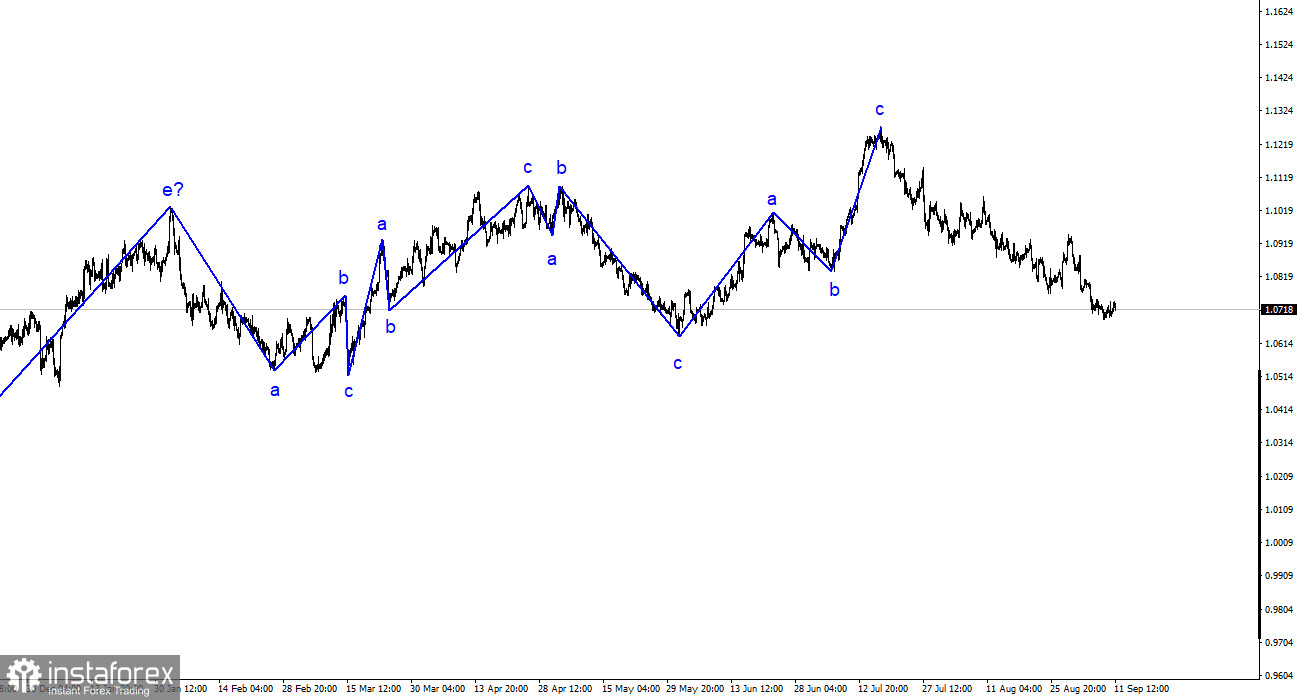

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. The ascending trend segment, which began building last year, has taken on a complex structure, with the past year showing only alternating three-wave structures. I expect the pair to reach around the 1.5 figure, where the construction of the last upward three-wave began. I still stand by my words. Another upward three-wave structure has been completed, and the market continues to build a downward trend.

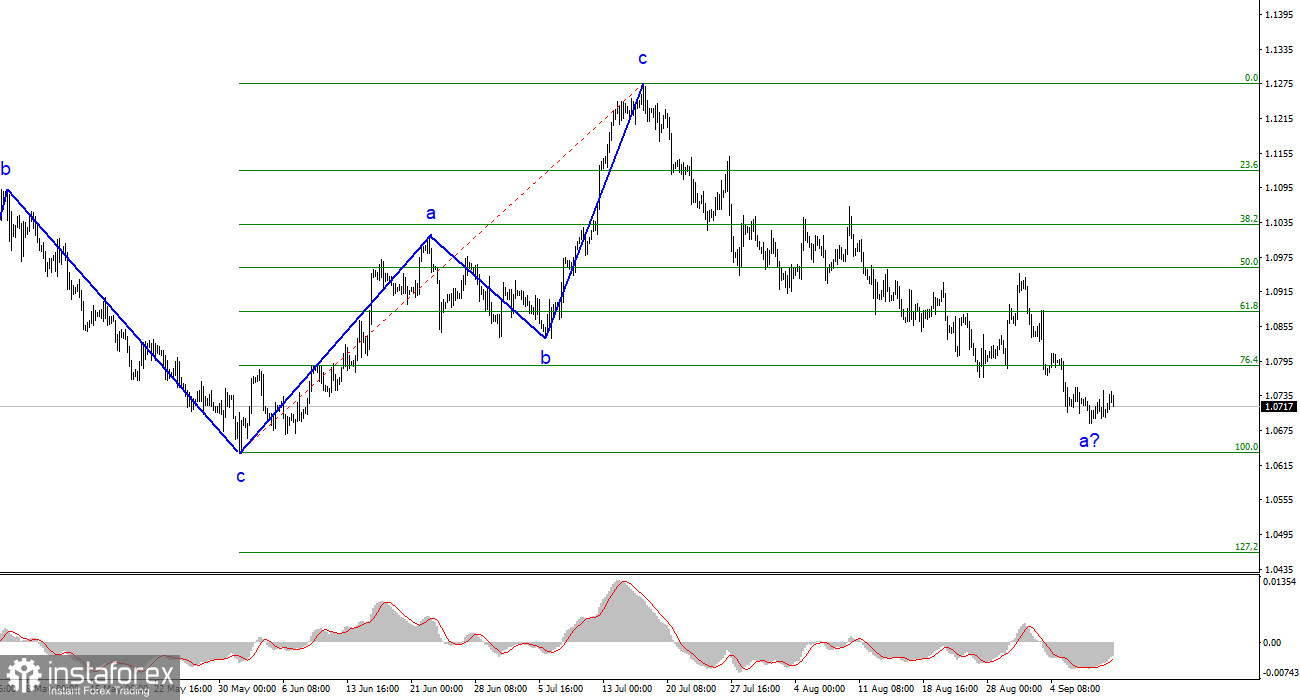

The recent increase in quotes looks like a partial-fledged wave 2 or b. We saw a similar wave from August 3 to August 10. Most likely, this is an internal correction wave in 1 or a. If that is true, the decline in quotes may continue for some time within the framework of the first wave of the downward trend. This is not the end of the decline in the European currency, as constructing the third wave is still needed. Five internal waves are already visible inside the first wave, so its completion is approaching.

The EU economy is growing weaker and slower.

The euro/dollar exchange rate rose by 25 basis points on Monday, but the amplitude is weak. Today, there is virtually no news background, so the market is in a calm state of anticipation. There is much to look forward to and anticipate this week. On Wednesday, an important report on US inflation will be released, and on Thursday, the ECB meeting results will be announced. Therefore, all the most interesting lies ahead.

While the market awaits significant events, I would like to draw attention to the updated economic forecasts for the Eurozone. According to the European Commission's forecasts, this year's growth is expected to be 0.8%, not 1.1% as previously stated. Next year's growth will be 1.3%, not 1.6%. Interestingly, the inflation forecast for this year is 5.6%, which is higher than the current Consumer Price Index. In the next year, price growth rates may drop to 2.9%.

What do these data tell us? Firstly, that the hawkish ECB policy is over. This is a bold conclusion, but the absence of a recession in the forecasts, when all economists expect one in the US next year, raises questions about the interest rate. Only if the rate is not raised further (maximum one increase) can we hope to avoid a recession. In addition, the inflation rate is falling very slowly. Christine Lagarde and other ECB members stated that inflation would decline slowly, and 2% could only be seen after 2025. Given that forecasts are usually more optimistic than reality, we may not see 2% until 2026. This suggests that the ECB is ready to end the tightening process.

General Conclusions.

Based on the analysis, the construction of the upward wave set is complete. The targets in the range of 1.0500-1.0600 are quite realistic. Therefore, I recommend selling the pair with targets around 1.0636 and 1.0483. A successful attempt to break through the 1.0788 level indicates the market's readiness to continue selling, and we can now expect the achievement of the targets mentioned above, which I have been talking about for several weeks and months.

On a larger wave scale, the wave labeling of the ascending trend segment has taken on an extended form but is likely complete. We have seen five upward waves, most likely the structure of a-b-c-d-e. Next, the pair built four three-wave structures: two down and two up. It has likely entered the stage of building another descending three-wave structure.