Gold traded downward last week, dropping by approximately 1% after the Labor Day holiday in America. The latest weekly survey indicated that optimism left the precious metals market last week.

According to Sean Lusk, Co-Director of Commercial Hedging at Walsh Trading, gold's performance still depends entirely on the U.S. dollar. He anticipates a weakening of the dollar in the near future.

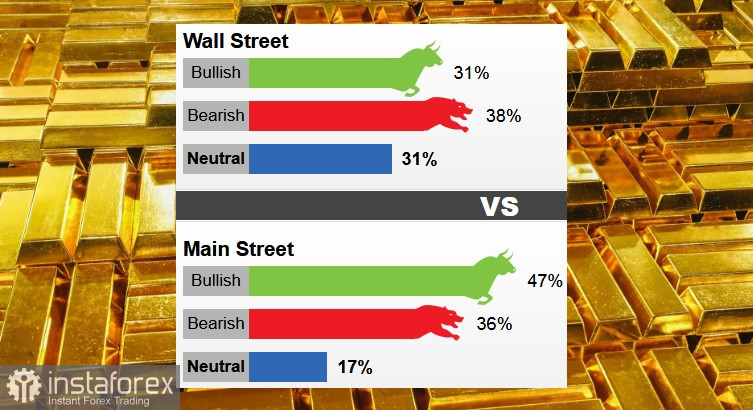

Last week, 13 Wall Street analysts participated in the gold survey. Four analysts, or 31%, expect gold prices to rise during the current week, while five analysts, or 38%, predict a price decrline. Another four analysts, or 31%, believe that the yellow metal will trade in a sideways trend.

In an online poll, 474 votes were cast. Of these, 222 respondents, or 47%, expect price to rise, while 169 voters, or 36%, anticipate a decline. Meanwhile, 83 voters, or 17%, have a neutral outlook. Retail investors expect a price around $1,933 per ounce.

The most significant economic data for gold volatility in the upcoming week will be the U.S. Consumer Price Index and the Producer Price Index for August, to be published on Wednesday and Thursday, respectively.

U.S. retail sales for August and the European Central Bank's interest rate decision, both scheduled for Thursday, will also influence the gold market.

James Stanley, Senior Market Strategist at Forex.com, thinks the Consumer Price Index and the ECB are likely to be decisive factors for gold this week.

Marc Chandler, Managing Director of Bannockburn Global Forex, believes gold prices could reach $1,950. Meanwhile, Adam Button, Chief Currency Analyst at Forexlive.com, considers bond yields a key indicator for both gold and stocks and sees limited potential for gold to rise until late autumn.

Adrian Day, President of Adrian Day Asset Management, predicts prices to rise for the current week.