The pound traded higher on Monday. And even though the growth was hardly impressive, it was still tangible. This is in the absence of influential economic releases and generally impersonal results from the Jackson Hole symposium. In general, all this growth can be seen as a blatant rebound after the pair sharply fell at the beginning of the previous week.

Speaking of today, the only thing worth paying attention to is the number of job openings in the United States, which is expected to fall by 12,000. There are two possible explanations for this figure. Firstly, there are no more available workers in the job market, and employers can't find new employees required for business expansion and development. The second explanation is that businesses are swiftly creating enough new jobs to meet the labor market's needs. As we can see, both explanations are diametrically opposed to each other. Therefore, we shouldn't expect this report to have an impact on the market. In general, this report typically goes unnoticed. So, the market situation will generally remain unchanged.

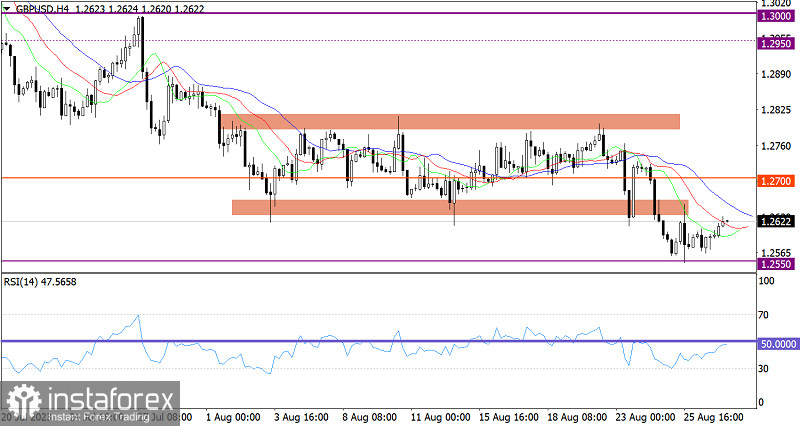

During a technical pullback, the GBP/USD pair returned to the lower band of the 1.2650/1.2800 sideways channel. Afterwards, it traded near the base of the bearish cycle.

On the four-hour chart, the RSI is moving in the lower area of the indicator, thus reflecting bearish sentiment among traders.

On the same time frame, the Alligator's MAs are headed downwards, which is consistent with the current movement. The MAs are not intertwined.

Outlook

Falling below the 1.2650 level may favorably impact the volume of short positions. However, a downtrend will only start once the price stays below the 1.2550 mark. The bullish scenario will come into play if the price holds firm above the 1.2650 level. In this case, the pair will move sideways again.

The complex indicator analysis points to a pullback in the short-term and intraday periods.