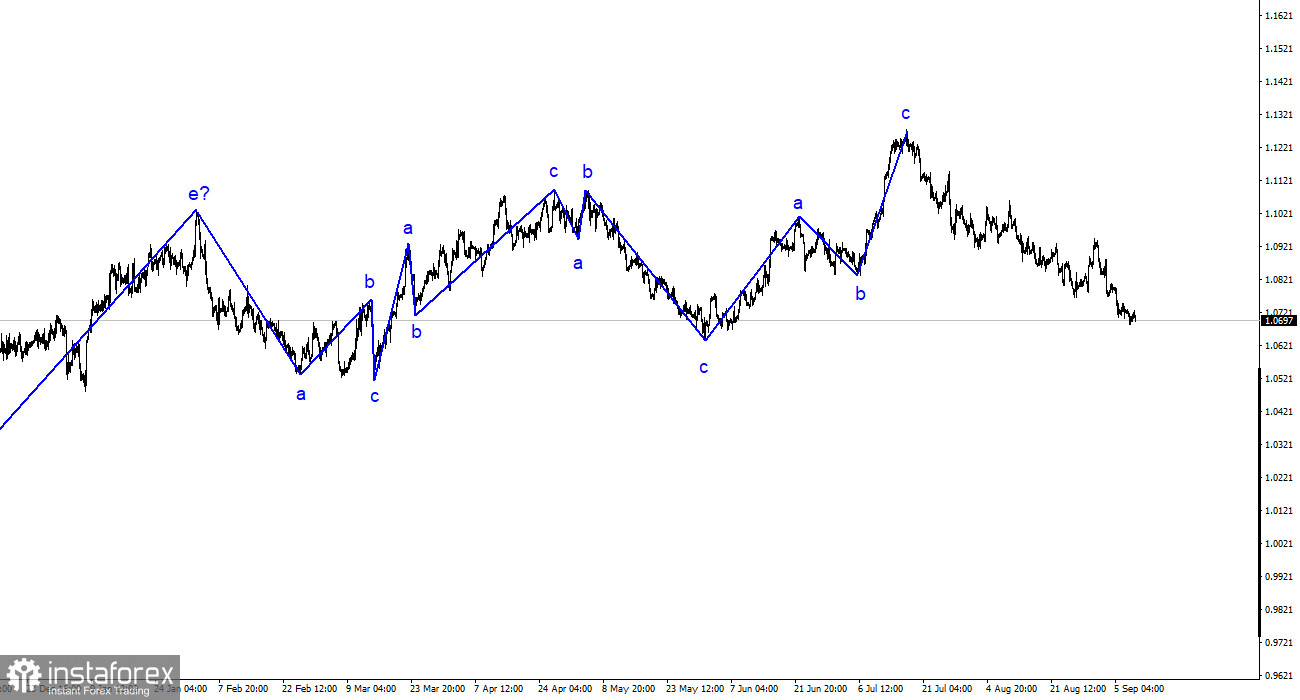

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. The entire ascending trend segment, which began to develop last year, has taken on a complex structure, and in the last six months, we have only seen three-wave structures alternating with each other. For some time now, I have regularly mentioned that I expect the pair near the 1.5 level, from which the last upward three-wave structure began to form. I still stand by my words. Another upward three-wave structure is complete, so the market continues to build a downward trend segment.

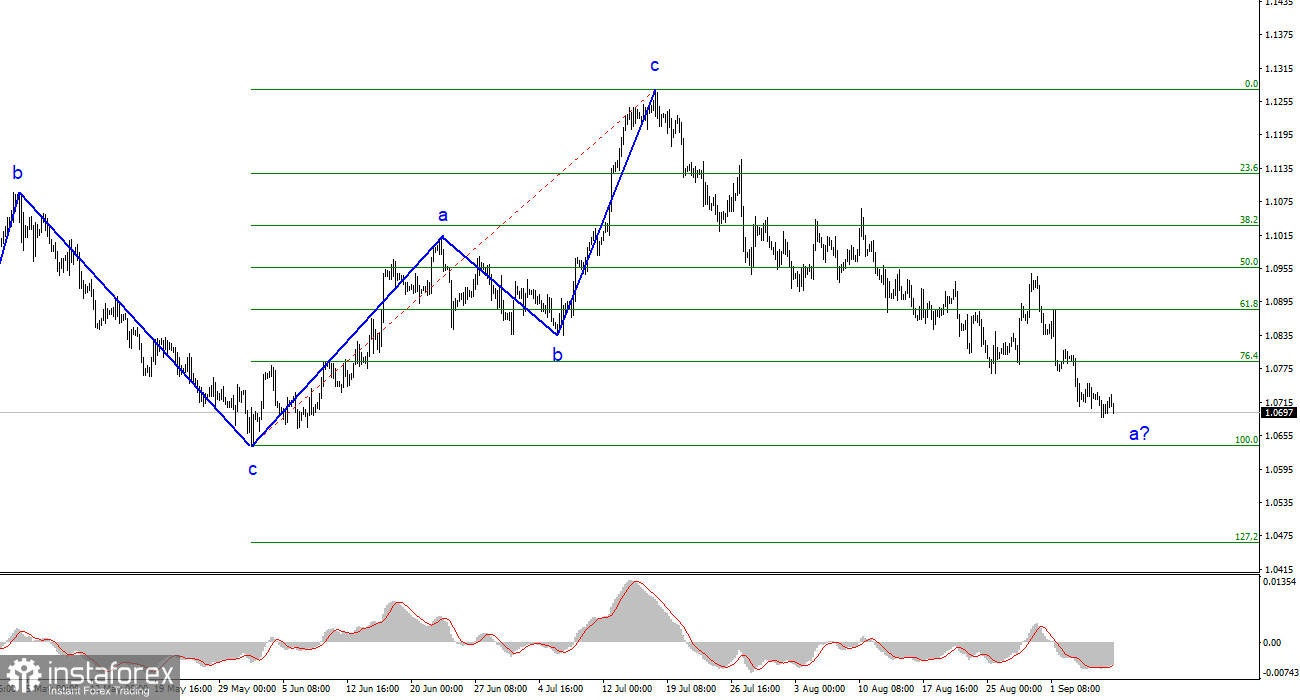

The recent increase in quotes does not resemble a full-fledged wave 2 or b. We saw a similar wave from August 3rd to 10th. Most likely, this is an internal corrective wave 1 or a. If this is true, the decline in quotes will continue for some time as part of the first wave of the descending trend segment. This drop in the European currency will continue as the construction of the third wave is still required.

Demand for the euro is declining, but what will happen next week?

The euro/dollar exchange rate remained unchanged on Friday. In the morning, we observed a slight increase in quotes, followed by a decrease after lunch. The pair lost about 30 basis points the previous day, which is not much either. However, demand for the euro currency is decreasing almost every day, and today, it can be said that it is decreasing in anticipation of the ECB meeting.

In the last year and a half, central banks' monetary policy has greatly influenced the foreign exchange market. And monetary policy depended on inflation. These two indicators have been driving the market, but now the situation is changing in the opposite direction. Central banks are beginning to signal the end of tightening, and the market is considering other factors in decision-making.

If we assume that demand for the euro currency has been rising over the past year due to the actions of the ECB, we should now observe the opposite movement as the ECB prepares to complete the procedure. By the way, this has yet to be loudly announced. We have heard several important speeches, and the ECB rate will rise quickly. However, the market still needs to decide about the September meeting, which will take place next week.

Of the 69 analysts surveyed by Reuters, 39 are in favor of an unchanged rate. Another 30 believe that the rate will increase by 25 basis points. Thus, the likelihood of tightening is approximately 50/50, but this does not change anything, as the market understands that tightening will end this year. The euro will continue to fall, and only a corrective wave can push it up slightly.

General Conclusions

Based on the analysis, the construction of an upward set of waves is complete. The targets around 1.0500-1.0600 are still achievable. Therefore, I recommend selling the pair with targets around 1.0636 and 1.0483. A successful attempt to break through the 1.0788 level indicates the market's readiness to continue selling. We can expect the achievement of the abovementioned targets, which I have discussed for several weeks and months.

On the larger wave scale, the wave labeling of the ascending trend segment has taken on an extended form but is likely complete. We have seen five upward waves, most likely the structure a-b-c-d-e. Then, the pair built four three-wave structures: two downward and two upward. It has likely moved on to building another descending three-wave structure.