On Monday, the GBP/USD currency pair also made a minimal correction towards the moving average line but failed to surpass it, and it could resume its decline this week. Just like with the European currency, there are no compelling reasons for the British pound to rise, but occasional corrections are expected. Therefore, a price consolidation above the moving average line may lead to an upward movement of around 100 points. Beyond that, it will depend on the fundamental background. It is of moderate strength this week, while the next week is expected to be strong.

Today, in the UK, several interesting reports have already been released. It was revealed that the unemployment rate in July increased to 4.3%, in line with market expectations. Wages grew by 8.5%, significantly surpassing forecasts, and the number of jobless claims decreased by 207,000, better than expected. Overall, this set of statistics can be interpreted in different ways. The wage increase suggests that inflation will remain high for longer, as people tend to spend more when they have more money, causing further inflation. Unemployment has risen, but the market was anticipating this. The reduction in jobless claims is positive for the British pound.

As we can see, the reports were quite important and interesting, but judging by the market reaction, they didn't generate significant movements.

Kathleen Mann believes it's better to raise rates and then lower them. On Monday, we expected a speech from the Chief Economist of the Bank of England, Huw Pill, but instead, we got a speech from Monetary Committee representative Kathleen Mann. She made several significant statements, which we will discuss below. However, let's first recall that Huw Pill stated just a week ago that he preferred to keep the rate at its peak for an extended period rather than raise it further and lower it in response to economic shocks. Kathleen Mann has an entirely different perspective.

Ms. Mann stated that it's better to continue raising the rate to maintain pressure on high inflation. "If I'm wrong, I will later support lowering the key rate," she said. In her opinion, inflation is still too persistent, and radical measures are needed to reduce it further. The absence of tightening won't help return inflation to the target level. She also noted that the Bank of England's target is 2%, so any ideas that 3% is close to 2% are impractical and unwarranted.

Now, we can only speculate about the British regulator's decision. As we can see, opinions regarding the rate have begun to diverge, making it extremely challenging to predict how many of the nine Monetary Committee members will support a pause next week. However, in any case, a pause would imply a softening of the hawkish stance, which could negatively impact the British pound's position. This scenario is more likely. Even if the rate increases, if Andrew Bailey's rhetoric implies an imminent pause or the end of the tightening cycle, the pound will likely continue declining.

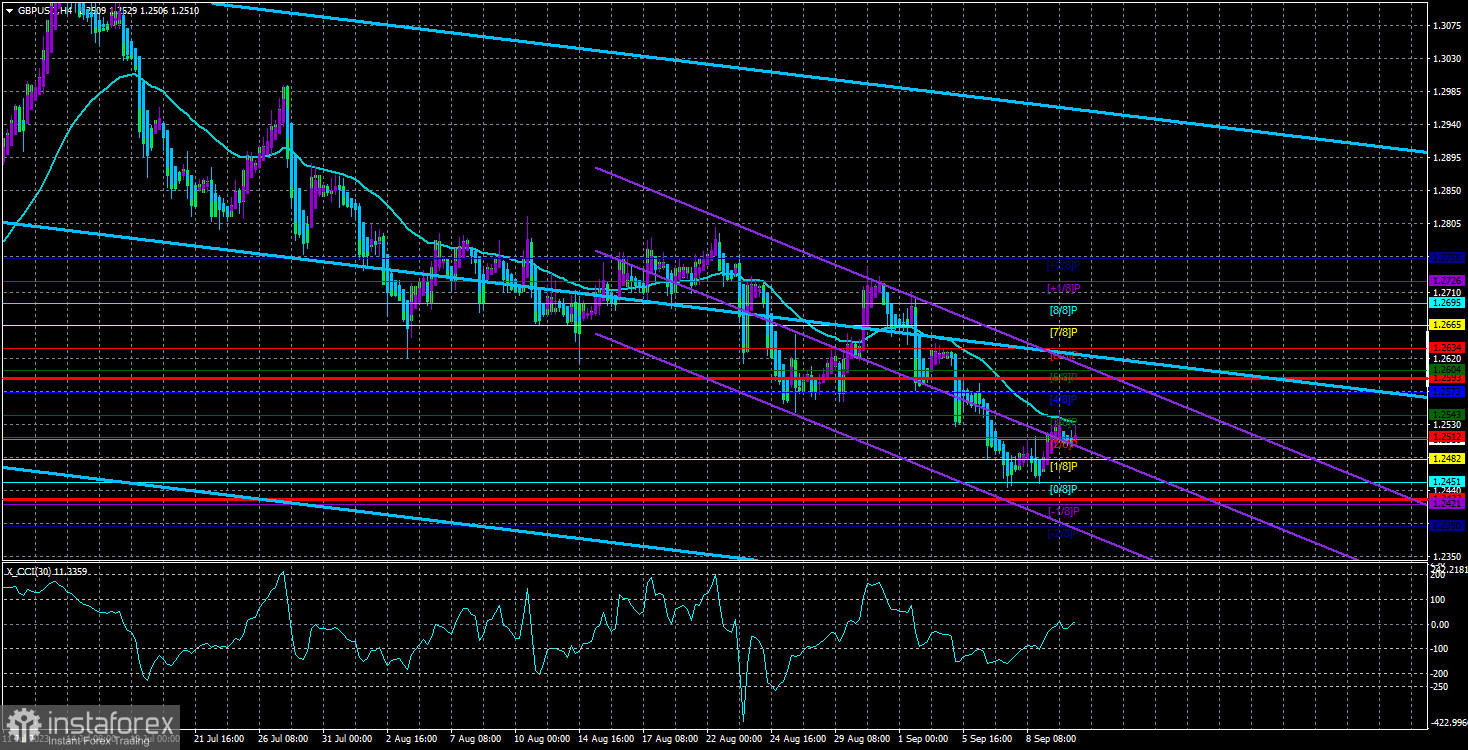

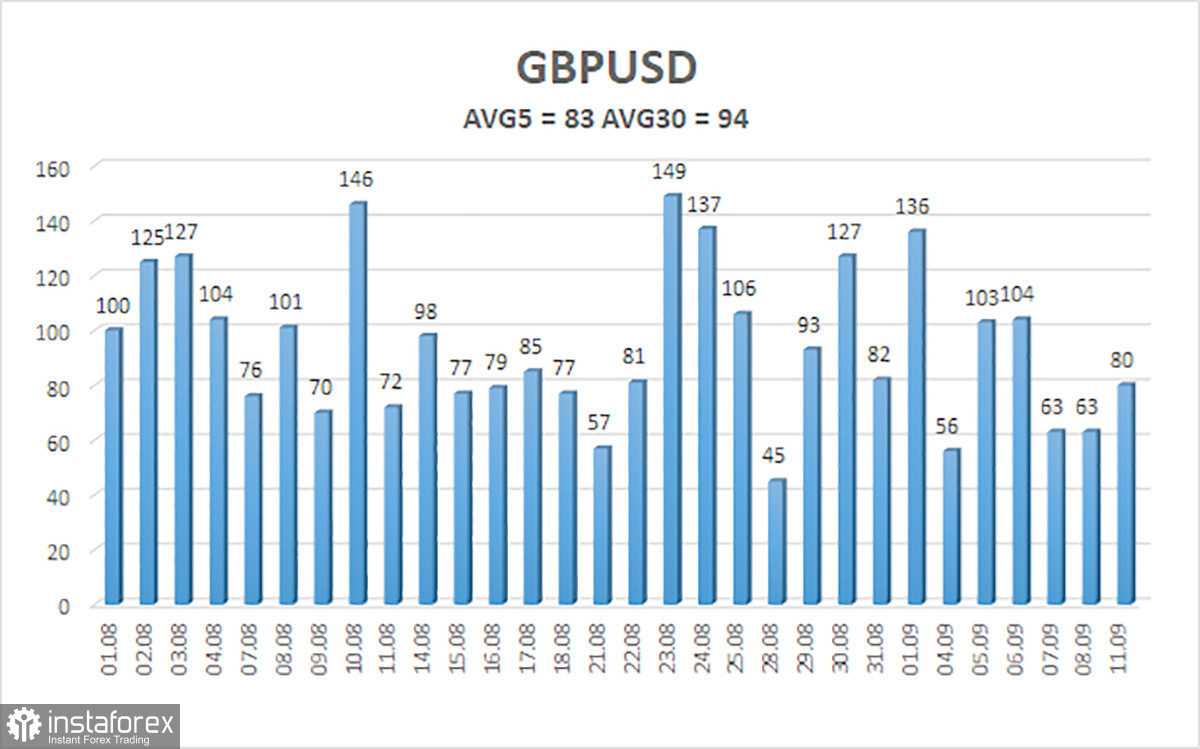

The average volatility of the GBP/USD pair over the last five trading days is 93 points. For the pound/dollar pair, this value is considered "average." Therefore, on Tuesday, September 12th, we expect movement within a range limited by the levels of 1.2427 and 1.2593. A reversal of the Heiken Ashi indicator downwards will signal a resumption of the downward movement.

Nearest support levels:

S1 – 1.2482

S2 – 1.2451

S3 – 1.2421

Nearest resistance levels:

R1 – 1.2512

R2 – 1.2543

R3 – 1.2573

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair has corrected towards the moving average. Therefore, at this time, new short positions should be considered with targets at 1.2451 and 1.2427 in case of a Heiken Ashi indicator reversal downwards or a price bounce from the moving average. Long positions can be considered if the price consolidates above the moving average line with targets at 1.2573 and 1.2593.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both point in the same direction, it indicates a strong trend.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel the pair is expected to trade over the next day based on current volatility indicators.

CCI indicator - its entry into the overbought zone (above +250) or oversold zone (below -250) indicates an approaching trend reversal in the opposite direction.