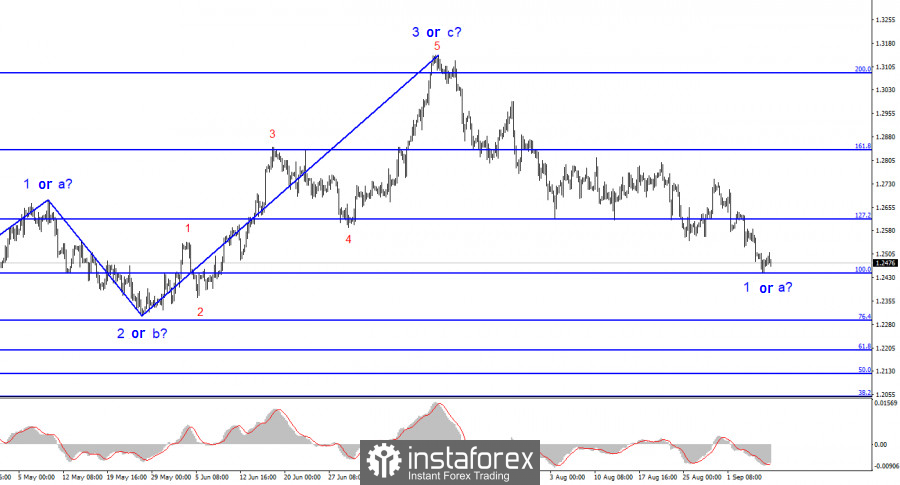

The wave analysis for the pound/dollar pair remains relatively straightforward and clear. The construction of the upward wave 3 or c appears to be completed, and the theoretical construction of a new downward trend segment has begun, which could still be wave d. Still, the probability of this is close to zero. The British pound has no grounds to resume its ascent; however, the wave analysis has become more complex. Wave 3 or c has taken on a more prolonged form than many analysts expected a few months ago. The ascending trend segment may still take on a five-wave structure if the market finds new reasons for long-term purchases. I do not see any such reasons at the moment.

The internal wave structure of the first wave of the new trend segment appears complex. Nevertheless, the market sentiment is relatively easy to gauge. Despite the pound's resistance, it has little reason to rise. The latest important statistics from America disappointed, but the UK has been waiting to see good news for a long time. The pound can only count on a corrective wave.

The market does not need strong news.

The pound/dollar pair saw a decrease of another 30 basis points on Thursday, followed by an increase of 10 points today. The recent days have seen low amplitude movements, which can be attributed to a weak news background. Yesterday reports on the EU GDP and US unemployment claims were released. Both the first and the second report had a significant impact on market sentiment. The dollar received a new boost as both reports favored it. EU GDP growth was weaker than expected, and the number of unemployment claims in the US was lower than forecasts. Therefore, demand for the US currency continues to rise, but the main reason is the wave pattern.

I want to remind you that the euro and the pound were rising for many months, even though the ECB, the Bank of England, and the Fed were raising interest rates simultaneously. Ascending trend segments were built, and after that, the construction of descending trend segments began, which we are currently witnessing. Consequently, factors like central bank meetings influence market sentiment but are not the "starting point."

If the Bank of England skips tightening this month for the first time in a year and a half, it could lead to further declines for the pound. However, the pound has been falling for a month and a half already, even though the interest rate was raised at the last meeting. If the Bank of England tightens monetary policy again, it could increase the pound, but then, the construction of corrective wave 2 or b will begin. After its completion, the descending trend segment will resume. If we rely solely on waves, the pair should decline almost in any case.

General Conclusions:

The wave analysis suggests a decrease within the descending trend segment for the pound/dollar pair. Completing the current descending wave is risky if it is wave d rather than 1. In this case, we might see the start of wave 5 from current levels. However, we are currently witnessing the construction of the first wave of the new segment. At most, buyers can expect the construction of wave 2 or b. An unsuccessful attempt to break through the 1.2444 level, corresponding to 100.0% on the Fibonacci scale, may indicate the market's readiness to build an upward wave.

The picture resembles the euro/dollar pair on a larger wave scale, but there are still some differences. The descending corrective trend segment is complete, and the construction of a new ascending one continues, which may already be complete or take on a full-fledged five-wave structure.