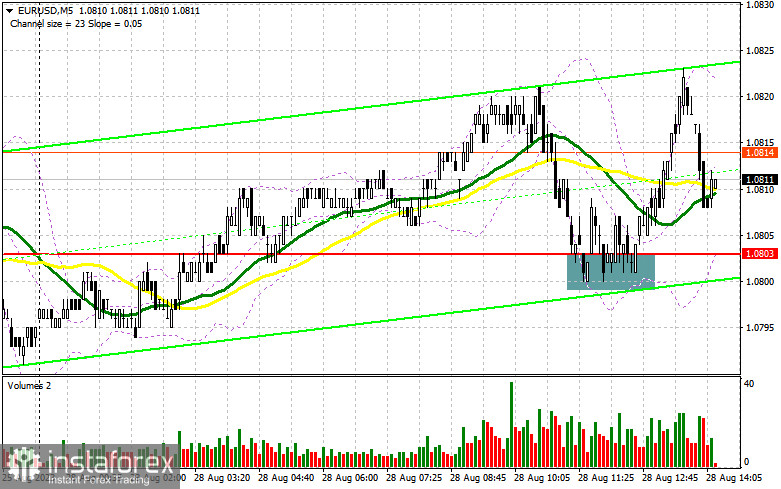

In my morning review, I mentioned the level of 1.0803 as a possible point for entering the market. Let's see what happened on the 5-minute chart. A decline to this level and its false breakout created an excellent entry point for buying the euro. As a result, the pair advanced by more than 20 pips. The technical setup has been left unchanged for the second half of the day.

For long positions on EUR/USD

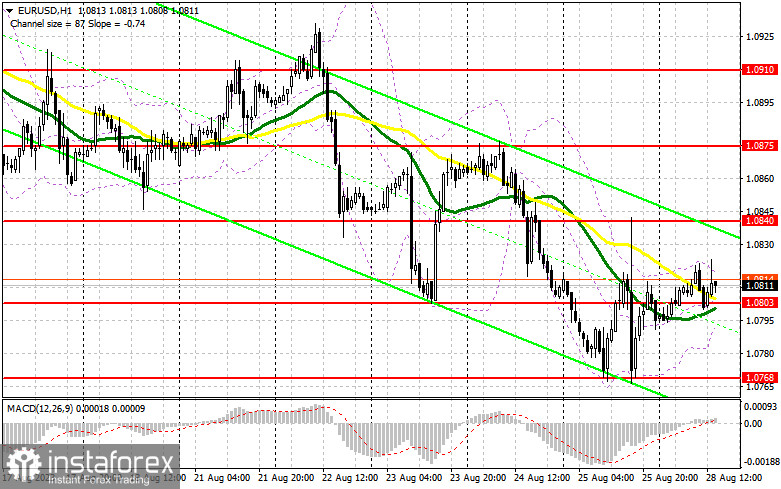

Given the absence of any significant economic releases from the US, market volatility is likely to remain low. Therefore, the best strategy today will be to wait for a decline after a false breakout around the low of 1.0803. This could provide an excellent entry point for buying the euro with an upward target at the resistance level of 1.0840, established last Friday. A breakout and successful test of this upper boundary will strengthen demand for the euro, offering an opportunity for an upward correction towards the 1.0875 range. The ultimate target would be the area around 1.0910, where I would consider taking profits. In the event of a decline in EUR/USD and no activity around 1.0803 in the second half of the day (this level has already shown its effectiveness once), the bearish trend will likely continue. In such a scenario, only a false breakout around the monthly low of 1.0768 would signal a buying opportunity. I would consider opening long positions on a rebound from 1.0734, keeping in mind a possible upward correction of 30-35 pips within the day.

For short positions on EUR/USD

Sellers made an attempt to regain control but failed to succeed. However, this does not necessarily mean that buyers will seize control during the second half of the day. Under the current conditions, it would be wise to consider selling the pair around the upper boundary of the sideways channel at 1.0840, where the price may surge in the near future. Only a false breakout at this level would signal a selling opportunity and may potentially lead to a decline towards the support level of 1.0803. However, it is crucial to wait for a breakthrough and consolidation below this range, followed by an upward retest, to confirm the sell signal. This could pave the way for a further decline towards the 1.0768 low, where larger buyers might emerge. The ultimate target for short positions would be the area around 1.0734, where I would consider taking profits. In the event of an upward movement in EUR/USD during the American session and the absence of bears at 1.0840, bulls may attempt a comeback. In this case, I will go short on the pair only when the quote hits the new resistance level at 1.0875. Selling will be possible at this point but only on a false breakout. Opening short positions immediately on a rebound would be a viable strategy from the high of 1.0910, considering a downward correction of 30-35 pips.

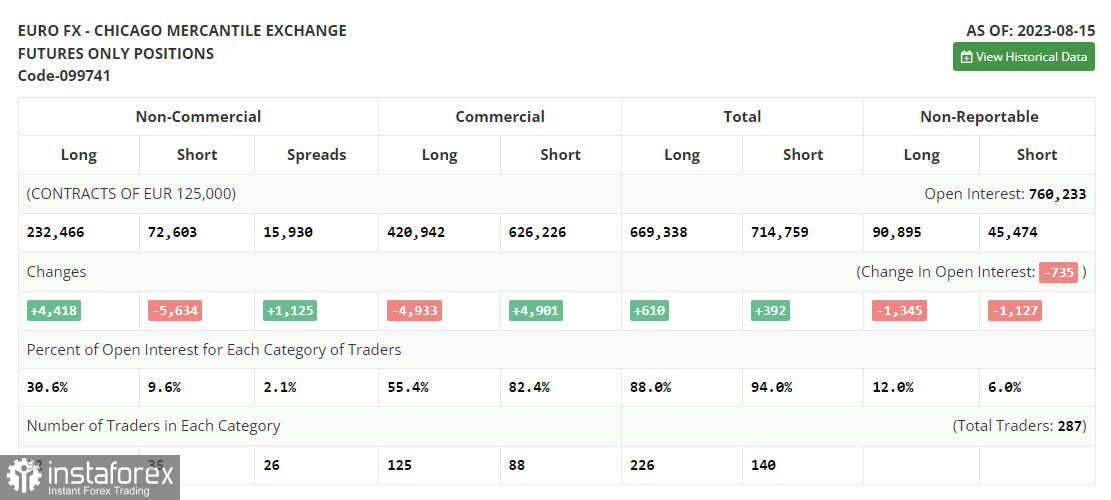

COT report

The Commitmens of Traders report for August 15 shows a notable increase in long positions and a drop in short positions. These figures already factor in the crucial US inflation data which brought back some buyers to the market. The Federal Reserve meeting minutes also indicated that not all committee members are aligned with the idea of raising interest rates to combat inflation. This keeps the chances of the euro's recovery alive, especially following the Jackson Hole symposium where Federal Reserve Chairman Jerome Powell made a statement. It is important to note that the recent decline in the euro seems to be appealing to traders. The optimal medium-term strategy under current conditions remains to buy risk assets on a dip. The COT report highlights that non-commercial long positions increased by 4,418 to stand at 232,466, while non-commercial short positions decreased by 5,634 to 72,603. Consequently, the spread between long and short positions surged by 1,125. The closing price was lower, settling at 1.0922 compared to 1.0981 the previous week.

Indicator signals:

Moving Averages

Trading around the 30- and 50-day moving averages indicates the range-bound market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a rise, the upper band of the indicator at 1.0825 will act as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.