All good things eventually come to an end. According to JP Morgan, investors should not get too carried away with buying oil, as its rally is coming to an end. The state of the global economy is expected to deteriorate. Currently, weak purchasing managers' data indicate sluggish economic growth in Europe and China, offsetting the strength in India and Japan. In the near future, a slowdown in industrial production and retail sales in the United States should be expected. And this is not the only reason for the imminent decline in Brent.

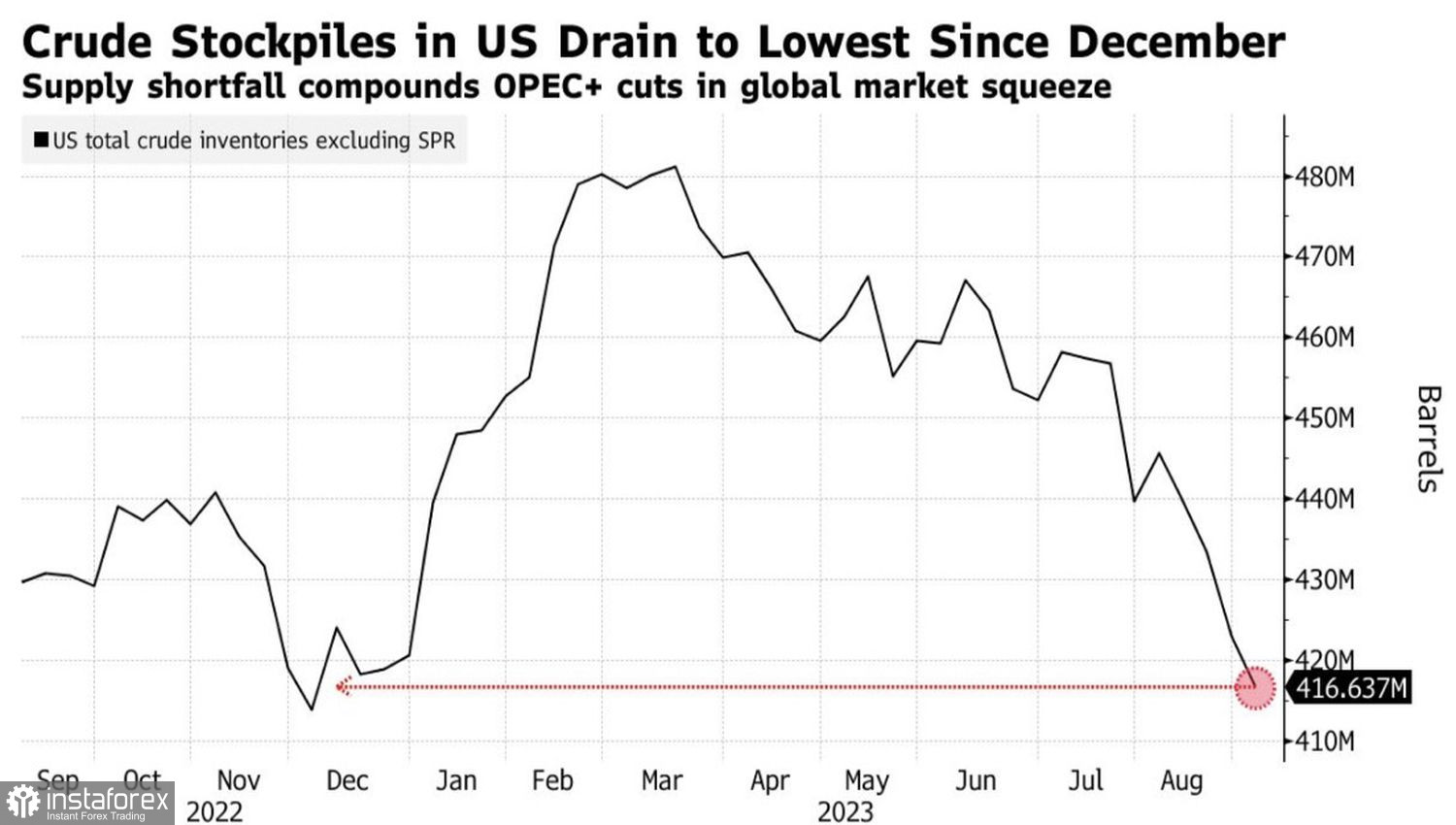

JP Morgan notes that liquid fuel production in the United States is hitting records, but the arrival of autumn and cooling weather will change the balance of power. Indeed, crude oil inventories in the United States have fallen to their lowest levels since December, indicating strong demand. However, the aggressive tightening of monetary policy by the Federal Reserve is increasingly affecting the U.S. economy. Additionally, fiscal stimulus is waning.

Dynamics of oil reserves in the USA

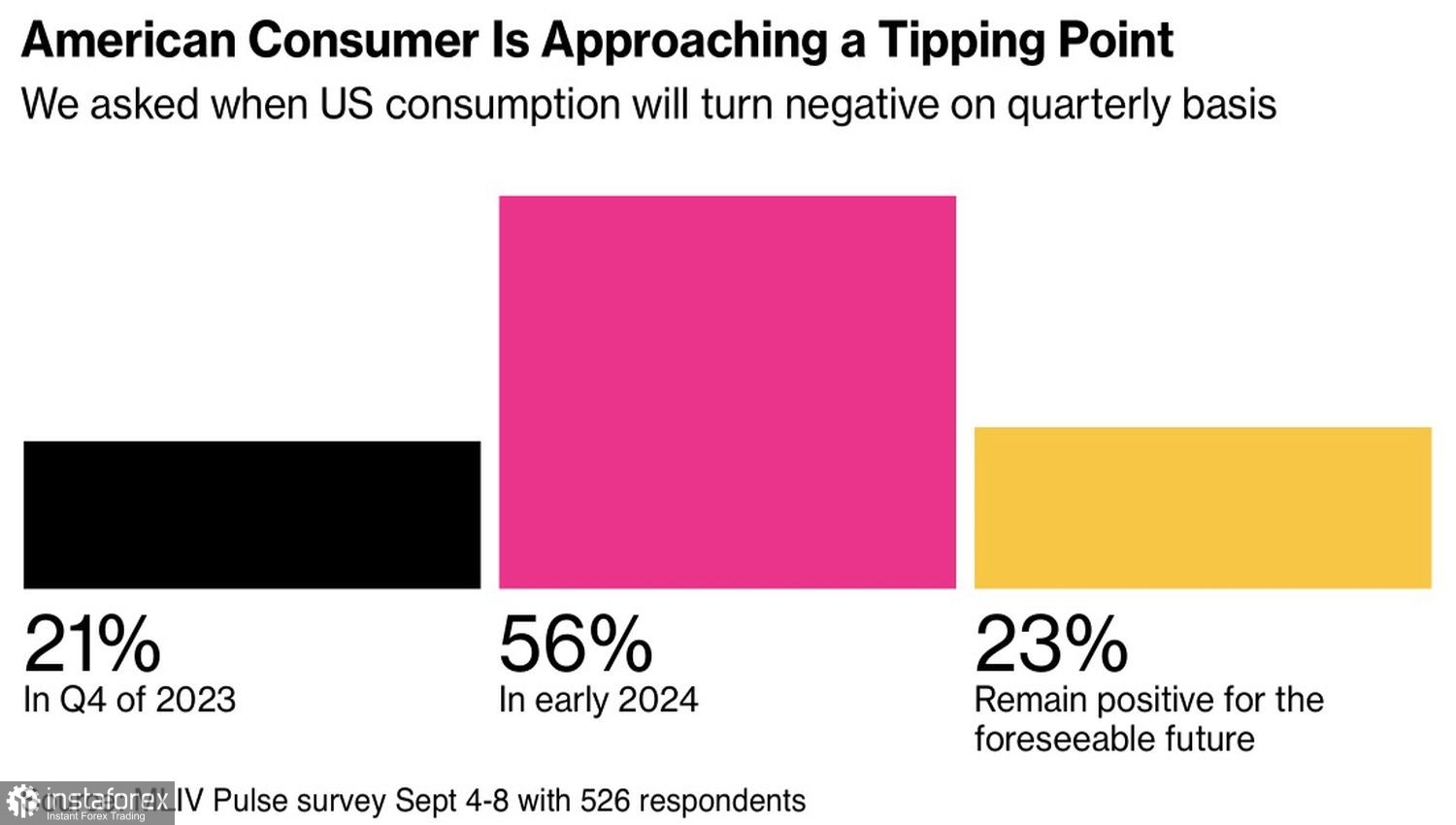

According to the majority of respondents in MLIV Pulse, consumption in the United States will begin to decline in early 2024. Of the 526 investors, 21% stated this will happen as early as the fourth quarter. Currently, stock and oil markets are rising due to expectations of a soft landing for the American economy and the end of the Federal Reserve's monetary policy tightening cycle. However, what if that's not the case? Accelerating inflation could push the federal funds rate higher, and declining consumption will bring back recession fears to the market. As a result, global risk appetite will decrease, and stock indices and black gold will decline.

Can Europe and China help? At the moment, it seems unlikely. The People's Bank of China has resorted to verbal interventions to support the plummeting yuan. This indicates that things are truly dire for the currency and the economy. According to the European Commission, the Eurozone is expected to be mired in stagflation. Where can we expect an improvement in global demand for oil?

Forecast of the timing of consumption reduction in the USA

Another driver of the Brent rally is the reduction in oil production by Saudi Arabia. Riyadh has decided to extend its commitments to cut production by 1 million barrels per day until the end of the year. This has stirred the black gold market and pushed the North Sea variety above $90 per barrel. However, oil production in the country has fallen by 9%, the lowest level in 15 years. This could lead to a recession and force Saudi Arabia to abandon its commitments.

A reduction in global demand and gradual supply growth will lead to a decline in Brent futures prices. The question is when exactly this will happen. At the end of the third quarter? Or will investors wait until the end of the year?

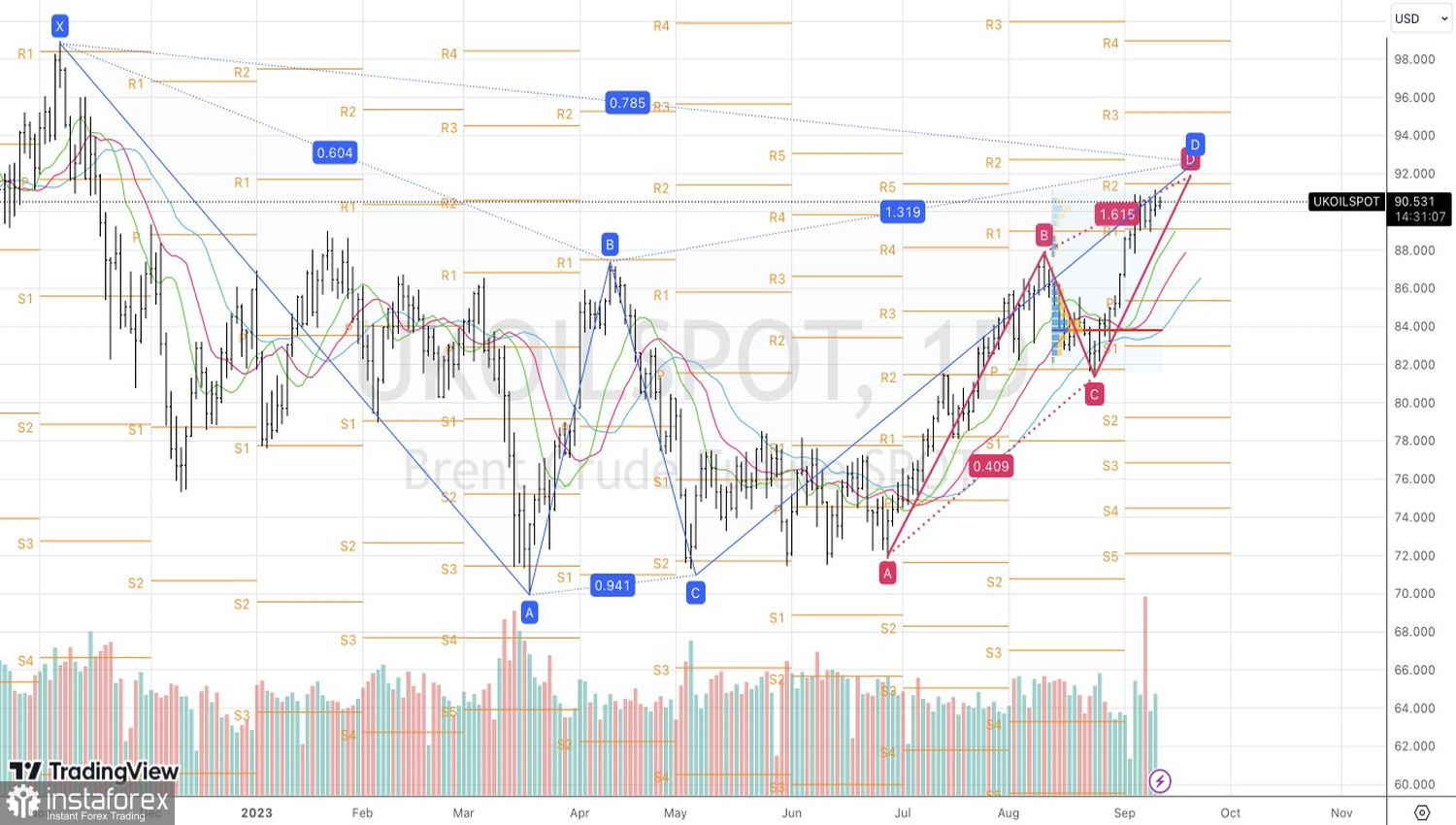

Technically, on the daily chart, Brent has approached the important convergence zone of $91.5–92.6 per barrel. It is formed by targets at 161.8% and 78.6% based on AB=CD and Gartley patterns. Therefore, we begin to lock in profits on previously formed long positions and consider switching to shorts on a rebound from significant resistances.