In anticipation of the US Consumer Price Index for August, volatility remained low, bond yields hardly changed, and the CAD was the only currency trying to strengthen against the US dollar. This is due to rising oil prices, which hit a yearly high on Tuesday. The decision by OPEC+ to further reduce production levels is supporting oil prices and providing support to commodity currencies, despite the fact that global demand is growing slower than expected.

It is estimated that US inflation will show a 0.5% increase in August (3.6% YoY), mainly due to rising energy prices. However, core inflation is expected to increase by a modest 0.2% MoM. Prices, in general, are decreasing, as nominal wage growth and rent increases slow down, indicating that the services sector is beginning to show the long-awaited lower inflation dynamics.

German investor sentiment unexpectedly improved from -12.3 points to -11.4 points in September, according to the economic sentiment index of the ZEW economic research institute. However, the assessment of the current economic situation fell from -71.3 points to -79.4. While expectations improved slightly, ZEW signals further declines in PMI and an increased risk of recession, with the average ZEW value at its lowest level since the pandemic. The euro is facing additional pressure ahead of the European Central Bank meeting.

It is unlikely for the US CPI to have a significant impact on the forex market since there's a low chance of a substantial deviation from forecasts.

NZD/USD

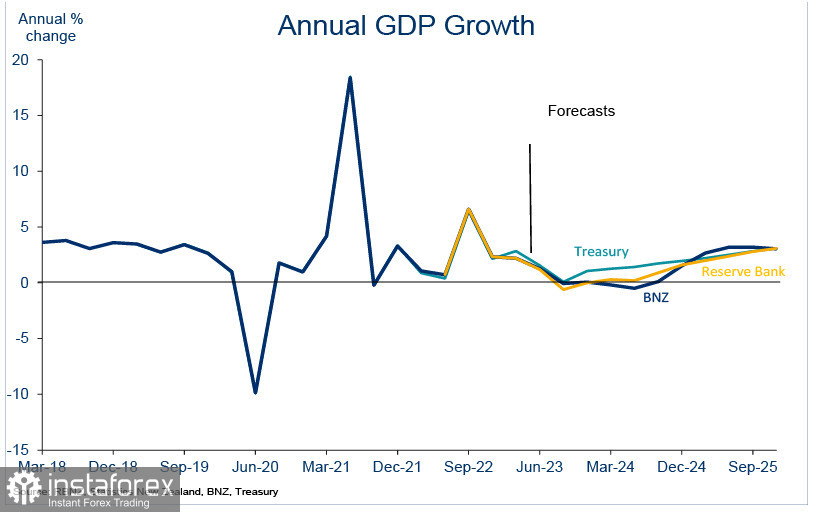

The Business Financial Data report showed a significant recovery in manufacturing activity after several difficult quarters, and now concerns about a recession have been put to rest. GDP estimates for the second quarter range from 0.3% (Treasury forecast) to 0.6% (BNZ bank forecast), with positive expectations also suggesting an improvement in the budget situation. The RBNZ's GDP growth estimate is 0.5%, implying significant export growth.

As for the inflation index, a 2.2% increase is expected in the third quarter, which will raise the annual inflation rate from 6.0% to 6.1%. Such forecasts could support the NZD exchange rate by increasing the likelihood of a peak interest rate, but it is premature to say this for now.

The Global Dairy Trade (GDT) auction finally brought some positive news. Prices for whole milk powder (WMP) rose by 5.3% and traded at an average price of $2,702 per tonne. While this is still a very low figure, a positive trend is emerging, which is also favorable for the kiwi.

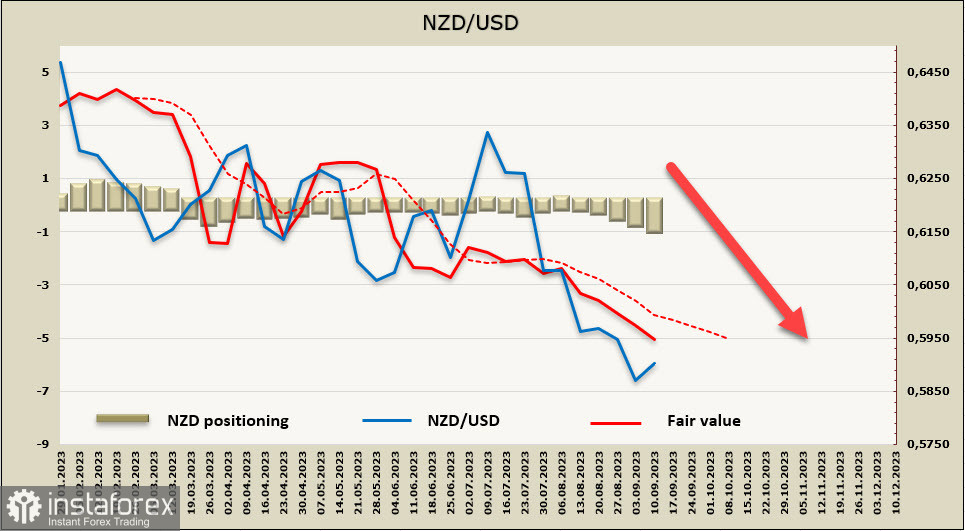

Reserve Bank of New Zealand interest rate forecasts have not changed, and there is no expectation of a rate hike in the near future, so overall, there are no reasons for NZD to strengthen against the US dollar. The kiwi continues to be sold in the futures market.

The net short NZD position increased by 0.2 billion to -0.82 billion during the reporting week, speculative positioning remains bearish, and the price firmly moves downwards.

The kiwi didn't find the strength to break the lower band of the channel. However, everything indicates that after consolidation, another attempt will be made, which may be more successful. Targets are 0.5852, then the lower band at 0.5820/30. A break below this zone will open the way to 0.5506. We consider it unlikely for the pair to correct higher to the middle of the channel at 0.6030/50. This can only happen in the event of a sharp deterioration in the fundamental picture for the US dollar, which is not currently observed.

AUD/USD

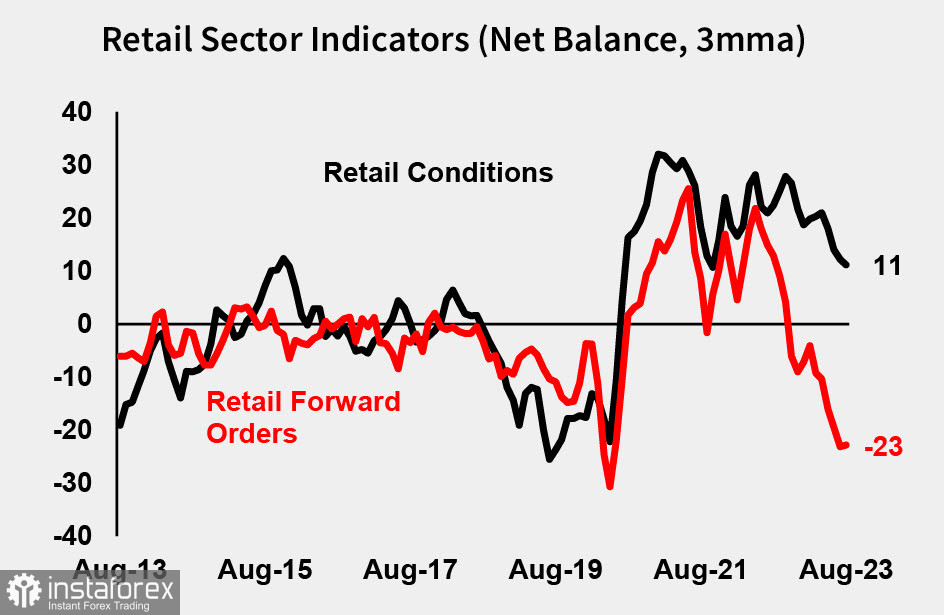

The NAB business survey showed that the economy will remain resilient in the third quarter after positive, albeit below-par, growth of 0.4% in the second quarter. Business confidence rose to +2 points, only slightly below the long-term average and sharply contrasting with depressed consumer confidence. Trading conditions, profitability, and employment increased, with broad-based improvements observed in most industries. Capacity utilization also exceeded 85% again. Measures of confidence and forward orders increased but remain below average, amid deep negativity in the retail sector. Measures of cost and price growth remained elevated in the survey.

In contrast, consumer confidence remains extremely weak (-1.5% this month), hovering near lows not seen since the global financial crisis and the COVID hysteria.

Low consumer confidence indirectly contributes to a decrease in consumer activity in favor of savings growth, so for the Reserve Bank of Australia, this indicator is more likely to be positive than negative.

The key event of the week for the AUD will be the employment report for August on Thursday morning. NAB Bank expects a significant improvement compared to relatively weak figures in July and predicts employment growth of 50,000, a decrease in the unemployment rate to 3.6%, and a labor force participation rate returning to 66.8%.

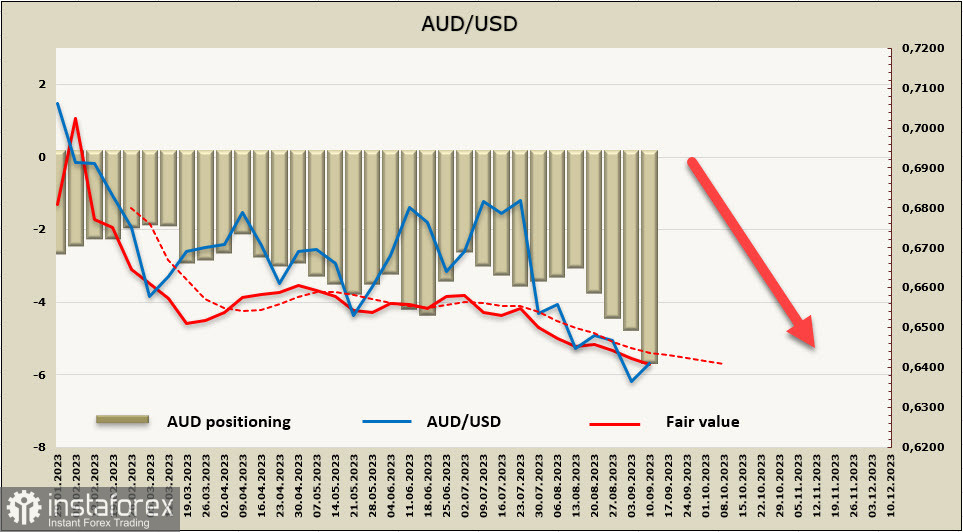

Markets see roughly a 50% probability that the RBA will raise rates again by the end of the year. These expectations prevent the Australian dollar from falling even further relative to current levels.

The net short AUD position increased by 0.8 billion to -5.3 billion during the reporting week. The price is below the long-term average and is facing a bearish trend.

The aussie is consolidating near the lower band of the channel, and the most likely scenario is a downward breakthrough. The nearest target is the recent low at 0.6358, followed by the lower band at 0.6290/6310. In this case, the long-term target will shift to 0.6172, and corrective growth to the resistance zone at 0.6510/40 is unlikely.